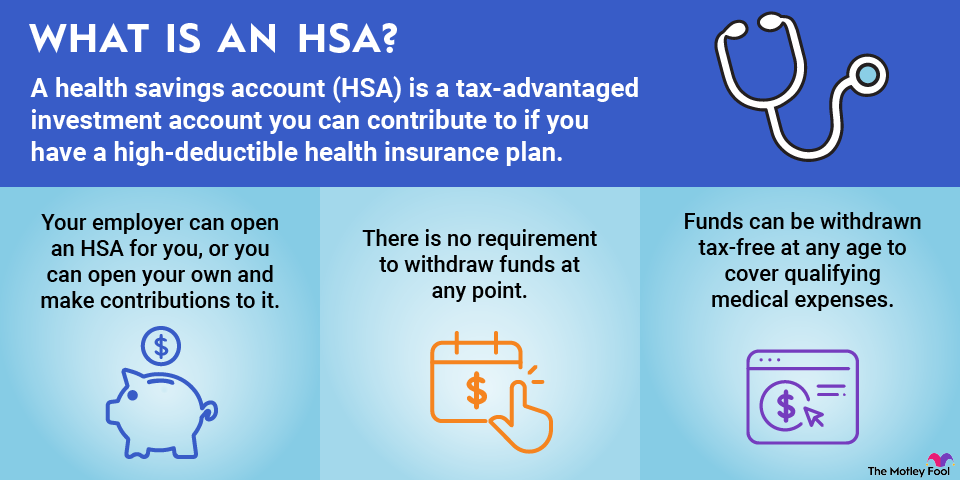

Health savings accounts (HSAs) are tax-advantaged accounts that you can use to save money to pay for medical care. HSAs are also excellent retirement savings vehicles since the money you contribute grows tax-free, and you can withdraw it for any purpose after age 65.

Strict rules govern who is eligible to use an HSA, the amount you can contribute, and what you can use withdrawals for before age 65. Here are the key HSA rules you need to know.

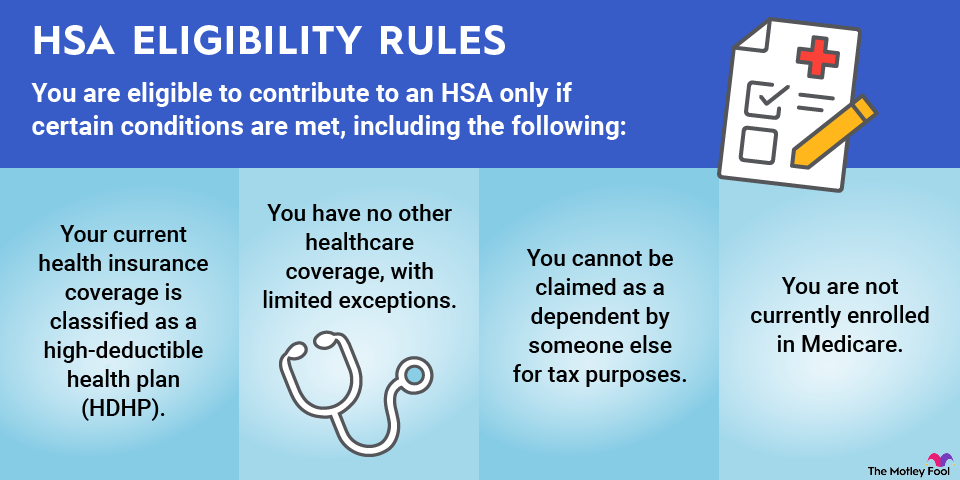

HSA eligibility rules

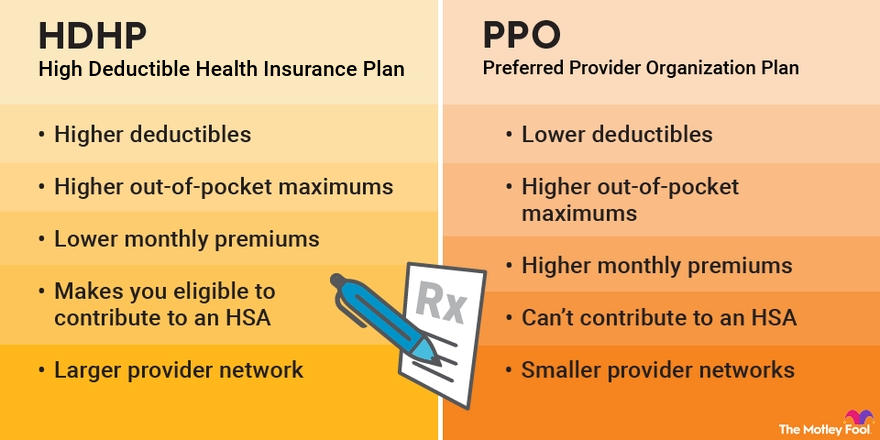

You are eligible to contribute to an HSA only if you meet certain conditions, including the following:

