Contributing to an individual retirement account (IRA) is a great way to increase your retirement readiness. But if you want to get the most out of your IRA, then you also need to understand the rules surrounding IRA distributions. Failure to meet the applicable requirements could result in costly penalties that unnecessarily rob you of your savings. Here are some of the most important IRA distribution rules.

What are required minimum distributions for IRAs?

Required minimum distributions (RMDs) are mandatory withdrawals that you must take from all of your retirement accounts, except Roth IRAs, beginning in the year you turn 73. If you have multiple traditional IRAs, you must calculate the RMD for each account. However, you can take the aggregate RMD from a single account or spread it out across multiple accounts.

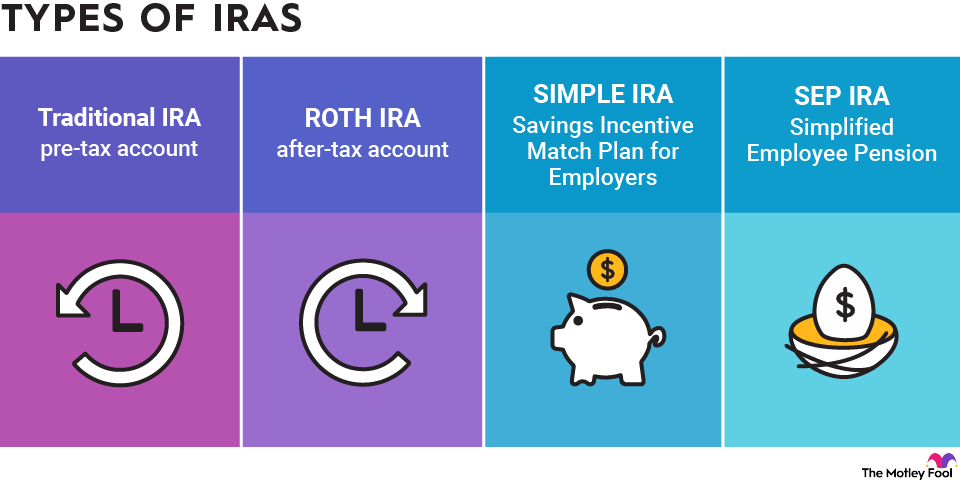

The government requires you to take these withdrawals to ensure that it gets a share of your savings since you pay taxes on funds in traditional IRAs and 401(k)s when the money is withdrawn. Roth IRAs are exempt from RMDs because the withdrawals are tax-free (since contributions are made with after-tax dollars). The government has no incentive to force you to withdraw funds from Roth IRAs since it doesn't get a cut of them.

How much you are required to withdraw annually depends on your IRA balance and your age. You can figure out your RMD by dividing your account balance by the distribution period for your age, shown in the life expectancy table on the IRS website.

For example, if you have $100,000 in a traditional IRA and you turn 73 in 2026, then you would divide your $100,000 account balance by the 16.4-year distribution period designated for 73-year-olds; your resulting RMD would be about $6,098. That is the minimum amount that you must take from your IRA this year, although you are free to withdraw more if you choose.

Failure to withdraw your full RMD by the end of the year results in a 25% penalty on the amount that you should have withdrawn. Continuing with the example above, if you withdrew only $1,000 from your traditional IRA this year, you'd owe a 25% penalty on the remaining $2,773 that you should have taken. You'd end up forfeiting about $1,275 to the government -- far more than you would have owed in income tax had you withdrawn your full RMD. However, if you corrected your mistake within two years, the penalty could be reduced to 10%.

What is the IRA early withdrawal penalty?

The government, under many (or most) circumstances, charges a 10% early withdrawal penalty if you receive funds from your IRA before you reach age 59 1/2. Early withdrawals from traditional IRAs are sometimes treated differently from withdrawals from Roth IRAs since the contributions to traditional IRAs are made with pre-tax dollars.

There are ways to avoid the early withdrawal penalty, outlined below.

When can I withdraw from my IRA without penalty?

You can take penalty-free distributions from your IRA if any of the following apply to you:

- You're age 59 1/2 or older: Once you reach this age, your withdrawals are no longer considered early and you won't owe a penalty, although you'll still pay income tax on traditional IRA distributions.

- You're withdrawing contributions only: This rule is applicable only to Roth IRAs, since you already paid taxes on those contributions. You can withdraw these contributions tax- and penalty-free at any time. You face penalties only if you withdraw earnings early.

- You're inheriting an IRA from a deceased person: Inherited IRAs have their own rules regarding distributions but still allow those younger than 59 1/2 to make penalty-free withdrawals.

- You have become permanently disabled: The government allows penalty-free distributions to any IRA owner who becomes totally and permanently disabled.

- You're using the funds to pay for higher education: Using your IRA funds for higher education, like college tuition, qualifies you for penalty-free distributions.

- You take substantially equal periodic payments (SEPPs): If you receive equal payments every year until you reach age 59 1/2, or for five years, whichever is longer, then you can take money out of your IRA penalty-free regardless of your age.

- You're using the funds to purchase your first home: If you withdraw money from your IRA to purchase your first home, then the first $10,000 of earnings you receive is exempt from the early withdrawal penalty.

- You have large, unreimbursed medical expenses: If you incur out-of-pocket medical expenses in excess of 7.5% of your adjusted gross income (AGI) in 2025 or 2026, you can withdraw IRA funds to cover these costs without paying the penalty.

- You're using the funds to pay health insurance premiums: If you are unemployed and paying out-of-pocket for health insurance, then you can withdraw the equivalent funds from your IRA without being assessed the early withdrawal penalty.

The above rules can change from year to year. For example, in past years, the penalty exemption for medical expenses kicked in at 10% instead of 7.5%. If you're younger than 59 1/2, it's always a good idea to double-check that you qualify for an exception to the early withdrawal penalty before you deduct any money from your account.

Another thing to remember: Just because you qualify for the penalty exemption doesn't mean there isn't a (perhaps immense) cost to taking money out early. When you do, you're selling off your investments and limiting how much money is left in your account to continue growing. Shrinking the size of your retirement account today can make it more difficult to save enough for your retirement, so you should attempt to find other ways to cover your costs without tapping your IRA.