Most investors view a real estate investment trust, or REIT, as a safe investment. These companies typically generate stable rental income, enabling them to pay out attractive dividends.

However, not all REIT stocks are safe investments. Many have had to reduce or suspend their dividend payments during market downturns because they didn't have enough financial flexibility to maintain them. Some have put themselves in such poor financial positions that they've struggled to survive.

An investor needs to carefully consider the safety of a REIT before buying shares. Here's a look at the hallmarks of the safest REITs as well as three top ones to buy right now.

What makes a REIT safe?

The safest REITs share many common characteristics. Three factors stand out as being important to dividend safety:

- An investment-grade credit rating backed by low leverage metrics. Debt financing is crucial in real estate. It's much easier to access funding with lower interest rates if a REIT has an investment-grade credit rating backed by low leverage, such as a debt-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) ratio of less than 6.0 times. The higher the credit rating and the lower the leverage ratio, the safer the REIT.

- A conservative dividend payout ratio. REITs must distribute at least 90% of their net income to remain compliant with IRS regulations. However, many pay more than 100% of their taxable income because they generate more cash flow -- measured by metrics like funds from operations, or FFO -- than net income because of depreciation. REITs still need to keep their FFO payout ratio to a conservative level, ideally less than 75%.

- A high-quality commercial real estate portfolio leased to credit-worthy tenants. Rental payments are the lifeblood of REIT dividends, so REITs need to own properties with high rental demand and lease their space to tenants that can afford to pay their rents.

REITs that have all three of these characteristics will be much safer than rivals lacking one or more of these traits, so they should pay a secure dividend while also offering consistent dividend growth.

Top safe REITs

With these characteristics in mind, here's a closer look at three of the safest REITs:

1. Realty Income

NYSE: O

Key Data Points

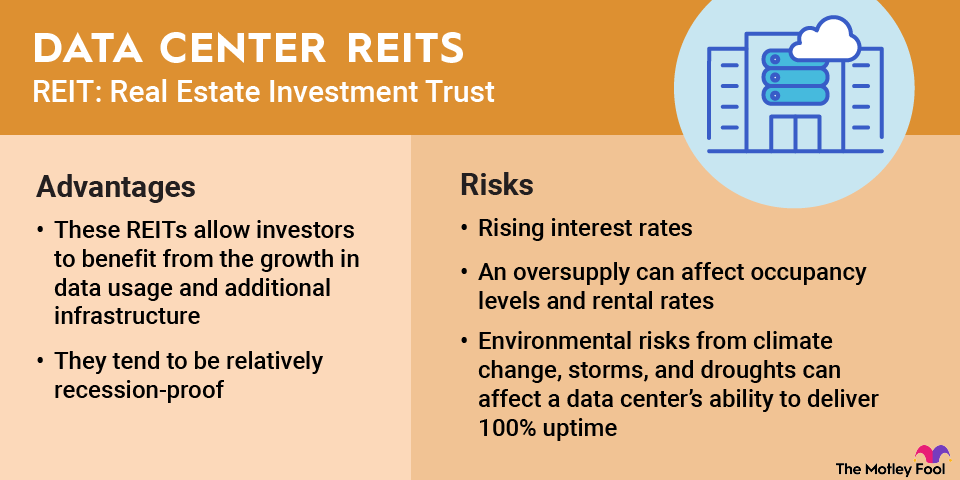

It is hard not to like Realty Income (O -1.52%). It is the largest net lease REIT around, with a portfolio that contains more than 15,600 properties. It focuses on retail, industrial, gaming, and other properties (like data centers). It leases these properties to high-quality tenants under long-term, net lease agreements. Those leases require that tenants cover all operating expenses, including routine maintenance, building insurance, and real estate taxes. As a result, Realty Income generates a very stable rental income.

The REIT pays out less than three-quarters of its FFO in dividends. That's a conservative level for a REIT. Realty Income also has one of the 10 best balance sheets in the sector by credit rating (A3/A-). Its strong financial profile makes Realty Income an extremely safe REIT.

Realty Income can also routinely increase its dividend. As of late 2025, the REIT had increased its dividend for 30 straight years (and more than 112 quarters in a row). Realty Income's strong financial profile has given it the flexibility to invest in additional income-producing properties, which grow its FFO per share to support dividend increases.

