If you're self-employed and looking for a retirement plan, you may be trying to decide between a solo 401(k) and a SEP IRA. Both allow individuals to sock away a lot of money for retirement, but there are a few subtle differences the self-employed need to consider.

This article will dive into the advantages and disadvantages to help you decide which is best for your situation.

Advantages of a solo 401(k)

The solo 401(k) has many advantages for those who are self-employed and who don't have any full-time employees besides themselves and their spouse.

High contribution limit

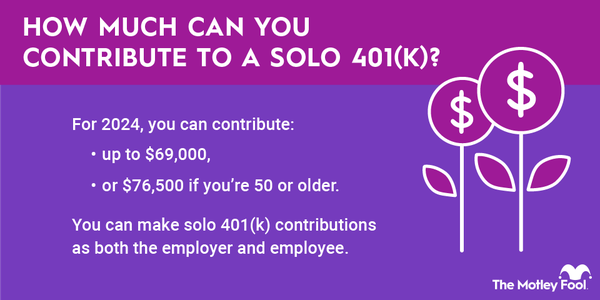

Just as with a regular 401(k), an individual can contribute up to $23,000 as the employee to a solo 401(k) account in 2024, or $23,500 in 2025.

Those 50 and older make an additional catch-up contribution of $7,500 in 2024. For those ages 50-59 or 64 and older, the contribution limit remains at $7,500 in 2025. However, workers ages 60-63 can make a higher catch-up contribution of $11,250.

It’s important to note that contribution limit is across all workplace retirement plans, so if you have another job that offers a retirement plan, make sure your salary deferrals do not exceed the annual contribution limit.

On top of the contribution limit, self-employed individuals can contribute up to 25% of their compensation as a profit-sharing contribution from the business into the 401(k) account.

If you don't pay yourself a salary, your compensation is adjusted for the employer half of self-employment tax and contributions for yourself. This results in a contribution limit of slightly less than 20% of net earnings from self-employment before tax.

Total contributions -- combined employee elective contributions and profit-sharing contributions -- are limited to $69,000 in 2024 and $70,000 in 2025. With catch-up contributions, these limits are $76,500 in 2024, and $77,500 (for those 50-59 or 64 and older) or $81,250 (for those ages 60-63) in 2025.

Roth accounts

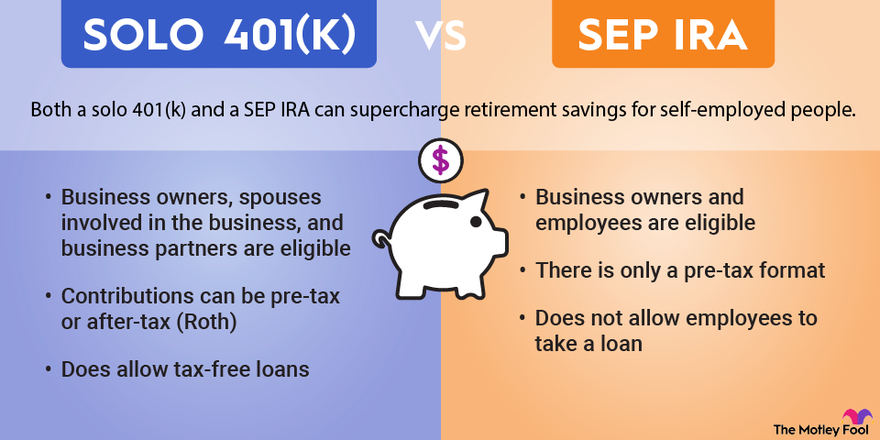

Solo 401(k)s allow for designated Roth accounts. In 2022 and previous tax years, only the employee contribution (plus catch-up contributions) could go into the Roth account. Profit-sharing contributions from the business had to go in before taxes. However, the Secure Act 2.0 changed the rules so that for 2023 and subsequent tax years, both employee and employer contributions can be made post-tax.

