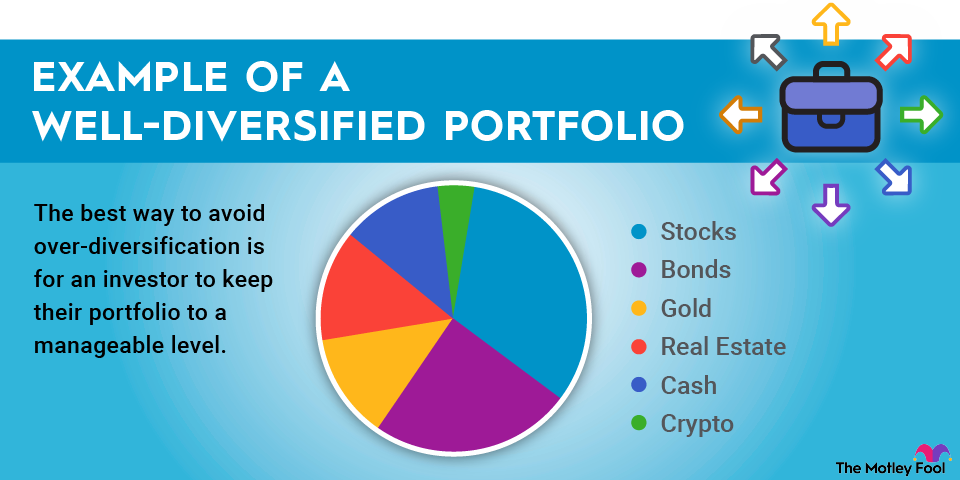

What are the risks of over-diversification?

The biggest risk of over-diversification is that it reduces a portfolio's returns without meaningfully reducing its risk. Each new investment added to a portfolio lowers its overall risk profile. Simultaneously, these incremental additions also reduce the portfolio's expected return.

However, at some point, an investor will reach the number of investments where the benefit of risk reduction from each new addition is smaller than the decrease in expected gains. Thus, there's no incremental benefit to adding that investment. It would be better to sell a lower-conviction idea and replace it with this new one than add it to the portfolio since there's no incremental benefit.

The other danger of over-diversification is that it takes an investor's focus away from their highest-conviction ideas. They'll need to divert some of their time to stay up to date on all their holdings. That could cause them to focus too much on losing investments and not enough on the winners. It would be better to cultivate the winning ideas and add capital to those investments while weeding out bad ones that don't add an incremental benefit.