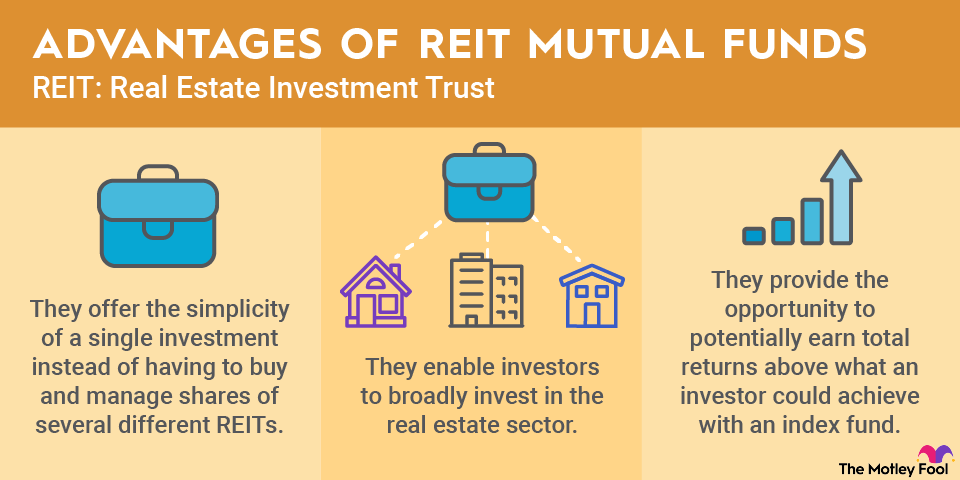

Real estate investment trusts (REITs) have become a popular way to invest in real estate. If you have the resources and would like to take an active role, you may be interested in how to start a REIT.

The process of setting up a REIT is much more complex than simply investing in one or buying your own rental property. In this guide, we'll cover how REITs work and the requirements to form one of your own.

What exactly is a REIT?

A REIT is a real estate investment company that owns or finances income-producing properties and distributes dividends to its investors. In fact, a REIT must distribute 90% of its taxable income to its investors.

There are two types of REITs: equity REITs and mortgage REITs. Equity REITs are the most common. They invest in income-producing real estate. Mortgage REITs provide financing for real estate and buy existing mortgages.

How is a REIT different from crowdfunding?

REITs and crowdfunding have the same general concept. The investors provide capital, the REIT or crowdfunding sponsor purchases real estate, and the investors hopefully earn a return on their investment.

One of the main differences is that investors commonly invest in a specific deal with crowdfunding. The sponsor raises money for that deal, the investors all get a piece of the cash flow, and once the property is sold, the investment is over. Each deal is a separate transaction.

REIT investors, on the other hand, are typically investing in a portfolio of properties. This portfolio can change over time as the REIT's management team disposes of poorly performing properties to invest in properties with higher returns. A REIT also usually continues to add more real estate assets to a portfolio as more investors purchase shares.

An investor's capital is typically tied up for several years when they invest in crowdfunding. The same is usually true with private REITs. However, publicly traded REITs can be bought and sold whenever the investor wants.

Why start a REIT?

REITs have more flexibility than equity crowdfunding or real estate syndication. You don't have to raise capital for each individual deal and possibly miss out on deals because you can't act quickly enough.

A REIT is an ongoing operation that can move in and out of investments to maximize the return. Investors essentially agree to trust you with your asset management abilities to give you more flexibility on how to best use the capital available. With a syndicate, you have to sell investors on your vision and plan for each specific investment you want to make.

A popular reason to start a REIT is the tax benefits. REITs usually aren't taxed on the trust level. Instead, investors are taxed on their dividends.

One of the main requirements of a REIT is that it must pay out at least 90% of its taxable income as dividends. And since depreciation is a major noncash expense used as a deduction for taxes, a REIT almost always pays out at least 100% of its taxable income. This leaves untaxed money in the REIT that can be used for other investments.

How to start a REIT

The Internal Revenue Service (IRS) requires a company to reach certain thresholds before classifying it as a REIT, and there are specific requirements the company must continue to meet. The following steps are a common strategy investors use to start a private REIT.

Decide which type of REIT you want to form

Unless you're already sitting on a $100 million-plus real estate portfolio, you'll probably be starting out as a private REIT. Beyond that, you'll decide whether you're going to form an equity REIT or a mortgage REIT.

