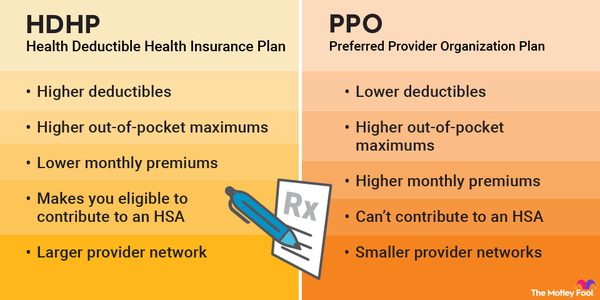

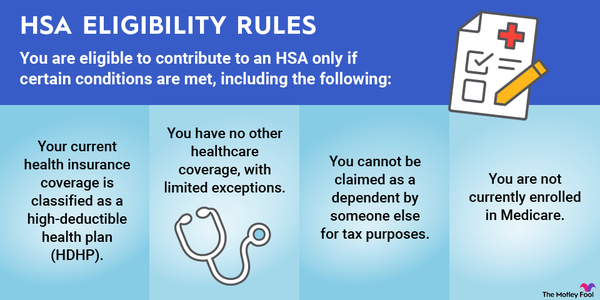

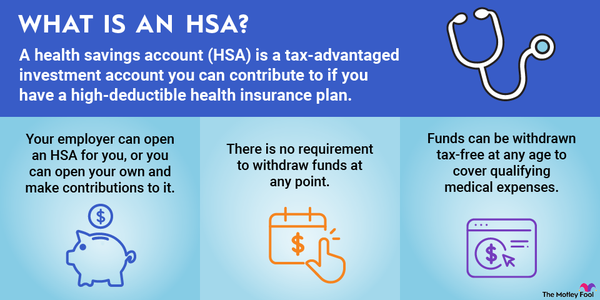

A health savings account (HSA) is a type of tax-advantaged investment account available only to individuals with high-deductible health plans (HDHPs). HSAs enable investors to save tax-free for eligible healthcare expenses, and HSA accounts can also be used as retirement savings vehicles.

If you are eligible to contribute to an HSA, there are ample reasons to do so since HSAs offer the most tax breaks of any investment account option.

To help you decide if paying into an HSA is right for you, here's what you need to know about the generous benefits these accounts can offer.

Tax benefits of health savings accounts (HSA)

The tax advantages of an HSA are the single biggest benefit of this type of account.

Many types of investment accounts, including 401(k)s and individual retirement accounts (IRAs), offer at least some tax savings. You may contribute to traditional 401(k)s and IRAs using pre-tax dollars, while withdrawals from Roth 401(k)s and Roth IRAs are tax-free.

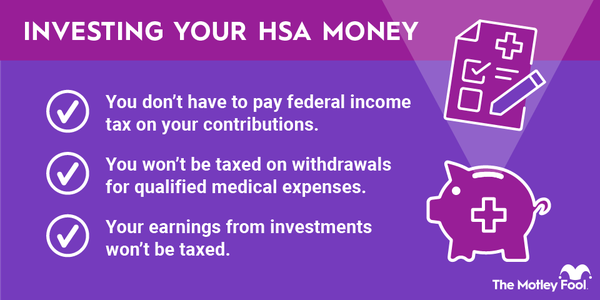

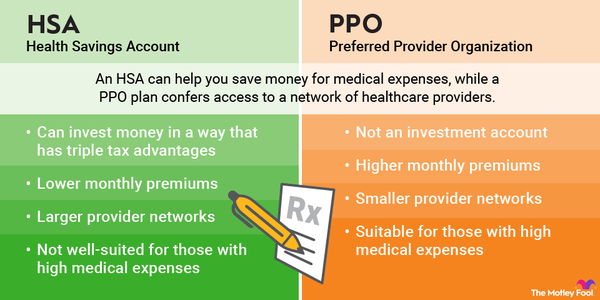

With 401(k)s and IRAs, you save on taxes either at the time of contribution or at the time of withdrawal -- not both. HSAs, in contrast, work like this:

- You invest in HSAs with pre-tax dollars. HSA contributions are deducted from your taxable income, often directly by your employer, which lowers your tax bill. The tax savings equals the amount of your HSA contribution times your marginal tax rate.

- HSA money grows tax-free. Just as with all 401(k) and IRA accounts, the funds that accrue in HSAs are tax-deferred. This means that -- depending on how you use the funds -- the money may only be taxed upon withdrawal in retirement, when your tax rate may be lower than it is today. Capital gains earned in your HSA today don't affect your tax liability for the current year.

