Are you up to date with the companies that Alphabet owns? It's all right if the answer is "no." With more than 260 completed acquisitions in April 2025 (including three in the last year alone), it's hard to keep up with this tech giant's wheeling and dealing.

The company, originally called Google, restructured into an umbrella organization named Alphabet (GOOG -1.19%) (GOOGL -1.16%) in 2015 for the explicit purpose of making people more comfortable with new services that don't have much to do with its online search and advertising business. What started as a student project in a Stanford garage has grown into a global empire.

Alphabet is no stranger to in-house innovations, but many of its most important business projects entered the company by way of acquisitions.

This strategy helps the company extend its reach far beyond its original search engine roots, pursuing a future where its technology intersects with almost every aspect of our lives. From artificial intelligence (AI) and autonomous vehicles to health technology and cloud computing, Alphabet's acquisitions reflect its commitment to leading innovation and diversifying its portfolio.

With each buyout, Alphabet not only gains access to new technologies and markets but also reinforces its position as a technology titan, leading by example as the digital world evolves.

Alphabet's approach to acquisitions is both strategic and visionary. It targets companies that offer unique technologies or capabilities that complement its existing business lines or open new avenues for growth. Equipped with some of the deepest pockets on the planet, Alphabet's acquisitive strategy has maintained its competitive edge while adapting to the rapidly changing technological landscape.

What companies does Alphabet own?

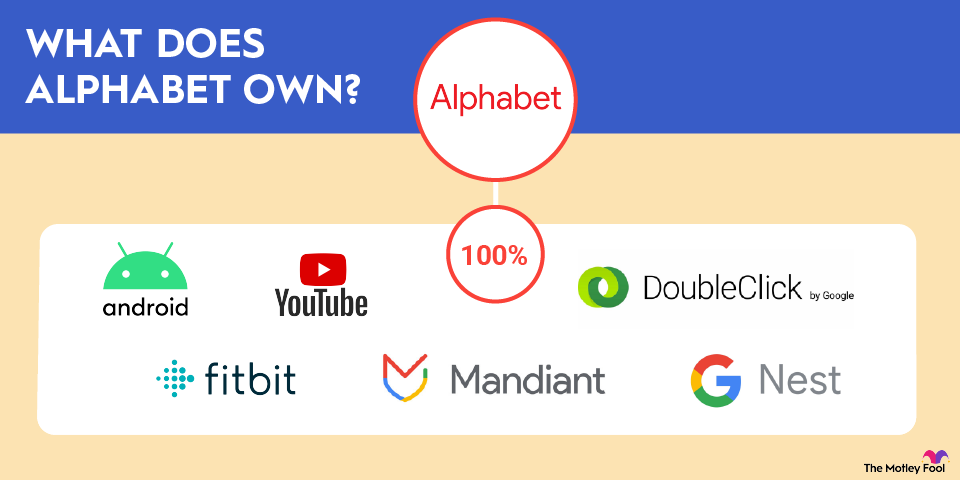

Alphabet's journey through acquisitions is more than a mere expansion strategy; it's a quest for innovation across the digital landscape. From essential tools like YouTube and Android that have become integral to our daily digital lives to ventures into future-forward areas like artificial intelligence with DeepMind and health tech with Fitbit, Alphabet's acquisitions paint a picture of a company always looking ahead.

These acquisitions not only enhance Alphabet's portfolio but also bring fresh challenges and opportunities, pushing the boundaries of what's possible in tech. While some deals, like the purchase of Motorola Mobility, might have seemed off-course, they provided valuable lessons and assets that furthered Alphabet's long-term strategy.

It would take entire books to cover all of Alphabet's buyout history in detail, so let's take a quick look at just a handful of important examples. The variety in Alphabet's acquisitions, ranging from household names to niche pioneers, demonstrates a deliberate strategy to diversify and solidify its influence across multiple sectors. Each acquisition, regardless of its immediate impact, contributes to Alphabet's broader vision of a seamlessly connected and technologically enriched world.

1. YouTube: $1.65 billion, 100% ownership since 2006

The internet never forgets, so I'm forever on the record saying YouTube wouldn't make any sense as a Google business in 2006. But the video-sharing platform signed on the dotted line just a couple of days later, sealing a stock-swap buyout worth $1.65 billion.

A lot has happened on that video service since then, but let's just skip almost two decades ahead. YouTube ads accounted for ad revenues of $36.1 billion in fiscal year 2024. Apart from Google Cloud, Alphabet doesn't break out detailed operating profits for subsidiaries, so it's hard to tell exactly how profitable that modest YouTube investment has been over the years. With the benefit of hindsight, the YouTube buyout was a spectacular business decision with an incredible return on the original price.

2. Android: Estimated $50 million, 100% ownership since 2005

The top mobile phones in 2005 were flip phones with text messaging. Apple (AAPL -0.20%) was reportedly working up the first iPhone in secret, and consumers hadn't seen the first true smartphone yet.

