Earnings reports are some of the most important sources of information available to stock investors. They provide important details about the current state of a business, reveal key financial information, and may include forward-looking earnings and revenue projections, as well as commentary from the CEO or other company leaders.

If you're invested in a particular stock, reading its quarterly and year-end earnings reports is one of the smartest things you can do to ensure your investment is still a good one. If you aren't invested in a company, reading through its recent earnings reports can help you analyze profitability, growth, financial conditions, and other important information to make educated decisions about whether a company would be a good fit for your portfolio.

What are earnings reports?

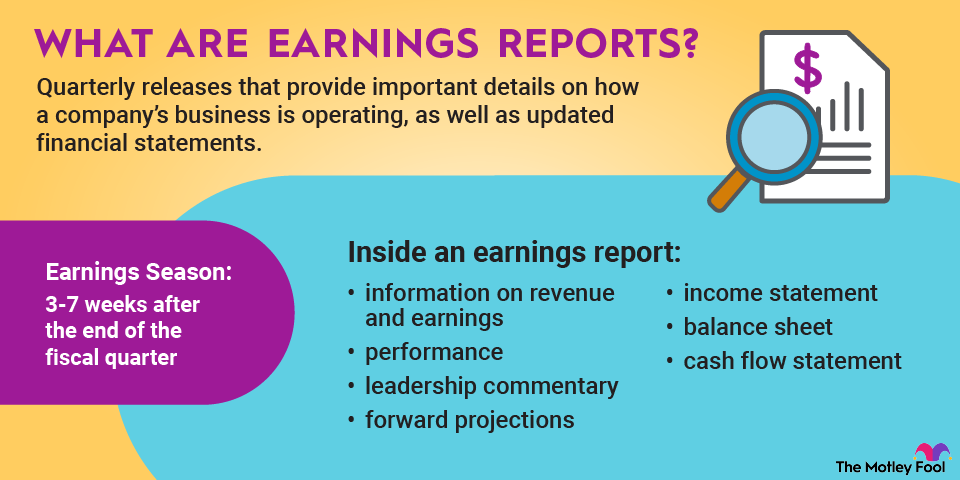

Earnings reports are (usually) quarterly releases that provide important details on a company's business operations and updated financial statements.

Publicly traded companies in the United States are generally required to issue earnings reports quarterly to disclose and discuss their business results, both quarterly and full-year, to the investing community. They must be issued in a timely manner after the end of the period being reported.

Most (but not all) companies release their earnings reports within three to seven weeks after the end of the fiscal quarter. This period that occurs after each calendar quarter is often referred to as earnings season. In a company's earnings report, you can find information on its revenue (also known as top line) and earnings (bottom line) and how specific parts of the company performed.

Most companies provide commentary from senior leadership on the results, along with valuable context about future growth initiatives. These typically come both in the form of comments in the written earnings report and in an earnings conference call, which usually occurs within a day or so after the earnings report is released. Many provide forward projections, or guidance, which tell investors how management expects the business to perform in the coming quarter or for the full year.

Upcoming critical earnings reports in 2025

Thousands of stocks trade on the New York Stock Exchange (NYSE) and the Nasdaq stock exchange in the United States, and thousands more trade on over-the-counter (OTC) markets and on international stock exchanges. So, it's impossible for us to discuss all of them. However, here's a list of some of the most closely followed companies when it comes to earnings reports, followed by their latest results and upcoming earnings dates.

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Amazon (NASDAQ:AMZN) | $2.4 trillion | 0.00% | Multiline Retail |

| Tesla (NASDAQ:TSLA) | $1.6 trillion | 0.00% | Automobiles |

| Microsoft (NASDAQ:MSFT) | $3.6 trillion | 0.70% | Software |

| Berkshire Hathaway (NYSE:BRK.B) | $1.1 trillion | 0.00% | Diversified Financial Services |

| Nvidia (NASDAQ:NVDA) | $4.5 trillion | 0.02% | Semiconductors and Semiconductor Equipment |

| Alphabet (NASDAQ:GOOGL) | $3.7 trillion | 0.27% | Interactive Media and Services |

| Shopify (NASDAQ:SHOP) | $220.9 billion | 0.00% | IT Services |

| Block (NYSE:XYZ) | $39.6 billion | 0.00% | Diversified Financial Services |

| Meta Platforms (NASDAQ:META) | $1.7 trillion | 0.32% | Interactive Media and Services |

| Nike (NYSE:NKE) | $84.6 billion | 2.81% | Textiles, Apparel and Luxury Goods |

Recent important earnings reports

For the 10 stocks in the earnings calendar chart above, here's a rundown of how things went the last time they reported earnings.

1. Amazon

NASDAQ: AMZN

Key Data Points

Amazon (AMZN +1.63%) reported its third-quarter earnings on Oct. 30, 2025, and the results were generally strong. Revenue and earnings both surpassed analysts' expectations, and the company's cost-cutting efforts resulted in excellent profit margin growth.