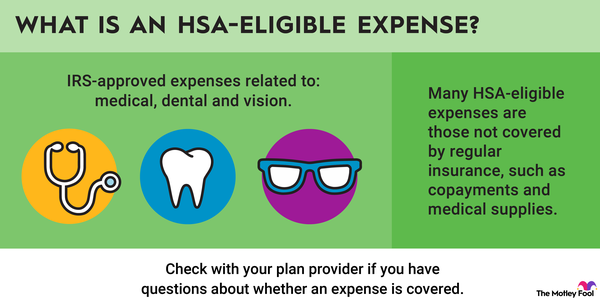

- You withdraw HSA money tax-free. Just as with Roth retirement accounts, you may withdraw funds from HSAs without incurring any taxes, provided the money is used for qualifying medical expenses. Those include everything from physical therapy, orthodontics, and insulin to feminine hygiene products, prescription and over-the-counter drugs, and telehealth services. The amount of money you avoid paying in taxes equals the HSA funds you withdraw times your marginal tax rate.

Using funds from an HSA can offer a triple tax benefit -- this sets HSAs apart from all other investment accounts. Especially if you incur large medical expenses, using this type of savings account can provide substantial value.

Seven more HSA benefits

While the tax savings alone provide a good reason to invest in an HSA, this type of investment account also confers other benefits:

- You may contribute to an HSA regardless of how much money you make. While some high-earners cannot contribute to Roth IRAs or make tax-deductible contributions to traditional IRAs, you can qualify for an HSA regardless of your income.

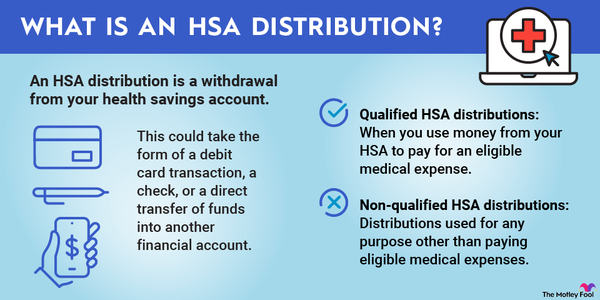

- HSA funds can be withdrawn at any time to pay for qualifying medical expenses. While HSAs make excellent retirement savings vehicles, they're intended to help defray the costs of medical care by enabling you to withdraw funds anytime you have qualified medical expenses.

- HSAs aren't use it or lose it: Unlike with a flexible spending account (FSA), money invested in an HSA does not need to be withdrawn in the same year. HSA funds may be received at any time.

- Seniors 65 and older can withdraw HSA money penalty-free for any purpose. Once you turn 65, you may withdraw money from your HSA for non-medical purposes without paying a penalty; you only owe taxes on the withdrawal at your ordinary income tax rate. This flexibility HSAs offer makes them ideal for saving for retirement.

- HSAs do not have required minimum distributions (RMDs). Most tax-advantaged retirement accounts, including 401(k)s and traditional IRAs, are subject to RMDs, which mandate the withdrawal of a minimum amount of money each year. Those age 72 or older must take an RMD annually to avoid a 50% penalty on the amount that should have been withdrawn. With HSAs, you can leave your money invested for as long as you like.

- HSAs can be opened in several ways and offer plenty of investment options. Your employer may offer an HSA, but if you’re eligible, you can also open one on your own with a bank or brokerage firm. You can invest your HSA funds into a wide range of securities, including mutual funds, exchange-traded funds (ETFs), stocks, and bonds.

- Your employer may also contribute to your HSA account. Assuming your employer offers HSAs, the company can directly contribute to yours. Contributions like these may be structured as matching programs.

Related Retirement Topics

Recent estimates from Fidelity Investments indicate a senior couple turning 65 in 2020 with high prescription drug expenses will need $325,000 in order to have a 90% chance of covering all of their medical costs in their remaining years. Paying Medicare premiums, buying medication, and incurring other out-of-pocket medical expenses are all common -- and potentially very expensive -- in retirement. Investing in HSA funds can help future retirees adequately save for an unforeseen healthcare expense.

While HSAs are not without downsides -- in the form of eligibility restrictions, potential fees, and a 20% penalty imposed on early withdrawals not used for qualified medical expenses -- the advantages of HSAs clearly outweigh the disadvantages for most people.