Brief history of Social Security

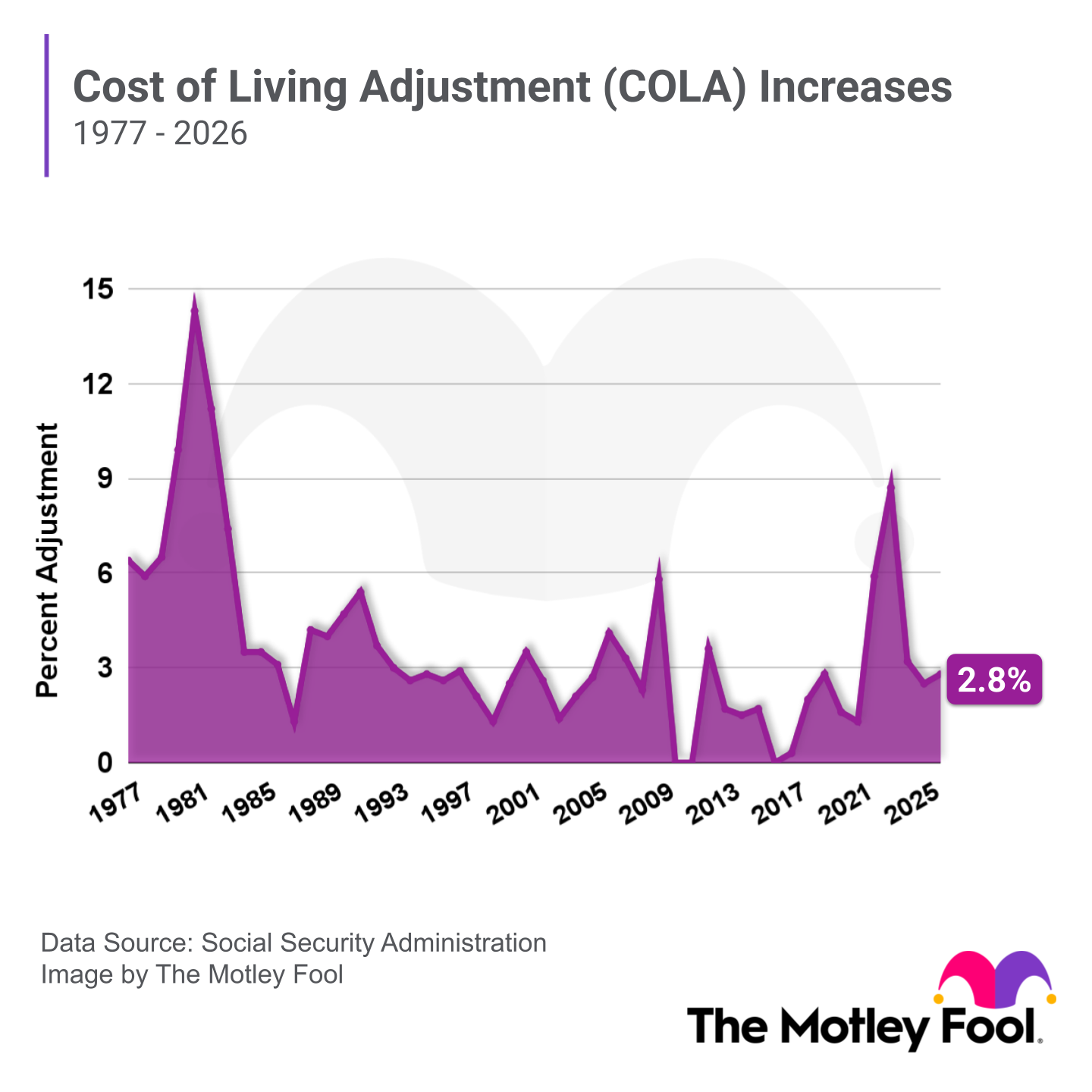

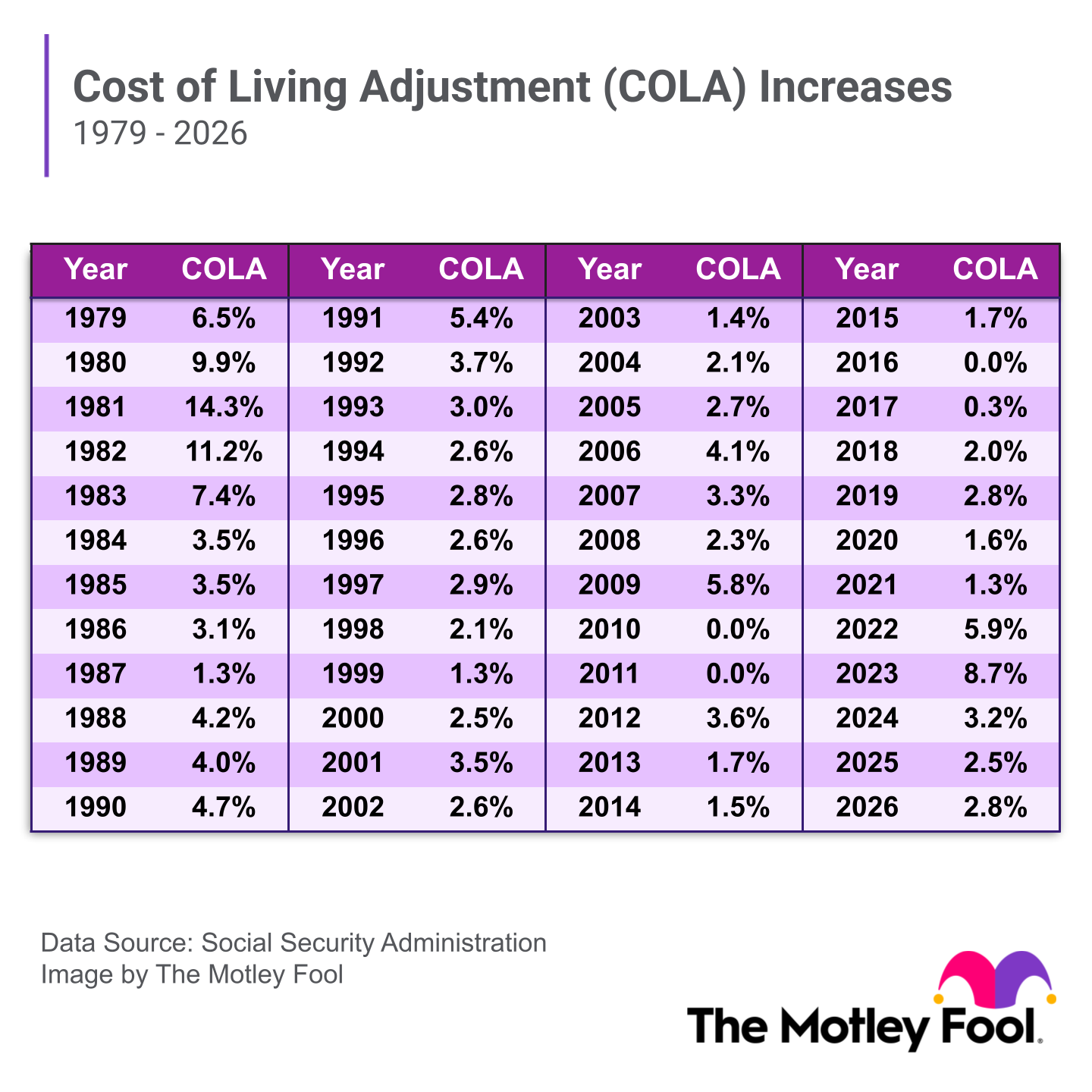

The Social Security program was created by the Social Security Act that President Franklin D. Roosevelt signed into law in 1935. The first checks went out in 1940. Originally it paid benefits only to workers 65 and older, but in the 1970s the government altered it to allow workers to claim benefits as early as 62. It also instituted annual cost-of-living adjustments (COLAs) to help Social Security keep pace with inflation.

The program has worked fairly well so far, but many people fear for the future, when there will be fewer workers to support a greater number of Social Security recipients.

The latest Social Security Trustees' Report indicates that the program's retirement trust fund could be depleted within the next decade, after which it would be able to pay out only about 77% of benefits to retirees. Though previous reports estimated that Social Security's disability trust fund would run dry by 2057, the latest trustee's report projects that the disability trust fund will not be depleted in the next 75 years.

The government has proposed several possible solutions for ensuring the long-term sustainability of the program, but at present, no plans have been set. There's no risk of the program disappearing in the next decade or two, but its future benefits may not go as far as they do today.

That's why today's workers need to prioritize their personal retirement savings, so they can cover most of their expenses on their own.