Amazon Web Services (AWS) was an especially strong point, with revenue up 20% year over year. The company's advertising platform also experienced excellent growth, with revenue increasing by 24%.

One thing to keep an eye on is Amazon's capital expenditures, which have accelerated recently due to artificial intelligence (AI)-related investments in data centers and related equipment. Management has stated that the company anticipates capital expenditures to rise to $125 billion in 2025, up from $83 billion in 2024.

Amazon's next earnings report is expected on or about Feb. 4, 2026.

2. Tesla

NASDAQ: TSLA

Key Data Points

In the second quarter of 2025, Tesla (TSLA -0.59%) reported a 12% year-over-year increase in revenue after two consecutive quarters of declines. However, it's unclear how much of the strong performance was due to the expiration of federal electric vehicle (EV) tax credits in September, which certainly pulled some sales forward. Looking ahead, the company is focusing on robotics, automation, and other futuristic products, and Tesla began testing its robotaxi service in June -- so stay tuned.

Tesla's next earnings report is expected on or about Jan. 27, 2026.

3. Microsoft

NASDAQ: MSFT

Key Data Points

In its fiscal first quarter of 2026 (its fiscal year ends June 30), Microsoft (MSFT +0.41%) reported $77.7 billion in total revenue, which handily topped expectations. Additionally, the company's forward guidance exceeded analysts' expectations for the second fiscal quarter, prompting investors to largely cheer the results.

On the bottom line, Microsoft's earnings came in better than expected, with $4.13 per share in net profit. Azure revenue grew 40% year-over-year, a sequential increase compared with the prior quarter's growth rate, driven by artificial intelligence (AI) demand.

Microsoft's next earnings report is expected on or about Jan. 27, 2026.

4. Berkshire Hathaway

NYSE: BRK.B

Key Data Points

Berkshire Hathaway is one of the few companies that always reports earnings on Saturdays since management wants the market to have time to digest it before trading opens on Monday. In the third quarter of 2025, Berkshire NYSE:BRK.A (BRK.B +0.11%) reported a 34% year-over-year earnings increase in its operating businesses, mainly due to stronger underwriting profits from insurance.

Warren Buffett and his team were net sellers of stocks in the third quarter, mainly due to reductions in the company's large stakes in Apple (AAPL +0.52%) and Bank of America (BAC +0.16%). Berkshire reported cash and short-term investments balance totaling $382 billion, which gives the company unparalleled financial flexibility going forward.

Berkshire Hathaway's next earnings report is expected on or about Feb. 20, 2026.

5. Nvidia

NASDAQ: NVDA

Key Data Points

For the third quarter of its 2026 fiscal year (ending October 2025), graphics chipmaker Nvidia (NVDA +2.92%) reported both revenue and earnings that handily surpassed expectations. It generated $57 billion in revenue and expects this to swell to $65 billion in the fourth fiscal quarter. Nvidia's revenue continues to grow rapidly, with 63% year-over-year growth in the second quarter, thanks to the continued surge in demand for AI chips.

Nvidia has been a major beneficiary of the surge in AI investment, which has fueled rapid growth in recent quarters. However, there are some concerns about the company's ability to sustain its growth. On the other hand, the industries it serves are expected to expand significantly over the next decade, potentially leading to substantial profit growth in the years ahead.

Nvidia's next earnings report is expected on or about Feb. 24, 2026.

6. Alphabet

NASDAQ: GOOG

Key Data Points

NASDAQ: SHOP

Key Data Points

8. Block

NYSE: XYZ

Key Data Points

NASDAQ: META

Key Data Points

NYSE: NKE

Key Data Points

Understanding key financial metrics in earnings reports

Earnings reports are a great way to spot profitability and growth trends in the companies you follow. The most obvious metrics to watch are revenue (sales) and earnings (net income), which are often referred to as the top and bottom lines, respectively.

Other key metrics in earnings reports include:

- Profit margins (gross, operating, net)

- Free cash flow

- Earnings before interest, taxes, depreciation, and amortization (EBITDA)

- Guidance for the next quarter or year

Why are earnings reports important?

Earnings reports are important because:

- They provide many important insights into the current state of the companies you invest in and clues about where those companies could be heading.

- Earnings reports can help you spot growth trends, profit margin growth or contractions, balance sheet health, and how management expects the business to perform going forward.

- A company's key executives can provide context and commentary about the numbers you read in their earnings reports.

Earnings Call

With most U.S. companies, earnings reports are the most up-to-date look investors will get at a company's business and financials. Reading the most recent earnings report is an important part of doing ongoing due diligence as a buy-and-hold investor and can help you find new investment opportunities.

Related investing topics

How to identify potential concerns in a company's earnings report

There's no perfect way to identify red flags in a company's earnings report, and it's important to evaluate any concerning information in context with the industry conditions, macroeconomic environment, and other factors.

Having said that, here are a few things to watch out for:

- Slowing earnings growth.

- Missed guidance (revenue or earnings).

- Reduced guidance.

- Margin compression that isn't for some valid reason.