An HSA distribution is a withdrawal from your health savings account. HSA distributions taken to pay for eligible medical expenses are not taxable, but they still must be reported to the Internal Revenue Service (IRS). If you take a distribution for purposes other than paying for covered medical expenses, it can have serious tax consequences since you will be taxed on the withdrawn funds at your ordinary income tax rate and could potentially also owe a 20% penalty.

Here's what you need to know about the rules for HSA distributions and your obligations to the IRS when you make them.

What is it?

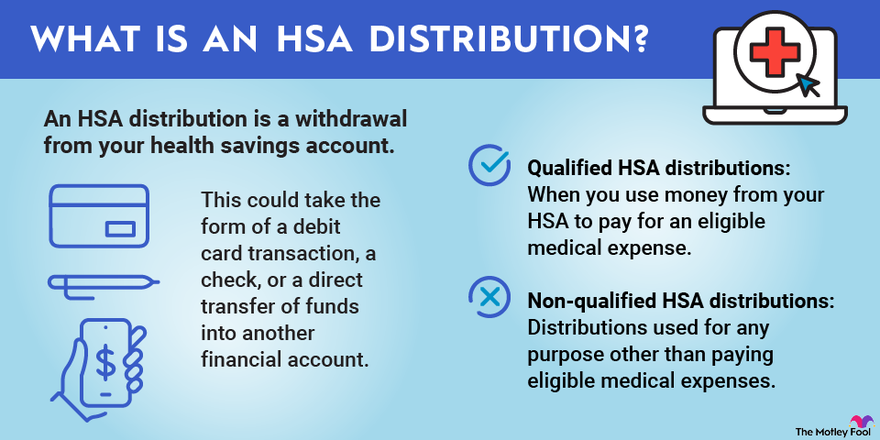

What is an HSA distribution?

An HSA distribution is a withdrawal of money from your health savings account. This could take the form of a debit card transaction, a check, or a direct transfer of funds from your HSA into another financial account.

HSA distributions are classified into two categories:

- Qualified HSA distributions: These occur when you use money from your HSA to pay for an eligible medical expense either by paying the provider directly via debit card issued by your HSA or by paying a provider with your own money and submitting receipts to your HSA for reimbursement.

- Non-qualified HSA distributions: These are distributions from your HSA used for any purpose other than paying eligible medical expenses. The distribution will be taxed as ordinary income and, if you are not yet 65 years old, you will generally also pay an additional 20% tax penalty to the IRS.

HSA distribution form

HSA distribution form for 2025

When you take money out of your HSA for any reason, the HSA trustee or custodian must prepare an IRS Form 1099-SA. The trustee or custodian who holds your account must complete this form regardless of whether the money from your HSA is sent directly to you or to an eligible medical provider after you receive medical services. The trustee or custodian must indicate the amount of the distribution on the form as well as whether it was a normal distribution, a return of excess contributions, a distribution made after the account holder became disabled, or a distribution made after the account holder's death.

The trustee or custodian will send a copy of IRS Form 1099-SA to you and to the IRS. In turn, you will need to use the information on IRS Form 1099-SA to complete IRS Form 8889, which must be included with your 1040 form when you file your taxes if you have an HSA.

Form 8889 allows you to inform the IRS of your HSA contributions and distributions and helps you calculate whether any portion of your distribution is taxable and/or subject to the 20% penalty for nonqualified distributions.

Qualified HSA distributions

Qualified HSA distributions

Qualified HSA distributions are distributions made for eligible medical expenses and thus are not subject to either income tax at your ordinary rate or to the 20% penalty for nonqualified distributions.

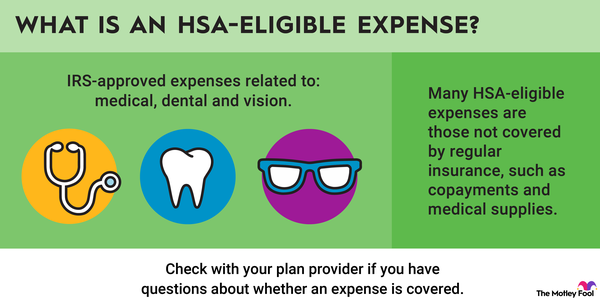

Eligible medical expenses generally include those that would generally be considered tax-deductible if you meet the threshold for deducting medical expenses. IRS Publication 502 has a detailed list of what medical expenses you can pay with HSA funds in order for the distribution to be considered qualified. They include prescription drugs, most types of dental care, chiropractic care, acupuncture, fertility treatments, eyeglasses and contact lenses, service animals, and more.

Related Investing Topics

Distributions and taxes

HSA distributions and taxes

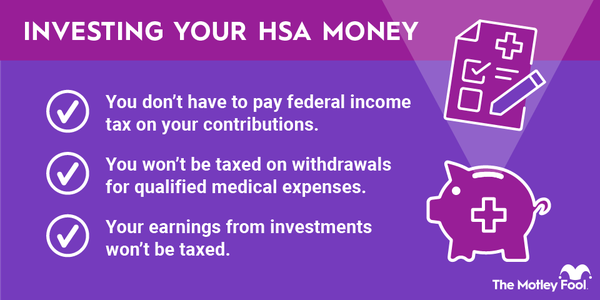

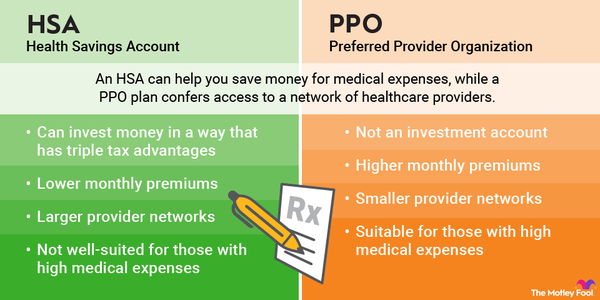

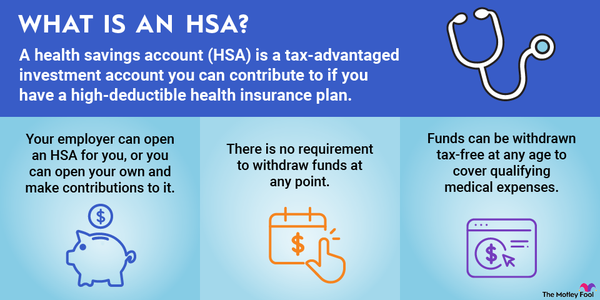

HSAs are a very valuable type of investment account because you can make contributions with pre-tax funds, allow your money to grow tax-free, and make tax-free withdrawals for medical expenses. Most other tax-advantaged accounts, such as IRAs and 401(k)s, allow either pre-tax contributions or tax-free withdrawals -- not both, as the HSA does.

Although a qualified HSA distribution is not taxable, you still must file IRS Form 8889 to report any distributions made during the year.

However, if you have made nonqualified distributions because you took money out of your HSA that you did not use to pay for eligible medical services, you will be taxed on the distribution at your ordinary income tax rate. If you have not yet reached age 65, you will also be subject to a 20% penalty on the withdrawn funds.

Those who are 65 or older may make nonqualified distributions without incurring the extra penalty and pay only ordinary income tax. In other words, HSA distributions made after age 65 are treated like those made from a 401(k) or traditional IRA. Because of this added flexibility, HSAs are often used as a retirement savings account.