The automotive industry is huge and very visible. Almost everyone is familiar with automotive brands, and most people have an opinion about the best new cars and trucks on the market. Because of this visibility, automotive stocks have gotten lots of interest from investors for decades.

Top car stocks of 2026

Some of the best-known automotive stocks are:

| Name and ticker | Current price | Market cap | Dividend yield |

|---|---|---|---|

| Ford Motor Company (NYSE:F) | $14.20 | $56.6 billion | 4.23% |

| Ferrari (NYSE:RACE) | $376.07 | $66.9 billion | 0.90% |

| Tesla (NASDAQ:TSLA) | $444.79 | $1.5 trillion | 0.00% |

| Stellantis (NYSE:STLA) | $10.91 | $31.3 billion | 7.07% |

| Volkswagen Ag (OTC:VWAGY) | $12.14 | $35.8 billion | 5.87% |

| Toyota Motor (NYSE:TM) | $221.52 | $288.7 billion | 2.85% |

| General Motors (NYSE:GM) | $82.87 | $77.3 billion | 0.69% |

The auto industry

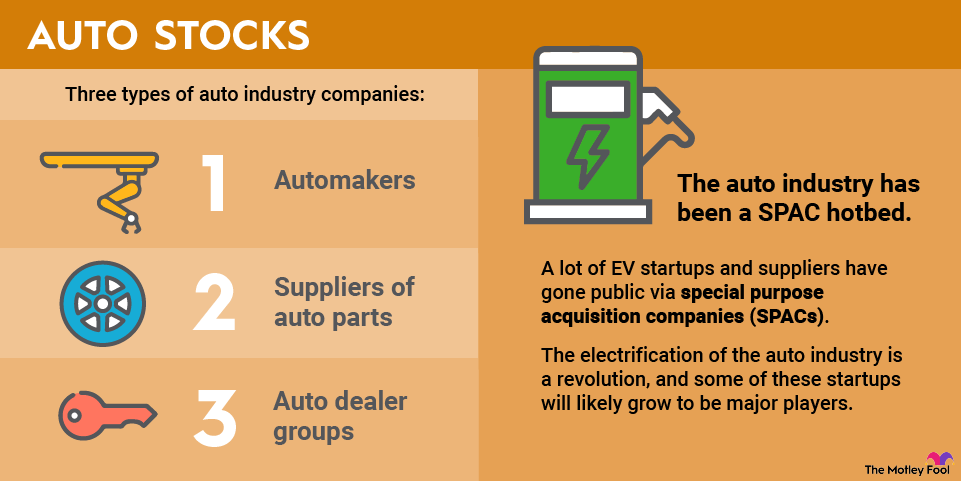

You'll find the following types of stocks within the automotive industry group:

- Automakers, which manufacture cars, trucks, and sport utility vehicles, including electric vehicles (EVs).

- Suppliers of auto parts, from seats and spark plugs to complex electronic systems, tires, and batteries for electric cars.

- Auto dealer groups.

- Auto parts retailers.

How do you evaluate an automotive stock?

Before investing in automotive stocks, it's essential to understand how economic cycles affect automotive companies and how these companies work to maximize profits and stay competitive during good and bad economic times. Additionally, investors should consider each auto company's strategy and relevance in the electric vehicle market.

- Valuation within the cycle.

- Financial health to invest capital in developing new cars -- a key issue in a capital-intensive industry subject to constant innovation.

- Electric vehicle strategy.

Understanding the auto sales cycle

Automakers and their suppliers are cyclical stocks, meaning their profits fluctuate in line with consumer confidence. When businesses and consumers are worried about the economy, they postpone buying new vehicles. Auto sales' cyclicality matters to investors because:

- Automakers have high fixed costs, which include factories, tooling, logistics networks, and labor contracts. These bills must be paid, regardless of the number of cars sold.

- Automakers and suppliers also need to invest in product development to make sure they have a steady stream of competitive new products.

- High costs and steady spending mean profit margins in the automotive industry tend to be low, even during good economic times.

- When sales slump, such as during a recession, automotive companies' profits fall sharply, putting future product spending and future competitiveness at risk.

One way to avoid the cyclicality of the sector is to invest in stocks exposed to the replacement market, such as auto parts retailers or manufacturers that primarily sell to the secondary market.

How do you understand car companies' financial statements?

For the most part, the financial statements of automotive companies aren't too difficult to decipher. Here are three things to know:

- Auto investors tend to examine operating income or EBIT (earnings before interest and taxes), as well as operating or EBIT margins (calculated by dividing profits by total revenue), and cash flow to assess an automotive company's financial performance.

- Automakers will often provide adjusted figures that exclude the impact of one-time charges and gains, such as write-offs and tax windfalls, which help understand the business's underlying performance.

- Many automakers have subsidiaries that are finance companies, which offer loans and leases to customers and dealers. They can make automotive financial statements confusing for investors. To help, most automakers provide debt and cash-flow figures specific to their core automotive businesses, often referred to as "automotive" or "industrial" numbers.

Competition in the car industry

Generally speaking, the automaker with the newest products tends to receive the highest prices and the most significant profits. Automakers must continually invest to be sure they have a steady flow of new products in the pipeline.

Virtually all automakers and many parts suppliers are also making significant investments in future technologies such as EVs, extra safety features, and autonomous driving systems.

Electric vehicles

Some exciting opportunities in the next few years will involve manufacturers of electric and hybrid electric vehicles. These are new and different, and most analysts expect them to displace internal-combustion cars eventually.

EV companies might see high growth, which is also exciting for investors. However, it's essential to note that the processes involved in developing and manufacturing EVs aren't significantly different from those employed by traditional internal-combustion vehicle manufacturers. That means EV manufacturers face high costs, just like conventional automakers.

It's also important to remember that all the major traditional automakers are introducing their own electric vehicles.

That competition has intensified as relatively high interest rates have slowed demand growth at a time when many carmakers have released new EV and hybrid models. As such, the primary focus over the last year or so has been on cutting costs and reducing capacity where necessary.

The future of the auto industry

The future of the industry lies in EV and autonomous vehicles, with an increasing part of the value in the car coming from its software component. In addition, many believe ride sharing, notably via robotaxis, is where the industry is headed.

Many of the major automakers have invested heavily in EVs, autonomous vehicles, and robotaxis, but the undisputed leader in terms of commercializing these opportunities is Tesla.

Its robotaxi rollout and its aim of having unsupervised full self-driving (FSD) available (so Tesla drivers can transform their vehicles into robotaxis, and Tesla can launch its dedicated robotaxi, the Cybercab) are not risk-free events. If Tesla can get it right, the stock's upside potential is significant.

How to invest in automotive stocks

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Related investing topics

Are automotive stocks for you?

Automotive stocks can be important contributors to your investment portfolio. And because they rise and fall with consumer confidence, they can be useful indicators that economic trouble -- or a recovery -- may be on the way.

In addition, investing in an automotive manufacturer means taking a positive view of the company's long-term hybrid and electric vehicle strategy. That's become harder to judge as relatively high interest rates have slowed the growth rate of EV unit sales, dropped pricing, and intensified competition.