A Roth account can make tax planning easier in retirement. Since funds go in after you pay income taxes on them, the government doesn't collect income tax on withdrawals in retirement.

It's important to know that while a Roth 401(k) account has similar rules to a Roth IRA, there are differences. Most notable are required minimum distributions and taxes on early withdrawals. You can roll over the Roth 401(k) account into a Roth IRA once you retire to access the more preferential treatment of retirement funds.

Loans

Most solo 401(k) plans offer a loan provision, which allows savers to temporarily access their retirement funds for a big purchase or emergency spending. You'll have to pay yourself back with interest within five years, but a 401(k) loan can be a better option than a more traditional loan from a bank.

Not an IRA

An interesting advantage of a solo 401(k) is that it's a 401(k) account and not an IRA. This is useful for higher-income individuals who aren't eligible to contribute to a Roth IRA but are interested in taking advantage of the backdoor Roth IRA. Doing so requires a nondeductible contribution to a traditional IRA and then a conversion to a Roth IRA.

But for the strategy to work, you must have only after-tax funds in your IRAs. If any IRA you own, including a SEP IRA, has pre-tax funds in it, you'll get hit with an extra tax bill based on the ratio of after-tax to pre-tax funds in your IRAs.

Using a solo 401(k) avoids the problem of mixing pre-tax and after-tax funds in an IRA. It also enables individuals to roll over pre-tax funds from existing IRAs into the solo 401(k) in order to execute the backdoor Roth strategy in the future.

Advantages of a SEP IRA

A SEP IRA may be a better option than a solo 401(k) for some entrepreneurs. Here are a couple of examples:

It can support a growing business

If you expect to hire new employees in the near future, a SEP IRA will cover you and your employees. A solo 401(k) covers only a self-employed individual and their spouse (if they also work in the business), but a SEP can be expanded to all employees.

Importantly, contributions from a SEP for each employee must be the same percentage of compensation for each employee. But the business owner has greater control over what percentage they contribute in any given year, ranging from 0% to 25%.

High contribution limits

A SEP IRA has the same overall contribution limit as a solo 401(k). The only difference is that there's no elective employee contribution portion with a SEP IRA, just the profit-sharing portion. Profit-sharing contribution limits follow the same rules as solo 401(k)s -- 25% of compensation or 20% of net income if you're self-employed -- and the overall contribution cannot exceed $69,000 in 2024 and $70,000 in 2025, excluding catch-up contributions. In 2024, only the first $345,000 could be used to calculate compensation. In 2025, this limit increases to $350,000.

For a self-employed person to max out their SEP IRA contribution limit in 2025, they'd need to earn $350,000 and contribute 20% of their net income, or $70,000.

You could max out a solo 401(k) with significantly less business income because $23,500 can come from your employee-side contribution. But if you're earning well above $300,000 from your business, the simplicity of establishing a SEP IRA may make it more appealing as a retirement savings vehicle.

Deciding which is better for you

Both a solo 401(k) and a SEP IRA can supercharge retirement savings for self-employed people. The solo 401(k) will typically allow them to contribute more to their retirement savings and offers greater flexibility for optimizing taxes both in the present and in retirement.

But there are several circumstances where a SEP IRA may be a better option. For example, if you hire new employees in the future, you'd need to upgrade a solo 401(k) plan to a small business plan, which can be much more costly. If you plan to hire employees down the line, a SEP IRA may be the right choice for you.

Furthermore, if you participate in and max out a 401(k) or similar retirement plan from another job, your ability to contribute to a solo 401(k) is greatly reduced. In that case, a SEP IRA may be a better choice due to its simplicity.

You can opt for both if you choose. Keep in mind that the contribution limit for the SEP IRA will be limited by the profit-sharing contribution in the 401(k). They cannot combine to be more than 25% of total compensation. There's no double-dipping, so there's little value in establishing both retirement plans. Pick one and go with it. You can always change things in the future if circumstances change.