With its portfolio of industry-leading brands, Stellantis (STLA +1.82%) is a well-known automotive name. So, understandably, car stock enthusiasts are consistently drawn to it. The corporation has a considerable global presence as the parent company of famous American brands, like Jeep, Chrysler, and Dodge; well-known French names, like Citroen and Peugeot; and legendary Italian brands, like Alfa Romeo and Maserati.

NYSE: STLA

Key Data Points

Should I invest in Stellantis?

Every individual has a unique investing perspective and financial situation. That said, investors may or may not find Stellantis stock appealing for several reasons. Most importantly, investors looking to steer clear of riskier investments will want to think carefully about purchasing Stellantis stock.

After a challenging 2024, when the company recognized significant decreases in revenue and earnings, management announced a plan to get the company back on track. There's no guarantee the company will succeed, so if investors are looking for more conservative routes to gain exposure to carmakers, Stellantis isn't the right choice.

One of the most obvious questions is whether you're interested in a consumer durables stock like Stellantis. Conservative investors or those with shorter investing horizons, for instance, may be less interested in an automaker. Consumer durable stocks tend to be cyclical, so those who are uncomfortable holding Stellantis through downturns should look elsewhere.

Another important consideration is whether you're looking to supplement your passive income. If you're looking for an interesting high-yield dividend stock, Stellantis is worth further investigation, especially since management seems focused on ensuring the company's financial security won't be jeopardized by a high payout.

Of course, it's not only auto investors who will find Stellantis stock alluring. With Stellantis' sizable position in Archer, investors can gain indirect exposure to Archer stock by picking up shares of Stellantis. The fact that Stellantis has signed an agreement to manufacture Archer's aircraft means even more exposure to Archer.

Lastly, if you're interested in an automaker that's embracing the transition to EVs and are unsure about Stellantis future in the EV market, it's worth considering EV pure plays like Tesla (TSLA +0.09%) and Rivian (RIVN -0.55%).

Is Stellantis profitable?

For several years, Stellantis had increased profits. In 2024, however, the company hit a pothole. After reporting diluted earnings per share (EPS) of 5.31 euros ($5.82) and 5.94 euros ($6.51) in 2022 and 2023, respectively, the automaker reported diluted EPS of 1.84 euros ($2.02) in 2024. Unfortunately, as of November 2025, Stellantis reported a diluted EPS of $0.00, representing a 100% decline.

Declining sales represented the main culprit in the company's inferior performance in 2024 compared to 2023. Stellantis reported only 5.42 million vehicle shipments in 2024, a 12% decrease from the 6.17 million reported in 2023.

Does Stellantis pay a dividend?

Stellantis has rewarded investors with a dividend. In 2023 and 2024, for example, it paid dividends per share of 1.34 euros (about $1.45) and 1.55 euros (about $1.68), respectively.

After its poor performance in 2024, management reduced the dividend to ensure the company didn't find itself in poor financial health. For 2025, the company projects it will return 0.68 euros per share (approximately $0.74) to investors. Unfortunately, Stellantis has failed to deliver on this projection as of November 2025.

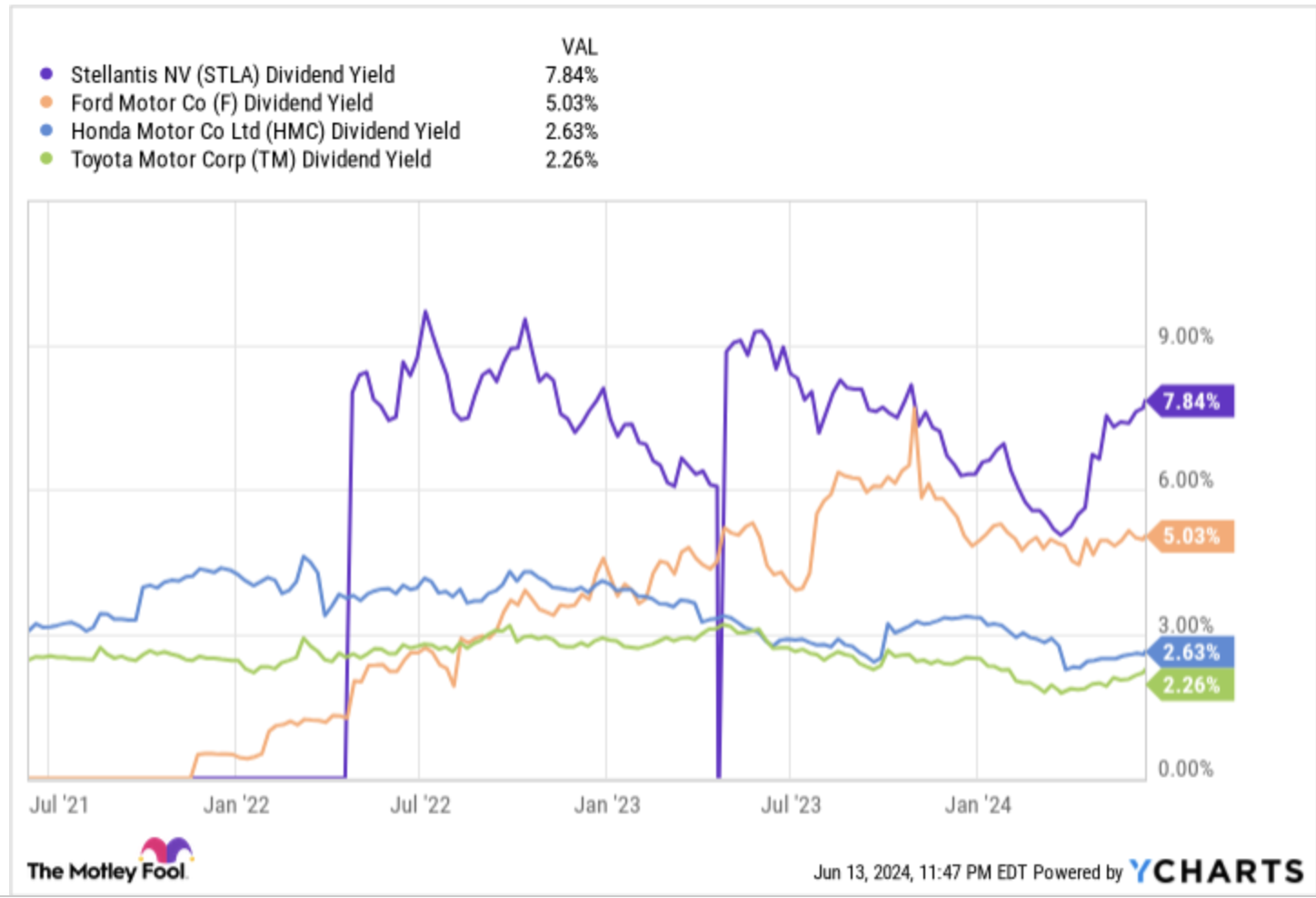

Stellantis has one of the highest dividend yields among automakers, with a forward yield of about 5.6% based on its share price as of February 2025. That's a significantly higher yield than peers like Honda Motor (HMC -0.78%) and Toyota Motor (TM -0.82%) currently pay.

The bottom line on Stellantis

Since the completion of the FCA and PSA merger, shares of Stellantis have failed to keep pace with the S&P 500 index. But it's important to remember that the company has operated in its post-merger form for just over three years. It's quite possible that this leading global automaker will be a long-term winner for investors. However, as Stellantis's future plans have changed, only time will tell if Stellantis will be the right vehicle for your portfolio.