On a company’s income statement, also called its profit and loss statement, you’ll find net income near the bottom. Net income is a critically important metric that investors must understand to have a good idea of a company’s profitability.

What is net income?

What is net income?

In simple terms, a company’s net income is revenue minus all expenses. Starting with total revenue, follow these steps to calculate net income:

- Subtract cost of goods sold, or COGS. These are the direct costs associated with producing and delivering products and services that have already been sold. This yields gross profit. Gross profit as a percentage of revenue is the gross margin.

- Subtract operating expenses. These include costs associated with sales, marketing, research and development, administrative functions, and other areas that support the business. Operating expenses also include any one-time costs, such as restructuring charges and inventory write-downs. This yields operating income. Operating income as a percentage of revenue is the operating margin.

- Subtract interest expenses. A company in debt, whether through bank loans or outstanding bonds, will generally have to pay interest on that debt.

- Subtract other miscellaneous expenses. This can include a wide variety of items, which vary from company to company. This yields pre-tax income.

- Subtract income tax expense. When a company produces a positive pre-tax income, it is generally required to pay income taxes. This yields net income, or net profit. Net income as a percentage of revenue is the net profit margin.

Understanding net income

Understanding net income

When someone talks about a company’s “bottom line,” they’re usually talking about net income. A positive net income tells you that a company has turned a profit; a negative net income, or net loss, indicates that a company is unprofitable.

Net income is an accounting figure. Companies generally use accrual accounting, under which payments and expenses show up when they’re earned or incurred. A payment that a company receives is only counted as revenue when that company actually delivers the product or service, not when the payment hits the company’s bank account.

Expenses are treated the same way. For example, the COGS associated with an item is only recorded when that item is sold, regardless of whether payment has been received, not when it’s produced. COGS also includes non-cash expenses such as depreciation, while operating expenses include non-cash expenses such as stock-based compensation.

A piece of the puzzle

A piece of the puzzle

Net income is a useful and essential profitability metric, but it’s not the only one. For example, it does not represent the amount of cash a company generates.

For a full understanding of a company’s profitability, pairing net income with free cash flow is your best bet. Net income is found on the income statement; free cash flow is found on the cash flow statement. Free cash flow measures the amount of cash that a company generates through operating activities in a given period.

Another thing to note about net income is that it can sometimes be a poor representation of profitability. One example: Generally accepted accounting principles, or GAAP, require that unrealized gains and losses on equity investments must be recognized in the calculation of net income. If a company owns a substantial stock portfolio, swings in the value of the portfolio influence net income and can distort the company’s profitability.

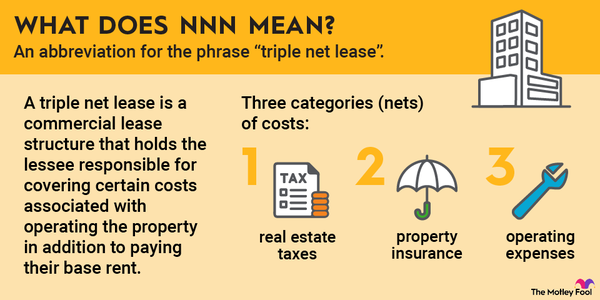

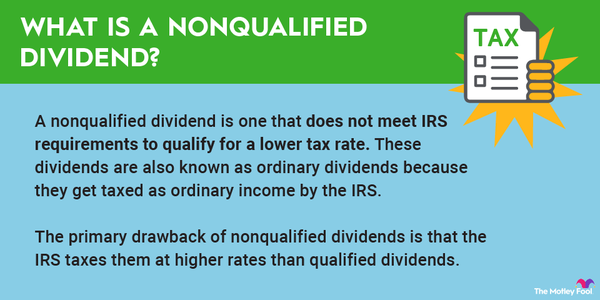

Related Investing Topics

Net income can be volatile

Net income can be volatile

While it would be nice if the net income of every stock in your portfolio rose each year without fail, that’s unlikely to be the case. Net income is the result of subtracting a large number, total expenses, from another large number, total revenue. A small change in either can lead to a massive change in net income.

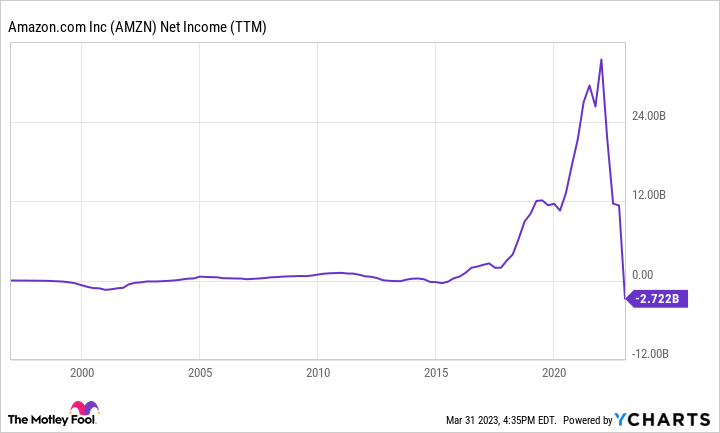

As an example, the chart below shows Amazon’s (AMZN -0.29%) trailing-12-month net income since the company went public.