- Your current health insurance coverage is a high-deductible health plan (HDHP). The definition of a qualifying HDHP changes periodically. Your insurance may qualify as a high-deductible health plan if one of the following is true:

- Your coverage is self-only (individual coverage), your plan's minimum annual deductible for 2026 is at least $1,700 ($1,650 in 2025), and your yearly out-of-pocket expense is capped at $8,500 ($8,300 in 2025).

- You have family coverage, your plan has a minimum annual deductible in 2026 of at least $3,400 ($3,300 in 2025), and the maximum out-of-pocket limit is no more than $17,000 ($16,600 in 2025).

- You have no other healthcare coverage, except in limited circumstances. Those exceptions may include coverage for:

- A specific illness

- A specific amount of money for hospitalization within a given period

- Dental or vision care

- Long-term care

- An accident or disability

- Liabilities incurred due to workers' compensation claims, tort laws, or ownership of property

- Someone else cannot claim you as their dependent for tax purposes.

- You are not currently enrolled in Medicare. If you are enrolled in Medicare Part A and/or B, you may not contribute to an HSA.

HSA rules for contributions

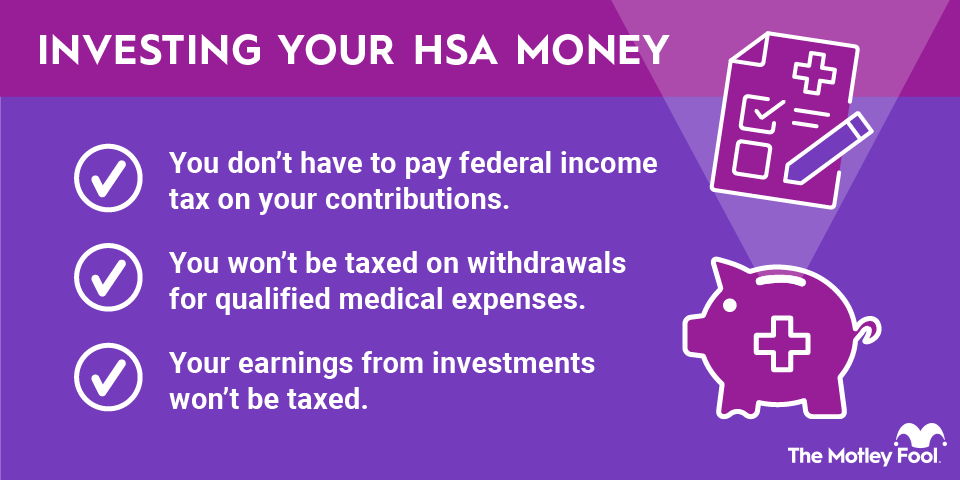

You can contribute to an HSA and invest the funds, which enables the money in the HSA to grow tax-free for as long as you like. The IRS sets annual limits, which change periodically, on the amount you can contribute to an HSA. Here are the maximum amounts you can contribute to an HSA in 2026:

- If you have self-only coverage, you can contribute up to $4,400 ($4,300 for 2025).

- If you have family coverage, you can contribute up to $8,750 ($8,550 for 2025).

- If you are age 55 or older, you can contribute an additional $1,000 as a catch-up contribution.

If your employer contributes to your HSA on your behalf, that counts toward your annual limit. HSA contributions generally vest immediately, meaning that any contribution from your employer is yours to keep, even if you leave your job shortly after your employer contributes the money.

Your contributions to your HSA are made with pretax dollars, which allows you to claim an annual tax deduction equal to the amount of your contribution for the year. Contributions from your employer are not considered part of your income and are not taxed. However, employer contributions are listed on your W-2 form in Box 12 and confer a tax benefit to your employer.

Employers offering HSA plans are subject to anti-discrimination rules to prohibit them from providing HSAs that unfairly benefit highly compensated employees. The law doesn't prohibit employers from contributing more money to the HSAs of certain employees, but they may not offer HSAs exclusively to high earners.

