What happens to your HSA when you quit a job?

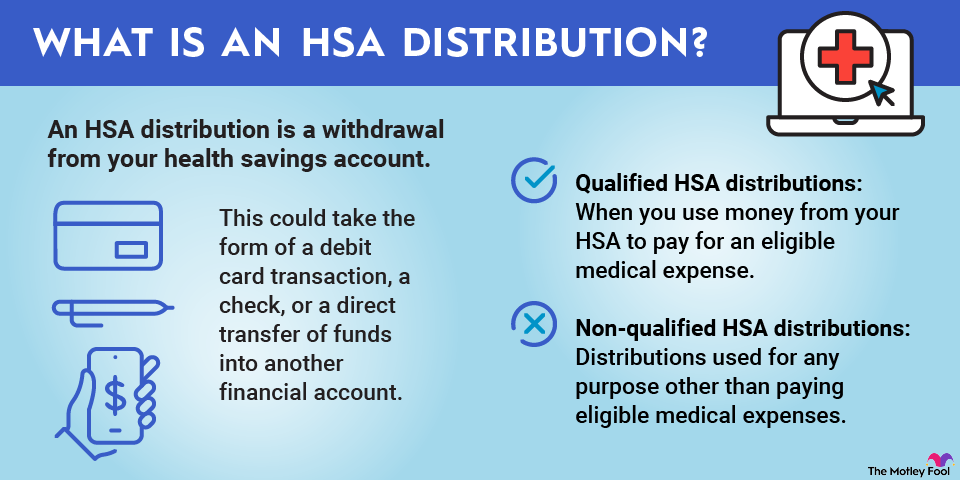

When you leave your job for any reason, you still get to keep all your HSA money. You can elect to leave the money invested with your current employer and make withdrawals whenever you wish, or you can transfer or roll over the HSA.

