The Nasdaq Composite Index defined

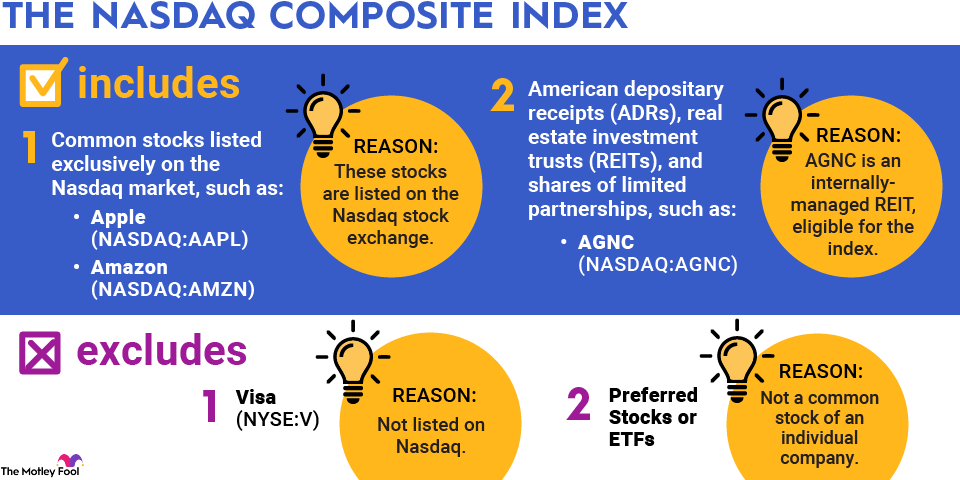

The Nasdaq Composite is a stock market index that consists of the stocks that are listed on the Nasdaq stock exchange. To be included in the index:

- The stock must be a common stock of an individual company, so preferred stock, exchange-traded funds (ETFs), and other types of securities are excluded.

- American depositary receipts (ADRs), real estate investment trusts (REITs), and shares of limited partnerships are eligible.

- The stock must have a specific number of both outstanding shares and shareholders.

That's why there are so many stocks included in the Nasdaq Composite and why the number of stocks in the index often changes. The index is designed to be representative of the entire Nasdaq stock market, not just the largest companies.

The Nasdaq Composite is one of the most widely followed stock indexes in the U.S. and is usually one of the three "headline" indexes that market commentators often cite -- along with the Dow Jones Industrial Average and the S&P 500.

Because the Nasdaq has a high concentration of companies in the technology sector -- particularly of the younger, fast-growing variety -- the Nasdaq Composite Index is often considered to be a good barometer of how well the tech market is performing.

Exchange-Traded Fund (ETF)

How to invest in the Nasdaq Composite Index

The easiest way to invest in the Nasdaq Composite Index is to buy an index fund, which is a mutual fund or ETF that passively tracks the index. An index fund is designed to invest in all of the components of a stock index and in the same weights as the index. The idea is that over time, index funds will deliver virtually identical performance (with lower fees) as the index they track.

For example, Fidelity offers two investment vehicles that track the Nasdaq Composite. On the mutual fund side, the Fidelity Nasdaq Composite Index fund (FNCMX +1.30%) has a 0.29% net expense ratio and no minimum investment. Fidelity also offers its Nasdaq Composite Index ETF (ONEQ +0.57%), which trades like any other stock and has a lower expense ratio of 0.21%.

Like the mutual fund, there's no minimum investment required. However, it's worth pointing out that the price of a single share is about $88 as of September 2025, so you'll need to invest at least that much or choose a broker that allows you to buy fractional shares of stock.

Financial Securities

Nasdaq-100: The other Nasdaq stock index

There's another Nasdaq-based index that is widely followed: The Nasdaq-100. This index, which is also market-cap weighted, is often confused with the Nasdaq Composite, but there's a big difference that's important to note.

Instead of including all of the common stocks listed on the Nasdaq exchange, the Nasdaq-100 only includes the stocks of the 100 largest nonfinancial companies listed. The 100 companies in the Nasdaq-100 make up more than 90% of the weight of the Nasdaq Composite Index. As you might imagine, the top 10 holdings of both indexes look very similar, as do their performance over time.

Just like with the Nasdaq Composite, there are mutual fund and ETF products that allow investors to track the Nasdaq-100 Index in their portfolio. Most notable is the Invesco QQQ ETF (QQQ +0.50%), which proportionally invests in the 100 index components for a low expense ratio of 0.2%.

Related investing topics

Should you invest in the Nasdaq Composite Index?

Investing in stock market indexes is a great idea if you don't have the time or desire to research and select individual stocks to invest in, or if you lack the experience and or risk tolerance necessary to properly evaluate stocks.

In fact, billionaire investor Warren Buffett, widely considered to be the most successful stock investor of all time, has said that index funds are the best investment choice for the majority of Americans. If you have the time and desire to invest in individual stocks properly, we encourage you to do so, but if you don't, there's nothing wrong with putting your investment portfolio on autopilot with index funds.

With that in mind, the Nasdaq Composite Index offers lots of exposure to tech heavyweights of today, such as Apple, Microsoft, and Amazon, while also giving investors some exposure to the tech heavyweights of tomorrow, thanks to its inclusion of every Nasdaq-listed common stock. As a result, the Nasdaq Composite Index could be a great investment choice if you don't yet feel comfortable choosing individual stocks or if you want broad exposure to the technology sector.