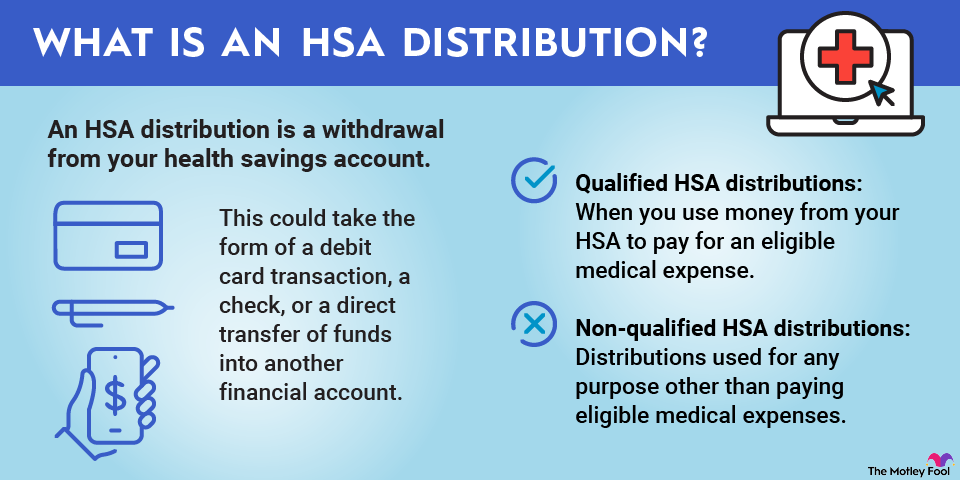

HSA rules for withdrawals

If you withdraw money from an HSA for any reason other than to cover eligible medical expenses, you will be subject to a 20% penalty on the amount withdrawn unless you are age 65 or older. This 20% penalty is double the 10% penalty that applies to early 401(k) or individual retirement account (IRA) withdrawals. You'll pay ordinary income tax on money withdrawn from an HSA not used for qualifying medical or dental expenses, regardless of whether you incur the penalty.

Unlike flexible spending accounts, you do not have to spend money in an HSA in the same year you make the contribution. You also are not subject to the rules for required minimum distributions (RMDs) that apply to other types of pretax retirement savings accounts, such as 401(k)s and traditional IRAs.

