Self-employed workers often have more freedom than their traditionally employed counterparts, but they also face unique challenges. One of the biggest is the lack of an employer-sponsored retirement account. A solo 401(k) can make meeting that challenge a little easier.

It's similar to a traditional 401(k), but it's designed specifically for the self-employed. Here's what you need to know about it.

What is a solo 401(k)?

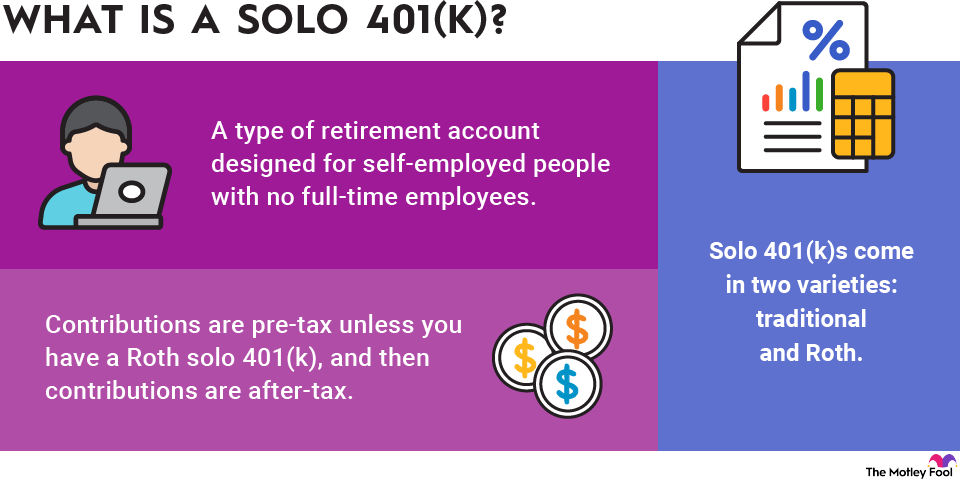

A solo 401(k), also known as a one-participant 401(k), is a type of retirement account specifically designed for self-employed people with no full-time employees. There is an exception if your spouse works for your business. In that case, both of you may contribute to a solo 401(k).

It works similarly to a 401(k), which a traditional worker might be offered through their job. But because self-employed people act as both employee and employer, they can contribute larger sums each year.

Solo 401(k)s at a glance

Here's a quick rundown of how solo 401(k)s work:

Eligibility | Contribution Limits | Taxes |

|---|---|---|

Self-employed or small business owner with no employees | 2025:

-$70,000 for those under 50

-$77,500 for those 50 to 59 and 64+

-$81,250 for those 60 to 63

2026:

-$72,000 for those under 50

-$80,000 for those 50 to 59 and 64+

-$83,250 for those 60 to 63 | Contributions are pre-tax with a traditional solo 401(k) and after-tax with a Roth solo 401(k) |

Benefits of a solo 401(k)

One advantage of a solo 401(k) is the opportunity to choose the type of plan and the investment options that work best for you. Traditionally employed workers are limited to what their company offers. When you're the boss, you decide how to invest your funds and which type of 401(k) you want.

Solo 401(k)s come in two varieties, each offering different types of tax savings:

- Traditional solo 401(k): You make contributions with pretax dollars, and these reduce your taxable income for the year. This type of 401(k) is tax-deferred, as you pay taxes on your distributions in retirement.

- Roth solo 401(k): You pay taxes on your contributions in the year you make them, but the money grows tax-free afterward. When you withdraw the funds in retirement, you get to keep them all for yourself.

If you're earning more money now than you'll be spending annually in retirement, a traditional solo 401(k) is likely the smart play. Delaying taxes until your income is lower will help you hold on to more of your money. A Roth solo 401(k) is better if you think your earnings are less than what you'll be spending in retirement.

In exchange for these tax benefits, you can't withdraw your solo 401(k) funds before age 59 1/2 unless you use the money for a qualifying exception such as a first home purchase or a large medical expense. Otherwise, a 10% early withdrawal penalty applies. You can withdraw Roth solo 401(k) contributions at any time, as long as you've had the account for at least five years, but not earnings.

Contribution limits for a solo 401(k)

Self-employed workers under age 50 may contribute up to $70,000 to a solo 401(k) in 2025. Adults aged 50 to 59 and those 64 or older can also make catch-up contributions of up to $7,500, bringing the total limit to $77,500. Those aged 60 to 63 can make catch-up contributions of up to $11,250, bringing the total limit to $81,250.