2. Mid-America Apartment Communities

NYSE: MAA

Key Data Points

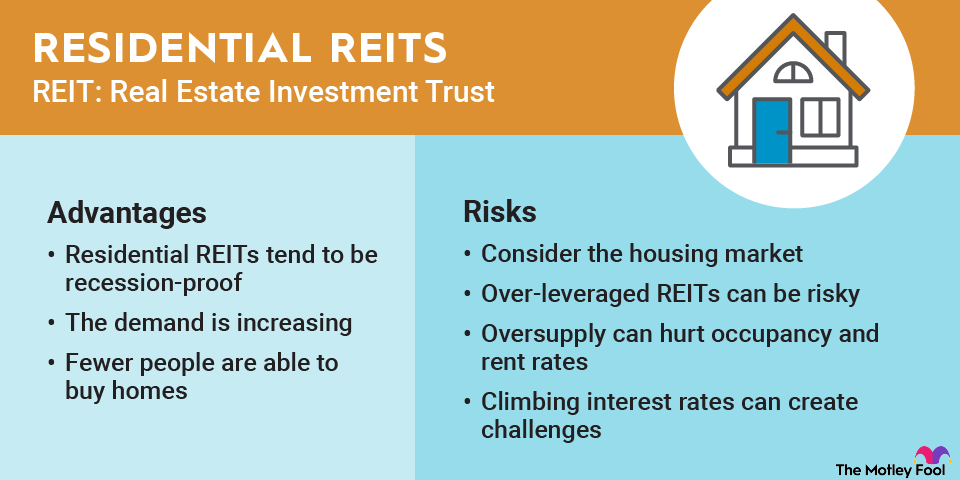

Mid-America Apartment Communities (MAA -0.55%) is one of the largest apartment landlords. It owned nearly 105,000 apartment homes in late 2025. The company focuses on owning apartment communities across the fast-growing Sunbelt region. It benefits from growing housing demand, which keeps occupancy levels high and drives steady rent growth.

Mid-America Apartment Communities also has a strong, investment-grade balance sheet. It's right up there with Realty Income with one of the 10 best credit ratings in the REIT sector (A3/A-). It also has a conservative dividend payout ratio.

The residential REIT's strong financial profile gives it the flexibility to invest in expanding its apartment portfolio. It will acquire apartment communities (operating and those under development), invest in development projects, and spend capital on apartment renovations. The REIT had about $1 billion of development projects underway in late 2025. These investments should help grow its FFO per share over the next several years, which allows the REIT to steadily increase its dividend.

It has never suspended or reduced its dividend since its initial public offering in 1994, and has increased its payment for 15 consecutive years. Given its strong portfolio and financial profile, Mid-America Apartment Communities should have no trouble continuing to increase its payout.

3. Prologis

NYSE: PLD

Key Data Points

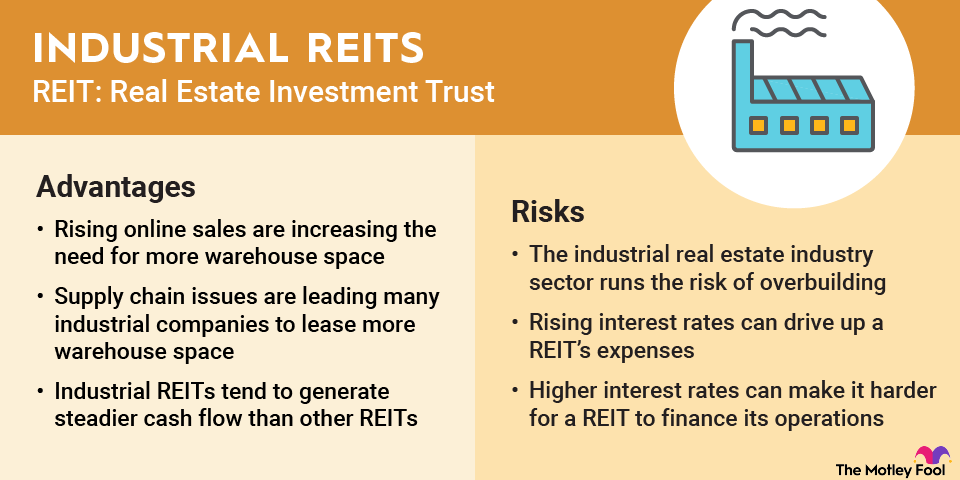

Prologis (PLD -3.48%) is the largest REIT in the warehouse sector. The leading industrial REIT owns more than 5,900 logistics real estate properties in 20 countries on four continents. It leases facilities under long-term agreements with high-quality tenants.

Prologis also has A-rated credit and a low-leverage balance sheet, as well as a low dividend payout ratio for the sector. That gives it tremendous financial flexibility to invest in expanding its portfolio by starting development projects and making accretive acquisitions.

The REIT's multiple growth drivers (which also include strong rent growth due to the robust demand for warehouse space) help drive above-average FFO growth. Over the last five years, Prologis has delivered 12% compound annual core FFO per share growth (double the REIT sector's average). That has enabled the company to raise its dividend at a brisk rate (13% compound annual growth compared to 6% for the average REIT).

With a fortress-like balance sheet and multiple growth drivers, Prologis should be able to continue growing its dividend at an above-average rate in the future.

Why invest in safe REITs

Investing in safe REITs has several benefits, including:

- Bankable dividend income: Financially strong REITs typically pay stable and steadily rising dividends.

- Lower volatility: REITs with lower risk profiles tend to be less volatile than those with riskier businesses.

- Solid capital appreciation potential: Financially safe REITs have the capacity to continue growing their businesses during industry downturns. That positions them to potentially deliver solid stock price appreciation potential over the longer term.

Related investing topics

Built on a strong foundation

The safest REITs share one thing in common. They have very strong financial profiles, giving them the financial flexibility to continue growing their dividends and real estate portfolios throughout the real estate cycle. Continued portfolio expansion should enable them to grow shareholder value while taking on much less risk than others in the sector. The ability to earn a solid return with less risk makes them great REITs to buy for the very long term.