Stellantis (STLA +2.55%) is a global automaker formed in 2021 through the merger of Fiat Chrysler Automobiles and PSA Group. It owns well-known brands such as Jeep, Chrysler, Dodge, Peugeot, Citroën, Alfa Romeo, and Maserati.

The company sells millions of vehicles annually across North America, Europe, and other international markets. While Stellantis continues to invest in electric vehicles, recent strategy changes signal a greater focus on profitability and traditional gasoline and hybrid models -- particularly in the U.S.

For investors, Stellantis stands out less as a pure EV play and more as a value-oriented automaker with strong cash flow and an attractive dividend.

How to buy Stellantis stock

Before you can hitch a ride with Stellantis as an investor, there are some basic steps you need to take to buy stocks.

- Open your brokerage app: Log in to your brokerage account where you handle your investments. If you don't have one yet, take a look at our favorite brokers and trading platforms to find the right one for you.

- Fund your account: Transfer money so you’re ready to invest.

- Search for Stellantis: Enter the ticker "STLA" into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should you invest in Stellantis?

Stellantis may appeal to investors who want exposure to the auto industry without betting entirely on EVs. The company remains profitable, generates significant cash flow, and prioritizes shareholder returns through dividends.

That said, automakers are cyclical businesses. Stellantis struggled in 2024 as vehicle shipments declined and earnings fell sharply, and its turnaround plan is still playing out. Investors with short time horizons or low tolerance for economic cycles may want to be cautious.

One differentiator is Stellantis’ investment in Archer Aviation (ACHR +0.71%). The company owns roughly 16% of Archer and has committed to manufacturing its electric aircraft, giving Stellantis indirect exposure to urban air mobility alongside its core auto business.

If you’re seeking a high-growth EV pure play, companies like Tesla (TSLA +0.90%) or Rivian (RIVN +0.80%) may be a better fit. If you want income, value, and diversification across many auto brands, Stellantis is worth a closer look.

NYSE: STLA

Key Data Points

Is Stellantis profitable?

For several years, Stellantis had increased profits. In 2024, however, the company hit a pothole. After reporting diluted earnings per share (EPS) of 5.31 euros ($5.82) and 5.94 euros ($6.51) in 2022 and 2023, respectively, the automaker reported diluted EPS of 1.84 euros ($2.02) in 2024. Unfortunately, as of November 2025, Stellantis reported a diluted EPS of $0.00, representing a 100% decline.

Declining sales represented the main culprit in the company's inferior performance in 2024 compared to 2023. Stellantis reported only 5.42 million vehicle shipments in 2024, a 12% decrease from the 6.17 million reported in 2023.

Does Stellantis pay a dividend?

Stellantis has rewarded investors with a dividend. In 2023 and 2024, for example, it paid dividends per share of 1.34 euros (about $1.45) and 1.55 euros (about $1.68), respectively.

After its poor performance in 2024, management reduced the dividend to ensure the company didn't find itself in poor financial health. For 2025, the company projects it will return 0.68 euros per share (approximately $0.74) to investors. Unfortunately, Stellantis has failed to deliver on this projection as of November 2025.

