BlackRock (BLK +0.38%) is the world’s largest asset manager, overseeing roughly $12.5 trillion in assets under management (AUM) as of late 2025. That scale often leads to confusion about what BlackRock actually owns versus what it manages on behalf of clients.

At its core, BlackRock is an asset management business. It invests money for individuals, institutions, and exchange-traded funds (ETFs), earning fees for managing those assets. While BlackRock’s funds hold large stakes in many of the world’s biggest companies, BlackRock's underlying investors, not the company itself, own those shares.

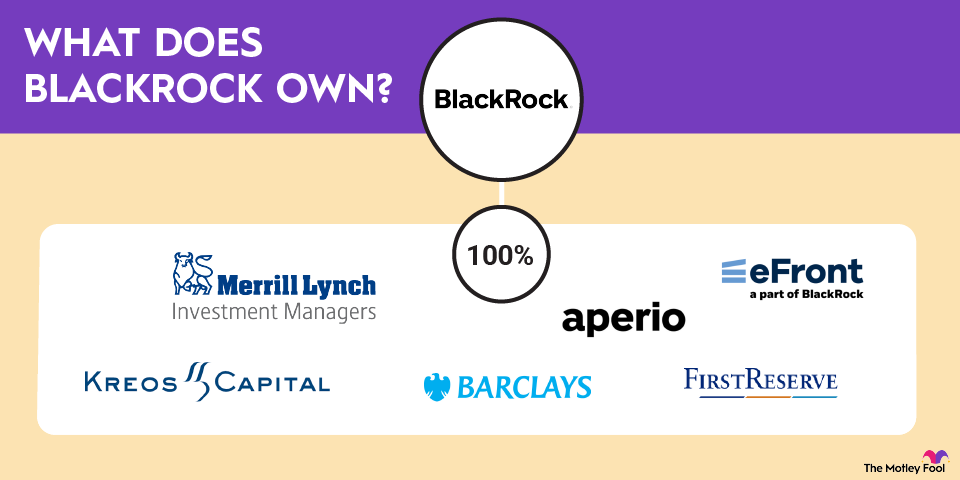

That distinction is important. In addition to managing client assets, BlackRock does own a smaller group of companies outright, primarily businesses that expand its investment, technology, and private-markets capabilities. Here’s a look at what BlackRock owns, how those businesses fit together, and what it may buy next.

What companies does BlackRock own?

BlackRock has acquired several companies over the years to expand its investment management capabilities. Here's a look at some of the companies it now owns:

Asset Management

Other investments

In addition to wholly owned companies, BlackRock has made several strategic minority investments, including:

- Acorns: The company invested in the micro-investing app in 2018. BlackRock has expanded the partnership and its investment over the years, and it is now an anchor investor in Acorns.

- iCapital: BlackRock increased its stake in the leading technology platform for alternative investments in 2020. It's the largest minority investor in the company.

What companies could BlackRock buy in the future?

BlackRock is an active but disciplined acquirer. Its focus has increasingly shifted toward private markets, alternative investments, and data-driven platforms.

In 2024, BlackRock agreed to acquire Preqin, a leading provider of private markets data, for $3.2 billion in cash. The deal expands BlackRock’s technology business and strengthens its position in private-market analytics, an area seeing rapid growth as institutional and retail investors seek more transparency into alternatives.

That same year, BlackRock also announced a deal to acquire HPS Investment Partners in a $12 billion stock transaction. The acquisition would create a global private credit franchise managing more than $220 billion in client assets, positioning BlackRock as a more direct competitor to alternative asset managers like Blackstone, KKR, and Apollo.

Looking ahead, BlackRock’s emphasis on alternatives reflects broader industry trends. According to data from Preqin, assets under management in alternative investments could approach $30 trillion by 2030, nearly double current levels. Private credit is expected to be one of the fastest-growing segments, fueled in part by banks pulling back from commercial and specialized lending.

That environment gives BlackRock multiple potential paths for future deals. The firm could pursue additional acquisitions in private credit, infrastructure, or real estate to deepen its alternative investment capabilities. It may also look toward technology platforms that help individual investors access private assets, such as digital marketplaces or portfolio-management tools designed for high-net-worth clients.

Historically, BlackRock has often started with minority investments before moving to full acquisitions. Its earlier investments in SpiderRock, iCapital, and Acorns followed that pattern. Future deals could take a similar approach, allowing BlackRock to expand into new segments while managing integration risk.

While large transactions may slow temporarily as the firm integrates recent acquisitions, BlackRock has the balance sheet strength and strategic flexibility to remain an active acquirer when the right opportunities arise.

The bottom line

BlackRock does not “own” the world’s biggest companies in the way many people assume. Instead, it manages assets on behalf of clients, who retain ownership of those investments.

That said, BlackRock does own a growing group of investment, infrastructure, and technology businesses that support its core asset-management platform, particularly in private markets and alternatives. Understanding that distinction helps clarify how BlackRock makes money, how it grows, and whether its stock makes sense as a long-term investment.