But Google had already laid the groundwork for the upcoming smartphone market. The company spent approximately $50 million on the Android development team that year. And so, the smartphone rivalry that would define the next decade was underway long before consumers could get their hands on the first next-generation handsets.

The smartphone wars started with the first iPhone release in 2007, followed by the first Android devices in 2008. App stores and mobile ads have added untold billions of top-line revenue and bottom-line profit for Apple and Alphabet. The YouTube deal was great, but Android delivered an even richer return on a smaller investment.

3. DoubleClick: $3.1 billion, 100% ownership since 2007

The game-changing YouTube and Android deal would not have been possible if Google hadn't started building a robust online advertising business first. Its first ad service was created from scratch, but the buyout of digital advertising leader DoubleClick took that operation to the next level.

Before the DoubleClick deal, Google only served text ads next to search results. The buyout elevated Google's AdWords platform to a full-featured ad delivery service with graphic banners and publishing solutions across many websites other than Google.

Alphabet has added a few separate revenue streams since then, collecting money from cloud computing services, high-speed internet connectivity, and smart home hardware sales. But Google-branded advertising still accounted for 75% of Alphabet's overall sales in the fourth quarter of 2024. The DoubleClick name went away when all ad services were rebranded to Google Ads in 2018, but this deal played a critical part in Alphabet's lucrative ad business.

4. Nest Labs: $3.2 billion, 100% ownership since 2014

Speaking of smart home devices, the company baked up its first Google Assistant devices from scratch. The resulting Google Home system could control Nest thermostats and smoke alarms as early as 2011, but Google wanted more control over its partner. So, Google boosted its stake in Nest Labs from 12% to 100% in a multibillion-dollar cash deal.

5. Fitbit: $2.1 billion, 100% ownership since 2021

Nest and Fitbit represent the majority of Alphabet's non-Google business these days. Both operations were brought in as fully realized product lines and established development teams. Alphabet is happy to spend billions of dollars on these solid businesses, especially since their presence can elevate the company's smart hardware and related services on a larger scale. Fitbit and Nest are great examples of these tactics, giving Alphabet an instantly competitive presence in Internet of Things markets that the company had largely left alone.

6. Wiz: $32 billion, announced in March 2025

Google has acquired at least a dozen cybersecurity companies over time, but the Wiz acquisition announced in 2025 casts a deep shadow over the smaller deals. It's the largest buyout in Alphabet's history.

This deal, pending at the time of writing in April 2025, addresses a rising need for advanced cybersecurity solutions. AI is growing more and more powerful, and widespread cloud adoption also creates new security challenges for organizations.

Wiz developed a practical platform that connects to major cloud providers and helps prevent cyber threats for all types of organizations. Google plans to combine its in-house AI expertise with Wiz's technology to create more automated security systems that work efficiently across different cloud environments.

The move positions Alphabet to protect its own vast data ecosystem, and also makes it a leading provider of cross-platform security solutions in an increasingly multicloud world.

7. Motorola Mobility: $12.5 billion, 100% ownership in 2011, sold to Lenovo in 2014

Here's the one that got away.

The $12.5 billion Motorola Mobility deal was Google's largest buyout at the time, meant to give the company a powerful phone brand that could compete directly with Apple's iPhone line. However, Google's Motorola phones never rose to the challenge, and Alphabet sold most of it to Chinese technology giant Lenovo (LNVG.Y +0.51%) three years later. That deal excluded "the vast majority" of Motorola's mobile patent collection, so Alphabet still holds on to some small part of Motorola. Lenovo only paid $2.9 billion for the smartphone business and supporting assets.

So, Alphabet went back to the lab again, working up a new mobile hardware strategy. Two years later, the first Google Pixel phones showed up, developed by Alphabet but manufactured by various third-party hardware specialists.

Related investing topics

The fundamental facts on companies owned by Alphabet

Not every buyout has been a raging success, and Alphabet's more than 200 acquisitions have certainly included many efforts of limited value. But it only takes a couple of massive success stories, such as YouTube, Android, and DoubleClick, to make investors forgive and forget those fizzled efforts.

All in all, Alphabet has generated game-changing business results and shareholder value from its buyout-based strategy.

The company's knack for making calculated bets has reshaped the tech landscape, setting new standards for what's possible. From transforming the way we access information and connect with each other to pioneering advancements in AI and digital advertising, Alphabet continues to push the boundaries, turning ambitious visions into tangible realities. And the company is not afraid to pick up smaller rivals and innovators along the way, usually with price tags too small to merit reporting.

The company is larger and richer than ever and will surely make more acquisitions in the coming years. The Alphabet structure that CFO Ruth Porat built a decade ago has proven flexible and useful. Alphabet's long-term future may rely on unexpected operations such as self-driving car services or medical research, which would seem strange in a Google-branded company structure but perfectly normal with the Alphabet architecture.

FAQ

Companies Alphabet owns: FAQ

About the Author

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anders Bylund has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet and Apple. The Motley Fool has a disclosure policy.