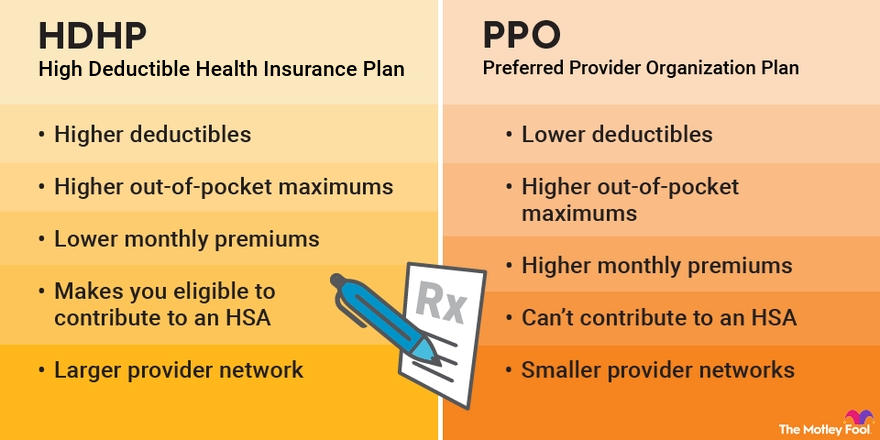

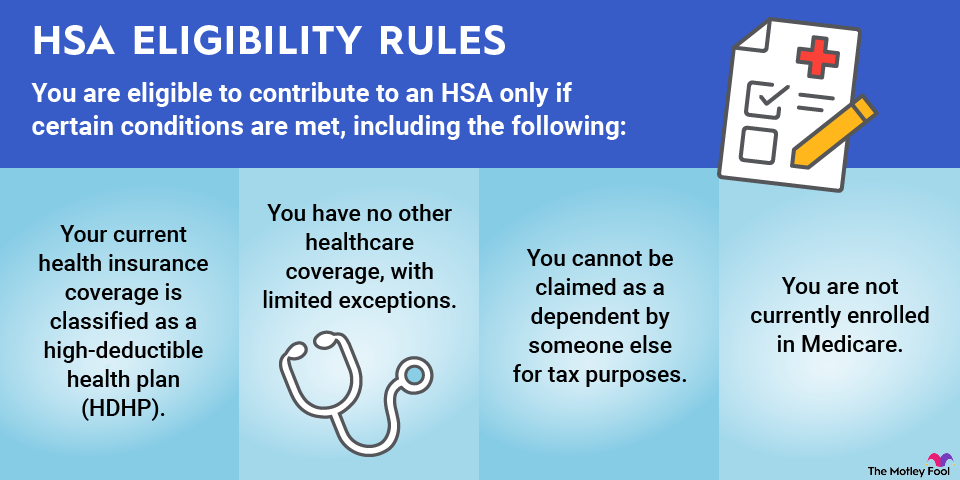

However, if you stop participating in the high-deductible health plan that made you eligible for the HSA, you will no longer be able to make new contributions to your HSA.

What happens to unused HSA funds?

Unlike a flexible spending account (FSA), HSA money isn't "use it or lose it." Your money can stay in your account for as long as you'd like. You can withdraw it tax-free to use for medical expenses at any time.

If you don't spend all your HSA funds, the unused money simply carries over, or rolls over, from year to year. It stays in your account, and you don't have to do anything to make that happen unless you want to move the money into a different HSA.

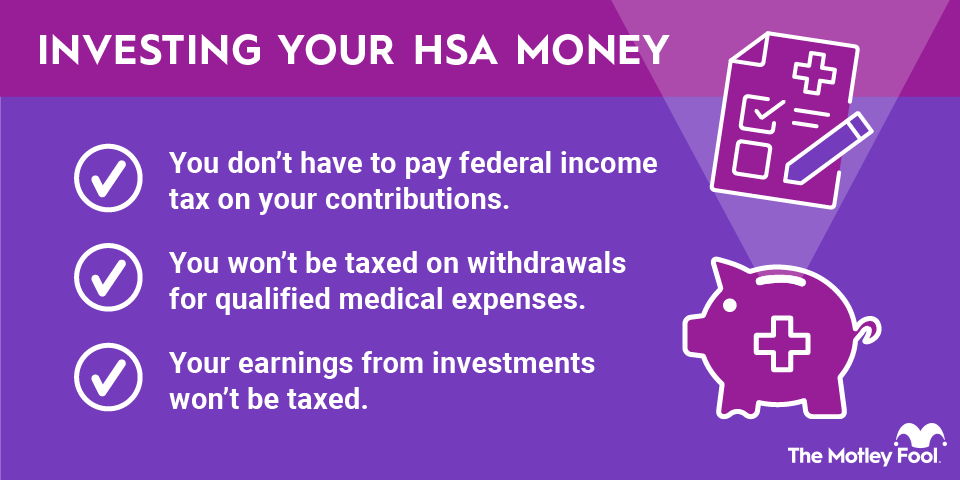

Once you're 65, you can withdraw HSA funds for any reason without penalty. However, you'd still owe ordinary income tax if the funds aren't used for medical expenses. That's why it's often best to use money left in your HSA to pay for healthcare in retirement.

Do HSA funds roll over from year to year?

HSA funds carry over from year to year, but this is different from an HSA rollover. Any contributions you make and gains from investments can remain in your account for as long as you'd like. The money is simply carried over from year to year until you choose to withdraw it.

What's the difference between an HSA transfer and a rollover?

An HSA transfer occurs when your HSA trustee directly moves your money into your new HSA for you. With an HSA rollover, the trustee sends you the money, and you must deposit it into your new HSA within 60 days to avoid penalties.

Why should I do an HSA rollover?

If you are changing jobs, rolling over an HSA may make sense if:

- You'd prefer not to leave an old employer with an account that you must remember to manage.

- You prefer to move your money to a different HSA provider offering better investment options, lower fees, or other advantages than your former employer's plan.