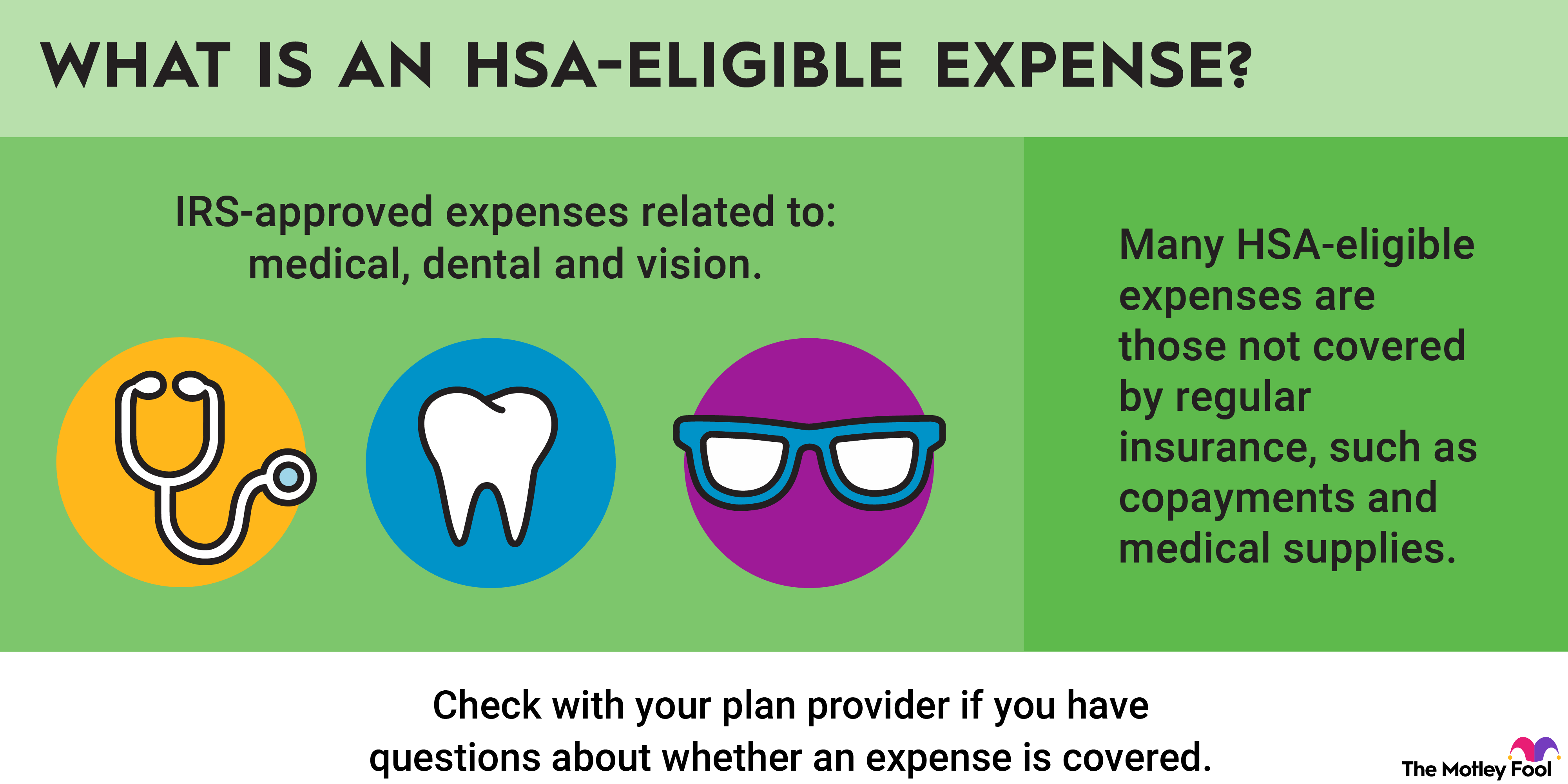

What is a qualifying medical expense for an HSA?

The IRS defines qualifying medical expenses as "the costs of diagnosis, cure, mitigation, treatment, or prevention of disease, and for the purpose of affecting any part or function of the body."

The IRS doesn't consider a medical expense to be "qualifying" just because it may generally benefit your health. For example, the IRS specifically states that vacation costs are non-qualifying expenses, even if taking a break may be beneficial to your mental or physical health. Qualifying expenses must be "primarily to alleviate or prevent a physical or mental disability or illness."

The IRS provides a long list of qualifying expenses in Publication 502 to help you determine if you can use your HSA funds to pay for a particular product or service. You can use your HSA funds to pay qualifying expenses for both yourself and eligible dependents.

You can generally use HSA funds to pay for medical services offered by practitioners, along with diagnostic devices, supplies, and equipment that care providers need to offer their services. Some of the most common HSA-eligible expenses are:

- Prescription medications

- Acupuncture and chiropractic care

- Ambulance services

- Dental services, including dentures

- Eye care, including contact lenses and glasses

- Infertility treatments

- Hearing aids

These are some of the expenses the IRS specifically designates as not HSA-eligible:

- Babysitting or child care for a normal, healthy baby

- Controlled substances, such as medical marijuana or drugs that are federally illegal

- Cosmetic surgery

- Dancing lessons

- Diaper services

- Electrolysis

- Funeral expenses

- Future medical care

- Hair transplants

- Health club dues

- Household help

- Illegal operations and treatments

- Insurance premiums

- Maternity clothing

- Medications imported from outside the U.S.

- Nonprescription drugs, except insulin

- Personal use items such as toothpaste and toothbrushes

- Surrogacy expenses

- Swimming lessons

- Teeth whitening

- Veterinary care (unless it's for a service animal)

- Weight loss programs, unless part of treatment for specific diseases

Several online stores sell only HSA-eligible products. Searching these stores' databases can help you determine if a particular medical product is covered by your HSA. You are not required to buy HSA-eligible items from any particular provider.

HSA reimbursement rules

You can either spend money on qualifying HSA expenses and be reimbursed or use an HSA debit card to pay for qualifying costs.

Using a debit card can be easier, but not all HSA accounts offer this option, and not all eligible medical services are payable via debit card. If you pay for the qualifying expenses and wish to be reimbursed, you must submit receipts before receiving the reimbursement.

HSA rules after age 65

Once you reach age 65, you can withdraw money from your HSA for any purpose without incurring a penalty. If you are age 65 or older and withdraw money from your HSA for any reason other than to pay for a qualifying medical or dental service, you'll owe ordinary income taxes on the distribution. In other words, the distribution is treated the same as a withdrawal from a traditional IRA or 401(k).

Related Investing Topics

How to start an HSA

While there is plenty to understand about how health savings accounts work, opening an HSA is relatively simple. Most HSAs are employer-sponsored, although you can also open an HSA with one of many financial institutions.

Many employers offering qualifying high-deductible health plans also offer HSAs. To enroll, you simply need to complete the necessary paperwork and arrange to have your HSA contributions deducted from your paycheck. You will also need to invest the funds in your HSA by choosing how to allocate the money, just like you would with any retirement savings account.

While you are allowed to maintain multiple HSAs if you choose, the annual contribution limits set by the IRS apply to all of your accounts combined.