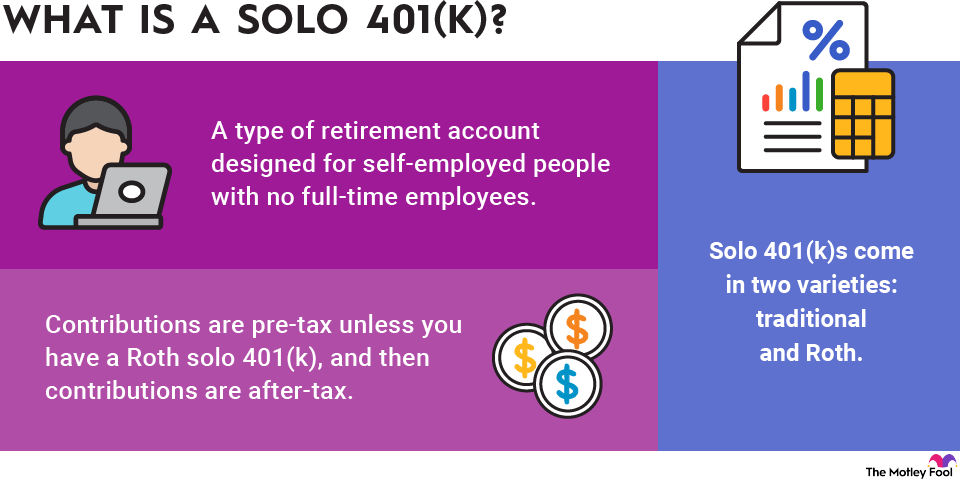

Contribution limits for a solo 401(k)

Self-employed workers under age 50 may contribute up to $70,000 to a solo 401(k) in 2025. Adults aged 50 to 59 and those 64 or older can also make catch-up contributions of up to $7,500, bringing the total limit to $77,500. Those aged 60 to 63 can make catch-up contributions of up to $11,250, bringing the total limit to $81,250.

In 2026, the solo 401(k) contribution limits are:

- $72,000 for adults under age 50

- $80,000 for adults aged 50 to 59 and 64 or older

- $83,250 for adults aged 60 to 63

Those are the maximum limits, but your own limits could be different. When you contribute to a solo 401(k), you can contribute as both employee and employer, and the limits are different for each one.

Employer and employer 401(k) limits

The 401(k) employee contribution limit for traditionally employed workers is $23,500 in 2025 and $24,500 in 2026. There are also catch-up contributions of $7,500 in 2025 and $8,000 in 2026 for those aged 50 to 59 and 64 or older. The catch-up contribution for those aged 60 to 63 is $11,250 in 2025 and 2026.

The employer contribution is up to 25% of an employee's contribution, or about 20% of your net self-employment income, which is defined as all your self-employment earnings minus business expenses, half your self-employment tax, and the money you contributed to your solo 401(k) for your employee contribution. For example, if you earned $100,000 in net self-employment income, you could make an employer contribution of up to around $20,000 to your solo 401(k).

Your maximum contribution is the lesser of the annual contribution limit (discussed above) or up to $23,500 of your compensation in 2025 and $24,500 in 2026, plus 25% of your compensation from your employer-side contribution. If you're 50 or older, you can also make catch-up contributions.

If you're younger than 50, you cannot contribute more than $70,000 in 2025 or $72,000 in 2026, even if your employer contribution would allow for it. You can't exceed your maximum employee and employer contributions for the year, even if you haven't hit the annual limit.

Related topics