Learning how to maximize your Social Security can make a big difference in your retirement planning. Social Security makes up about 30% of income for people 65 and older. But increasing your Social Security requires careful planning.

Seven tips for raising your Social Security

Seven tips to increasing your Social Security check

In this article, we'll cover seven strategies for maximizing your Social Security checks and explain how much you'll get after accounting for Medicare and taxes.

1. Earn a bigger paycheck

1. Earn a bigger paycheck

Of course, you can't just snap your fingers and make your boss give you a raise. But your benefit is based on how much you've paid into Social Security, so earning more will help you score fatter checks. If negotiating a higher salary at your current job isn't an option, you could apply for better-paying jobs or take on a side gig.

Keep in mind, though, that Social Security will only consider your earnings up to the maximum taxable income in any given year. The taxable maximum is $160,200 in 2023; it increases to $168,000 in 2024. So, even if you earn $1 million in 2024, Social Security would record your yearly income as $168,600.

Taxable Income

2. Work 35+ years

2. Work at least 35 years

The Social Security benefits formula uses an inflation-adjusted average of your 35 highest years of earnings. If you only work 32 years, you'll have three years with $0 in earnings, which would drag down your benefit. Working at least 35 years will help you maximize your benefit -- and working additional years could increase your benefit if you're replacing lower-earning years with higher-earning ones.

3. Delay as long as possible

3. Delay as long as possible

You won't be eligible for your primary insurance amount until you reach full retirement age (FRA), which is 67 if you were born in 1960 or later. It's possible to start Social Security at age 62, but your benefit will be about 30% lower.

If you truly want to score the maximum Social Security benefit, though, you'll want to delay past FRA. You'll earn an extra 8% in delayed retirement credits for every year you wait, up to age 70, which is when your benefit maxes out.

4. If working, avoid claiming until FRA

4. If you're working, avoid collecting a check until FRA

In 2023. if you claim Social Security while working and haven't reached FRA, Social Security imposes limits on how much you can earn before it withholds part of your benefit:

- Until the year you reach FRA, Social Security withholds $1 for every $2 you earn above $21,240. That threshold will increase to $22,320 in 2024.

- From the year you reach FRA to the month you're eligible for your full benefit, Social Security withholds $1 for every $3 you earn above $56,520. That threshold will increase to $59,520 in 2024.

Once you reach FRA, Social Security won't withhold part of your benefit, no matter how much you earn. Note that even if you collect benefits early and continue working, Social Security will recalculate your benefit when you reach FRA to give you credit for the amount it withheld. Your benefit will increase as a result.

5. Collect spousal or survivor benefits

5. Collect spousal or survivor benefits

If your current or former spouse earned significantly more than you, you may get a bigger benefit by collecting based on their work record. Spousal benefits are paid to current spouses, as well as ex-spouses (if the marriage lasted at 10 least years).

The maximum benefit is 50% of their primary benefit. Collecting early will reduce your benefit more, but you can't earn delayed retirement credits for waiting past FRA. Your benefit will max out at age 67, not 70.

If you're a widowed spouse (or if your ex-spouse of at least 10 years has died), you could be eligible for survivor benefits. Survivor benefits are up to 100% of the late spouse's benefit (if they were already claiming) or up to 100% of their primary insurance amount (if they weren't taking benefits yet).

You can claim as early as age 60, rather than 62, for a reduced amount. As with spousal benefits, survivor benefits max out at age 67. Note that Social Security doesn't let you claim multiple benefits. You can collect your own retirement benefit or a spousal or survivor benefit, but not both.

6. Get a one-time do-over

6. Get a one-time do-over

If you've already started receiving Social Security but now wish you'd held out for a larger benefit, you may have two options for increasing your checks:

- If it's been fewer than 12 months since you were approved for benefits: You can withdraw your application for benefits and reapply later, but you'll need to repay all benefits you received, as well as any money withheld for taxes and Medicare premiums.

Medicare

- If you're already FRA but haven't turned 70 yet: You can request that Social Security suspend your benefits to earn delayed retirement credits, and then reinstate them later. Once you're 70, Social Security will automatically restart your payments if you haven't already had them reinstated.

7. Open a Roth account

7. Save for retirement in a Roth account

You technically won't get bigger Social Security payments if you opt for a Roth IRA or a Roth 401(k) over traditional accounts, but you will get to keep more of your benefit. Withdrawals from Roth accounts are generally tax-free in retirement because you've already paid taxes on that money. However, with traditional retirement accounts, you get a tax break on your contributions but have to pay taxes on withdrawals.