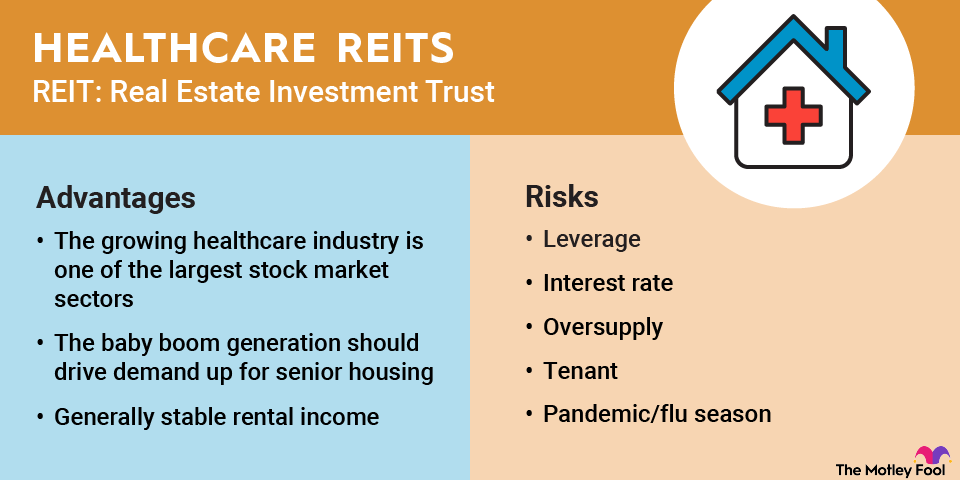

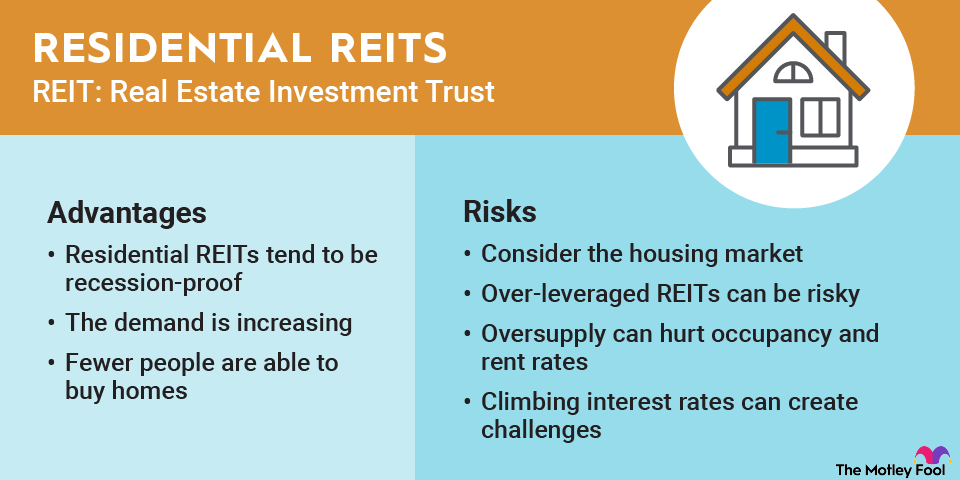

With equity REITs, there are several niches that involve different property types. Investors are usually more interested in these because they know what they're investing in. Here are some of the types of REITs you could form:

- Retail REIT

- Office REIT

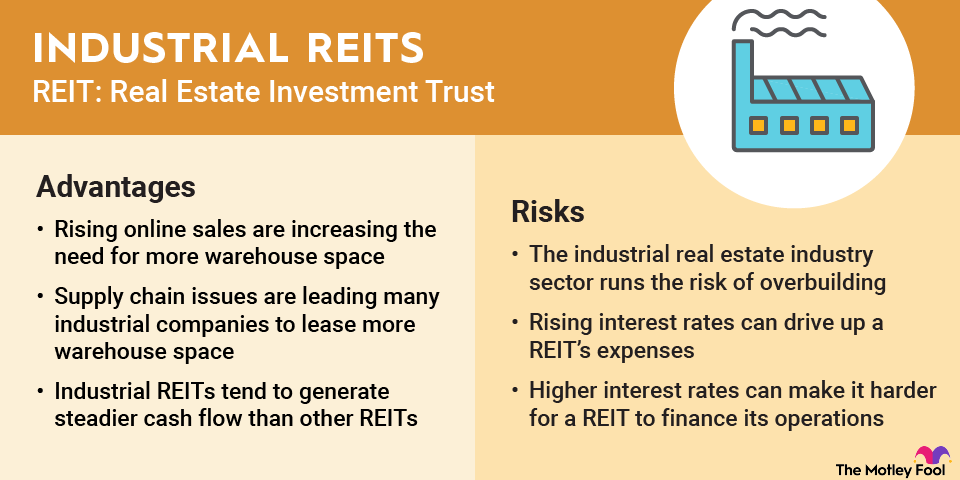

- Industrial REIT

- Residential REIT

- Healthcare REIT

- Hospitality REIT

- Infrastructure REIT

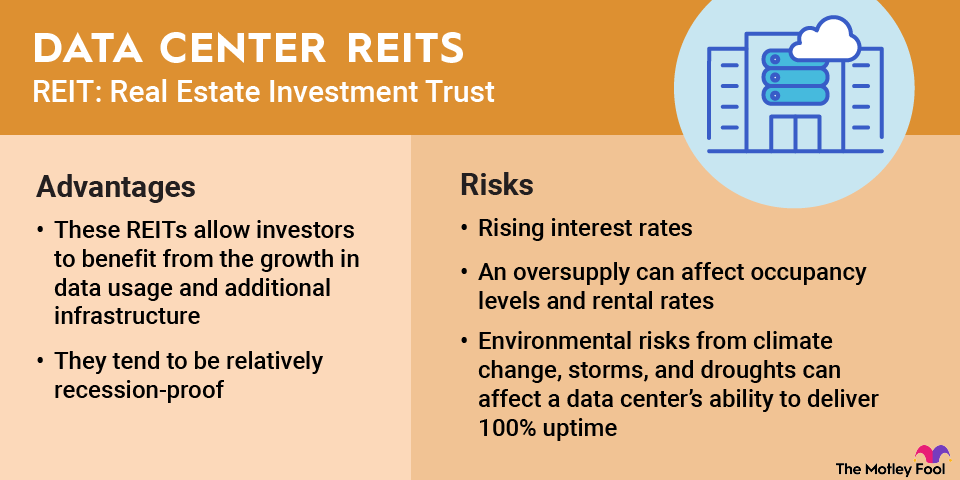

- Data center REIT

- Self-storage REIT

Once you have a plan, the following steps will take you from idea to REIT status.

Form a taxable entity

You, along with any partners, must first create a corporation that will later become the REIT. Since certain requirements still have to be met, the corporation is often set up as a management company. This is the best time to put a specific operating agreement in place among you and any partners. The agreement will determine how the company will be managed moving forward.

Draft a private placement memorandum

You should enlist an attorney to help with this part. The private placement memorandum (PPM) will provide very specific details of the company. Some of them will include:

- The objective

- Profiles of the management team

- The company's financial information

- How profits will be distributed

- Fees

- Rules for how investors can sell their shares

- Risks

- Agreement between the company and investors

You will provide potential investors with the PPM. Having a clear objective and thorough details will go a long way toward making investors feel comfortable with your company.

Find investors

Your company will need at least 100 investors to be classified as a REIT. You don't necessarily need to get all 100 up front since the IRS requires you to meet that threshold only by the beginning of the REIT's second tax year.

However, losing your REIT status for not having enough investors would be bad for investor relations. Most REIT start-ups will get commitments from at least 100 investors before moving forward.

It's also important to note that five or fewer investors can't own more than 50% of the shares in a REIT. In that case, the company would be taxed as a personal holding company.

Convert your management company into a REIT

Once you're ready to move forward with your REIT start-up, you'll need to change your company's structure from a management company to a REIT and amend the certificate of incorporation you filed.

Transitioning the company into a REIT will also involve filing IRS Form 1120-REIT when filing taxes. This form will request the information to verify that your company meets the criteria to be taxed as a REIT, and you will continue to use this form when filing taxes.

Maintain compliance

Starting a REIT isn't a one-and-done deal. You must continue to qualify to receive the same tax treatment. The ongoing requirements for a REIT are:

- Pay 90% of the REIT's taxable income to investors in dividends.

- At least 75% of the REIT's assets must be in real estate or real estate mortgages on a quarterly basis.

- At least 75% of the REIT's gross income must come from rental income or mortgage interest.

- A maximum of 5% of the REIT's income can be from nonqualifying sources such as service fees or other types of business income.

This isn't an all-inclusive list. The IRS provides a full list of the requirements to be taxed as a REIT.

How much does it cost to start a REIT?

It generally costs at least $1 million to start a REIT, and the total could be much higher. Here are the main costs involved:

- Real estate: The largest expense is usually purchasing the initial real estate for your REIT's portfolio. You can spend from $1 million to more than $10 million, depending on the area and the type of real estate.

- Repairs and renovations: Your properties will likely need at least some initial work done. The cost of repairs, renovations, and upgrades can range from $100,000 to more than $1 million.

- Legal fees: Forming a REIT requires legal and regulatory paperwork, which generally ranges from $50,000 to $250,000.

- Insurance: You'll need property and liability insurance. The cost of insurance depends on the market and the value of your properties.

- Property management: This includes property management setup fees and the ongoing expense of paying your property managers. The cost will depend on the number of properties you have and the amount of management needed.

Taking your REIT public

Taking your REIT public is the big payday and the opportunity to grow into a multibillion-dollar company.

While some REITs have had an initial public offering (IPO) to raise as little as a few million dollars, most wait until their value reaches at least $100 million. The time it takes to go public with your REIT will depend on the amount of capital you were able to raise from investors in the beginning and the size of the starting real estate investment portfolio.

Going public isn't a simple process, and it's definitely not cheap. There is a lot of red tape, and the initial cost is normally several hundred thousand dollars. Once your REIT is public, you also have additional expenses and stringent reporting requirements. Hassles and expenses aside, it's a great target to aim for. If you manage your REIT properly, it's achievable.

Related investing topics

The bottom line

Starting a private REIT is an excellent way to raise capital from investors while maintaining the flexibility you need to manage the assets in a way that will increase returns. Starting a REIT will also help you scale the size of your portfolio faster than many other options.

Of course, starting a REIT isn't the best option for every real estate investor. Take a careful look at your short- and long-term real estate goals to determine whether the REIT structure is right for you.

If you have limited experience and knowledge, you'll probably want to start with a few syndication deals to build a successful track record. This will be important for attracting investors, especially since they will have to put a lot of trust in you to manage their REIT investment. Either way, knowing how to start a REIT will help you significantly as you create your roadmap to operating your public REIT.