When is probate court required?

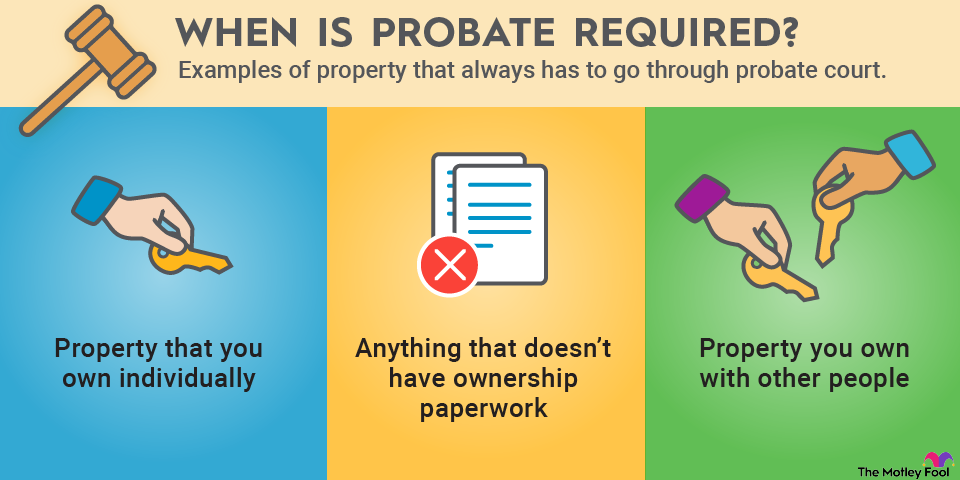

There are a few types of assets that can avoid the probate process entirely, and we’ll get to those in the next section. But first let’s go over property that always has to go through probate court.

Property that you own individually: If assets are titled in your name only, they will have to go through the probate process upon your death. For example, if your name is the only one on your vehicle’s title, it will have to go through probate court. You may be able to avoid this by adding a transfer on death (TOD) designation to a title, but the process and availability of this varies by state.

Anything that doesn’t have ownership paperwork: As an example, if you have a collection of old baseball cards, that’s the type of asset that usually doesn’t have clear ownership paperwork. Items such as furniture, clothing, and electronics also fall into this category. The best work-around is to name specific items in your will if you want them to go to specific people. This will simplify the process, but it won’t eliminate probate entirely.

Property you own with other people: If you own property or other assets jointly with another person (aside from your spouse), it will typically end up in probate. An example is if you own an investment property with a partner or if you own half of a small business with another person.

When is probate not required?

The general rule is that probate is not required when assets are owned jointly or when there is a beneficiary named. We mentioned joint homeownership earlier, but there are many other possible cases. For example, if you and your spouse have a joint checking account, ownership of the account would automatically pass to them if you were to die. If you jointly own a vehicle, the same concept would apply. The exception is if the property is titled as “tenants in common,” which means that your portion would pass to your heirs and not to the other owner.

There are other assets that don’t go through probate regardless of whether you die with a will or not. Life insurance proceeds and retirement accounts are other examples since these typically have beneficiaries as well as contingent beneficiaries named. Any accounts or assets designated as “payable on death” or “transfer on death”, also known as “POD” and “TOD,” respectively, are also not subject to probate.

It’s also worth mentioning that some of these assets can end up in probate, particularly when a beneficiary dies before the property owner and especially if any contingent beneficiaries aren’t around either. For example, if you and your spouse own your home jointly, but they die before you, the home will likely end up in probate. The same can be said if your life insurance beneficiaries predecease you.

How to avoid probate

Property in a living trust is another example of a situation when probate is not required since assets in these vehicles will pass to the named beneficiary or beneficiaries when you die. This can help avoid probate altogether on assets that would otherwise be subject to the process.

While probate can be a time-consuming process, it also isn’t cheap. According to Trust & Will, the typical cost of probate court is between 2% and 7% of the entire estate’s value. There are attorney fees, compensation for the executor, probate bond costs, court fees, and more.

Creating a trust is perhaps the most effective way to avoid probate, but it isn’t something most people can just do on their own. The best course of action is to contact a professional, such as an estate planning attorney or Certified Financial Planner® who specializes in estate planning, to help determine the best plan for your specific situation.