Roth withdrawals aren't counted as income for Social Security purposes, so saving in a Roth IRA account maximizes the amount of your Social Security check you actually get to keep.

Average Social Security payment

The average Social Security payment

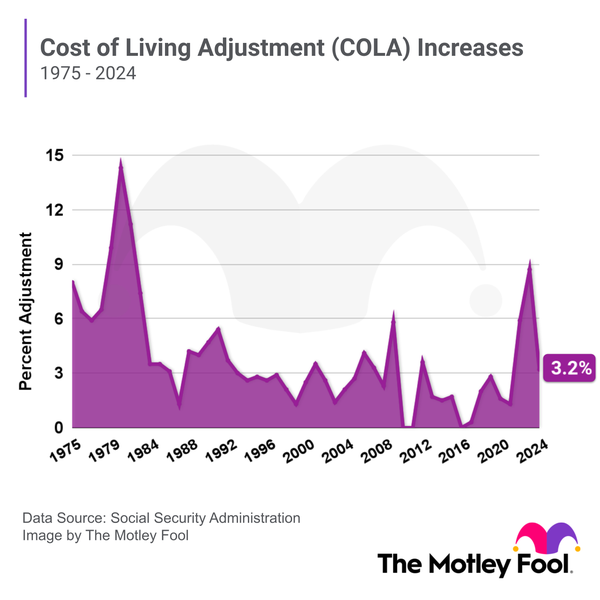

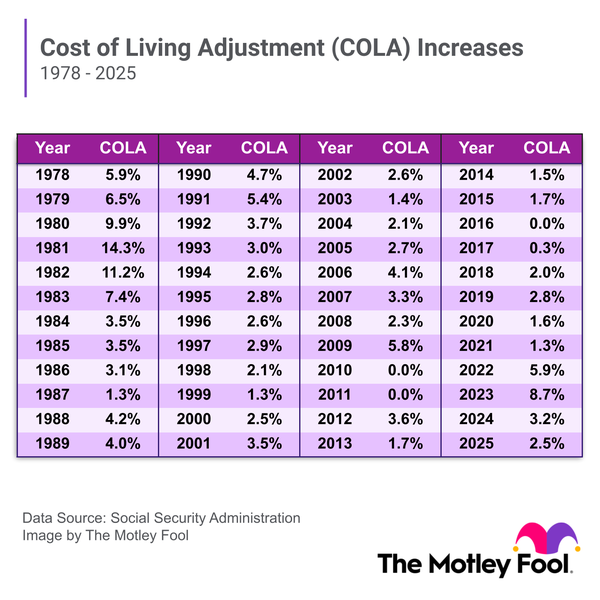

In 2023, the average Social Security payment for retired workers was $1,848 per month. The average monthly benefit is expected to rise to $1,907 in January 2024 once the 3.2% cost-of-living adjustment (COLA) for 2024 is applied.

The maximum monthly benefit for someone retiring at FRA in 2023 is $3,627. With the 2024 COLA, that amount will jump to $3,822.

How much will Medicare deduct from my check?

How much will Medicare deduct from my Social Security check?

Most people don't pay a Medicare Part A premium; however, Part B premiums are typically deducted from Social Security checks. In 2023, most seniors pay $164.90 a month for Part B premiums, but those with incomes above $97,000 (individuals) or $194,000 (married couples) pay higher amounts.

Related investing topics

The bottom line

One of the biggest myths about Social Security is that increasing your payments is easy. But as you can see, maximizing your Social Security benefit requires you to work more, earn more, or delay benefits you may need well before age 70.

While Social Security is a lifeline for seniors in the U.S., retirement is difficult when your benefit is your only source of income. That's why it's essential to invest for retirement as early as possible. But if you're behind on saving, then working longer and delaying benefits are two good strategies for maximizing your Social Security.

FAQs

Maximizing Social Security: FAQs

At what point do you max out Social Security?

You'll max out Social Security retirement benefits at age 70, at which point you can no longer earn delayed retirement credits. You also can't earn delayed retirement credits for spousal and survivor benefits. Your benefit will max out at full retirement age, which is 67 for anyone born after 1959.

What is the 35-year rule for Social Security?

The 35-year rule refers to the benefit formula Social Security uses. Your benefits are based on your highest 35 years of earnings. If you worked fewer than 35 years, the years you didn't work are calculated as $0.

At what age is Social Security no longer taxed?

Federal taxes on Social Security are based on your income, not your age. Up to 50% of your benefit is taxable if your income is between $25,000 and $34,000 (singles) or $32,000 and $44,000 (married couples). Above these thresholds, up to 85% of your benefit is taxable.