Calculating interest expense on a payable bond should be relatively straightforward, but the accountants got involved. Generally accepted accounting principles (GAAP) turn what is ordinarily a simple multiplication problem into something slightly more complicated.

With some examples, I'll show how to calculate interest expense under three scenarios: bonds sold at a discount, at premium, and at face value.

Calculating interest expense for bonds sold at a discount

Let's start first with bonds issued at a discount. Assume XYZ Corp. sells $100,000 worth of five-year bonds with a semiannual coupon of 5%, or 10% per year. Investors think the company is risky, so they demand a 12% yield to maturity for buying these bonds.

The first step is to use a finance calculator to calculate how much the company will receive from selling these bonds by entering the following information into a financial calculator:

Future value: $100,000 (The face value of the bonds).

Number of periods: 10 (5 years of semiannual payments).

Payment: $5,000 (5% semiannual coupon multiplied by the face value).

Rate: 6% (12% yield-to-maturity divided by two semiannual periods).

Solve for the present value.

The result is that the company receives only $92,639.91 from selling these bonds. Thus, the bonds are sold at a discount of $7,360.09 ($100,000 in face value minus proceeds of $92,639.91).

Interest expense calculations

Every six months, XYZ Corp. will naturally have to pay its bondholders cash coupons of $5,000. This is clearly interest expense. However, it isn't the only amount recorded as interest expense on a bond sold at a discount.

The discount on the bonds of $7,360.09 is an additional cost of financing. GAAP requires that the discount is amortized into interest expense over time.

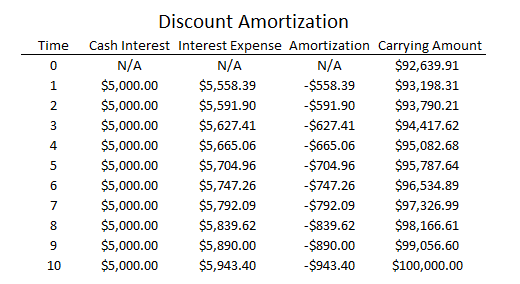

To calculate the interest expense for the first period, we take the $92,639.91 carrying value of the bonds and multiply it by half the yield-to-maturity. This results in $92,639.91*(0.12/2)=$5,558.39 of interest expense for the first semiannual period.

The actual cash interest paid was only $5,000 — the coupon multiplied by the bond's face value. However, interest expense also includes the $558.39 of amortized discount in the first six months.

To calculate interest expense for the next semiannual payment, we add the amount of amortization to the bond's carrying value and multiply the new carrying value by half the yield to maturity. Here's what the math looks like for the full five-year period.

Related investing topics

Bonds sold at face value

You're in luck. When bonds are sold at face value, the amount of interest expense is simply the coupon for each payment multiplied by the face value. Thus, using our previous example of $100,000 in XYZ Corp. bonds with a 5% semiannual coupon, the company would record interest expense of $5,000 ($100,000*5%) for every period. There is no premium or discount to amortize, and thus interest expense should equal the coupon rate multiplied by the face value of the bond.

A great broker can make it easy for you to buy bonds as well as stocks. Visit our broker center for more information.