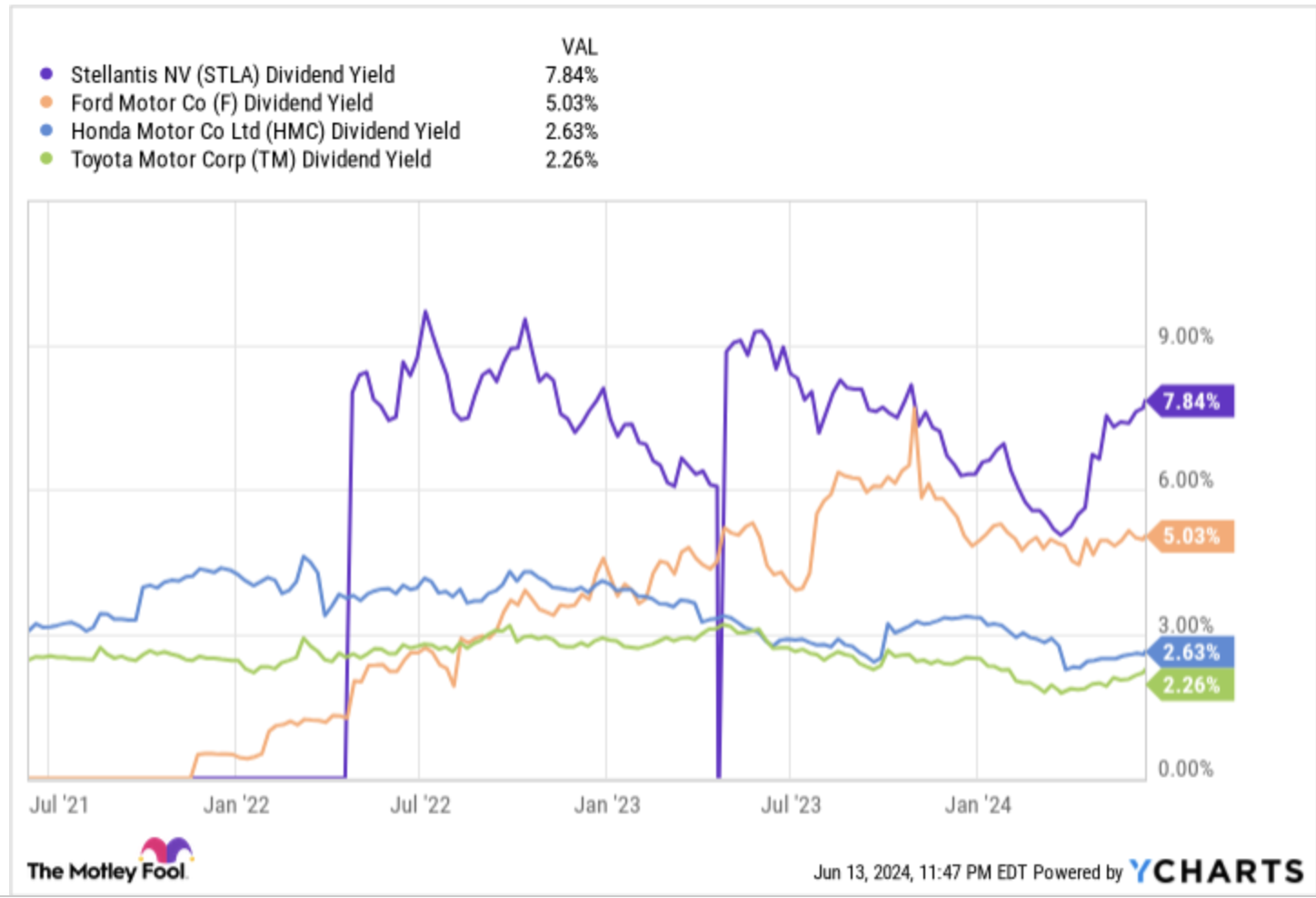

Stellantis has one of the highest dividend yields among automakers, with a forward yield of about 5.6% based on its share price as of February 2025. That's a significantly higher yield than peers like Honda Motor (HMC +2.11%) and Toyota Motor (TM +0.66%) currently pay.

Lest investors fret that the high dividend yield portends poor financial health, the company has articulated a dividend policy that targets a payout ratio between 25% and 30%.

How to invest in Stellantis through ETFs

If you want broad EV exposure, an exchange-traded fund (ETF) that includes Stellantis among its holdings is a great choice (although there aren't many choices out there).

- The Global X Autonomous & Electric Vehicles ETF (DRIV +0.35%) is a good option. Committed to stocks that provide exposure to autonomous vehicles and EVs, the Global X Autonomous & Electric Vehicles ETF has 77 holdings. Stellantis is among the fund's top 25 holdings, with a 1.01% weighting. The ETF has a total expense ratio of 0.68%, meaning $6.80 of a $1,000 investment goes toward fees.

- If you're more interested in Stellantis as a potential source of passive income and care less about EV exposure but still significant exposure to the auto industry, the Invesco FTSE RAFI Developed Markets ex-U.S. ETF (PXF -0.07%) is worth considering. The fund focuses on the stocks of foreign companies with high dividend yields and low price and earnings volatility. It has over 1000 holdings and assets under management of over $2.1 billion. Stellantis represents a minor equity position, with a 0.40% weighting. The ETF has a 0.43% expense ratio, which amounts to $4.30 in fees on a $1,000 investment.

Will Stellantis stock split?

Since the completion of the merger in 2021 that created Stellantis as it is today, the company has not split its stock, and there's no indication that it intends to split it anytime soon. Given that many brokers now offer fractional shares of stocks, fewer companies seem inclined to offer stock splits.

Although many stocks split in 2024 and some are scheduled to split in 2025, Stellantis management is unlikely to announce an upcoming split in the near future.

The bottom line

Since the completion of the FCA and PSA merger, shares of Stellantis have failed to keep pace with the S&P 500 index. But it's important to remember that the company has operated in its post-merger form for just over three years. It's quite possible that this leading global automaker will be a long-term winner for investors. However, as Stellantis's future plans have changed, only time will tell if Stellantis will be the right vehicle for your portfolio.