In 2026, the solo 401(k) contribution limits are:

- $72,000 for adults under age 50

- $80,000 for adults aged 50 to 59 and 64 or older

- $83,250 for adults aged 60 to 63

Those are the maximum limits, but your own limits could be different. When you contribute to a solo 401(k), you can contribute as both employee and employer, and the limits are different for each one.

Employer and employer 401(k) limits

The 401(k) employee contribution limit for traditionally employed workers is $23,500 in 2025 and $24,500 in 2026. There are also catch-up contributions of $7,500 in 2025 and $8,000 in 2026 for those aged 50 to 59 and 64 or older. The catch-up contribution for those aged 60 to 63 is $11,250 in 2025 and 2026.

The employer contribution is up to 25% of an employee's contribution, or about 20% of your net self-employment income, which is defined as all your self-employment earnings minus business expenses, half your self-employment tax, and the money you contributed to your solo 401(k) for your employee contribution. For example, if you earned $100,000 in net self-employment income, you could make an employer contribution of up to around $20,000 to your solo 401(k).

Your maximum contribution is the lesser of the annual contribution limit (discussed above) or up to $23,500 of your compensation in 2025 and $24,500 in 2026, plus 25% of your compensation from your employer-side contribution. If you're 50 or older, you can also make catch-up contributions.

If you're younger than 50, you cannot contribute more than $70,000 in 2025 or $72,000 in 2026, even if your employer contribution would allow for it. You can't exceed your maximum employee and employer contributions for the year, even if you haven't hit the annual limit.

Related topics

How to start a solo 401(k)

Follow these steps to open a solo 401(k):

- Get an Employer Identification Number (EIN): You need an EIN to open a solo 401(k). You can apply for one of these on the IRS website.

- Choose your broker: Explore different brokerages and examine their investment offerings, fees, and customer service.

- Fill out the appropriate paperwork: Your broker will send you a plan adoption agreement and an application to complete before you can deposit money into your account.

- Fund your account: You may put money into your solo 401(k) by sending a check or using direct deposit.

After that, you can start choosing your investments and making regular contributions to your account. You can also roll over funds from other retirement accounts in your name if you choose. Here are a few more important notes about managing a solo 401(k):

- You must make your solo 401(k) employee contributions by Dec. 31.

- You have until the tax filing deadline for the year -- usually April 15 of the following year -- to make your employer contribution.

- If you have $250,000 or more in your solo 401(k) by the end of the year, you're required to submit a Form 5500-EZ information return to the IRS with your tax return for that year.

Solo 401(k) vs. other retirement plans

If you don’t think a solo 401(k) is a good fit for you, here are some other options you may want to consider:

- Simplified Employee Pension (SEP) IRA: A SEP-IRA is another popular option among self-employed individuals with no employees. You may contribute up to the lesser of $70,000 in 2025 and $72,000 in 2026, or 25% of your net income. You can use one of these accounts if you have employees, too, although you’ll have to make mandatory contributions to your employees’ accounts. This could limit how much you can afford to contribute to your own retirement.

- Traditional or Roth IRA: Traditional IRAs and Roth IRAs are available to all workers. You can open them with most brokers, and you’re free to choose from many common investments. You may contribute up to $7,000 in 2025 and $7,500 in 2026. If you're 50 or older, you can contribute an extra $1,000 in 2025 and $1,100 in 2026.

- Self-directed IRA: Self-directed IRAs are traditional, Roth, or SEP IRAs that allow you to invest your money in real estate and other assets you can’t typically invest in with an IRA.

Each account has its pros and cons, so you’ll have to decide which is best for you. A SEP-IRA might be a better fit if you don’t want to deal with the more complex reporting requirements of a solo 401(k). But solo 401(k)s let you choose between tax-deferred and Roth accounts and take out loans, while SEP IRAs don’t allow these things.

If you can’t decide on a single type of retirement account, you could always consider more than one. For example, a Roth IRA could be a smart complement to a tax-deferred solo 401(k) if you want to set aside some extra money above and beyond what the solo 401(k) allows.

A solo 401(k) is definitely worth considering, especially if you don’t have any employees and you’d like to set aside a lot of cash for retirement. But if you don’t think it’s the right fit for you, there are plenty of other options out there. Focus on what makes the most sense for you right now. If that changes down the road, you can always do a rollover later on.