23 Questions to Give Your Retirement Savings a Sanity Check

23 Questions to Give Your Retirement Savings a Sanity Check

Saving for retirement is a job for everyone

Saving for retirement is not a choice. It’s a necessity. Social Security benefits are a vital economic linchpin for retirees, but they aren’t likely to provide for all your financial needs. They were designed to fulfill only about 40% of the income Americans had before retirement.

But Americans need an estimated 80% of the income they were making before retirement to make ends meet. Contrary to popular opinion, income needs don’t fall that much when you retire. You’ve still got to eat and have a place to live. You’re highly likely to still need a car. You still need healthcare -- and healthcare expenses often rise for older people. You’ll still like to have fun. All of those needs require money. You need retirement savings to fund a comfortable and happy life in retirement.

Plus, about 66% of us are afraid Social Security won’t be there when it comes time to retire. It’s probably not necessary to worry that much -- politicians can find a way to fund Social Security given the will. But frankly, it’s also impossible to predict what will happen on the Social Security front going forward. Retirement savings are the answer to anxiety on that score.

People are living longer than ever before. That’s a tremendous benefit. But to live happily, you need to build a retirement nest egg. To build and maintain a nest egg successfully, you’ve got to do a periodic sanity check on your plans and your savings. Ask yourself these questions.

Previous

Next

1. Do I know how much I need to save?

Retirement savings don’t just grow spontaneously. You should start out with a goal in mind.

Here’s a rule of thumb you can use. First, determine how much income you want at retirement to live comfortably. If you’re near retirement, calculate whether your current salary (for example) would do it. If you’re younger, ask a trusted older person whose lifestyle you like what they make.

Now you’ve got a goal. Let’s say around $55,000 a year in retirement seems like it would give you everything you need in the golden years. You are comfortable assuming that Social Security, which currently pays $17,532 per year on average, will give you a chunk of that. Let’s assume you need to save enough for your own nest egg to give you $40,000 per year in retirement.

The first rule of thumb is to multiply that income you want in retirement by 25. For $40,000 yearly, you’d need $1,000,000 saved at retirement.

This figure is high. But it’s very doable. A 30-year-old who put just over $500 per month consistently in a retirement savings fund earning 7%, an average for the stock market, would end up with this much at 65.

Ultimately, plan for your goal. Start by knowing what it is.

ALSO READ: 5 Retirement Saving Tips for 2019 -- and Beyond

Previous

Next

2. Do I know where to put my retirement savings?

There are two basic retirement savings vehicles, 401(k)s and individual retirement accounts (IRAs). While you can save under a mattress or in a regular (ie, non-retirement) savings account, both these vehicles offer savers specific benefits that neither a mattress nor a non-retirement account can provide.

Because of these benefits, they’re hands-down the best places to save.

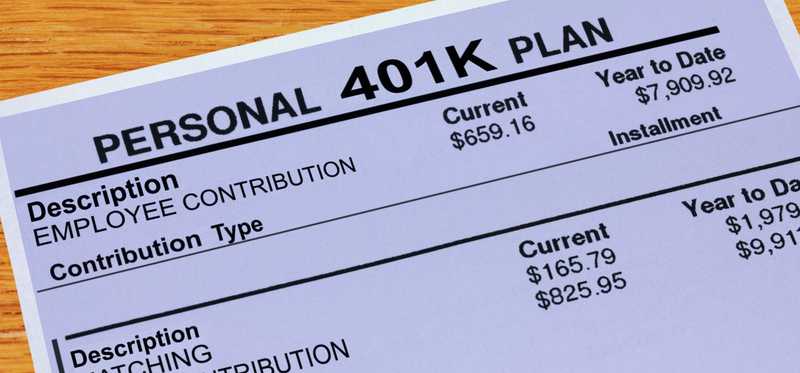

A 401(k) is a defined contribution plan offered through workplaces. “Defined contribution” means you decide what your contribution is going to be, by determining a percentage of your paycheck to contribute. Your company then takes it out of your paycheck automatically.

People can save up to $19,000 per year in 401(k)s. If you’re 50 years of age or older, the maximum is more, at $25,000, to enable you to catch up in retirement savings.

About 78% of employers who offer a 401(k) plan offer a match. That means they will contribute a matching percentage of your contribution. Companies usually match from 50% to 100%. If your company matches 50%, for example, and you contribute 5% of your income, they contribution an additional 2.5% of your income. Matches are great deals, because that money doesn’t cost you a cent.

IRAs are self-directed plans. That means you need to open one through a bank, brokerage, or other financial institution.

People can contribute a total of $6,000 per year to IRAs; $7,000 if they’re 50 or older.

There are two types of IRAs, traditional and Roth. The difference lies in their tax advantages. Read on to find out more.

Previous

Next

3. Am I tax-efficient with 401(k)s?

All the retirement savings vehicles offer tax advantages, but each is slightly different in what it offers. Know the ins and outs for the highest level of tax efficiency.

Contributions to 401(k)s are taken out of your paycheck before taxes are taken out. That means you pay no tax on the amount. This lowers the taxes you pay in the year, and can lower your tax bracket.

All 401(k) contributions grow tax-free until you withdraw them, including any employer matches.

You will be taxed when you withdraw the money. You must take required minimum distributions (RMDs) starting at the age of 70 1/2. You can take them before that, as early as 59 ½ if you wish.

Withdrawals before 59 ½ are subject to penalties and tax.

Previous

Next

4. Am I tax-efficient with my traditional IRA?

Both types of IRAs offer tax advantages, but they are different from each other.

Contributions to traditional IRAs are not taken out pretax; you contribute to them with money that has been taxed. But those contributions are tax deductible in the year you contribute them, and up to April 15 of the following calendar year.

You can exclude qualified traditional IRA deductions from your taxable income, and you can do this whether or not you are eligible for other tax deductions, such as mortgage interest or healthcare expenses. The deduction will lower your tax bill.

Contributions grow tax-free until you withdraw them.

Although they are not taxed at contribution, traditional IRAs will be taxed when you withdraw them. They are subject to the same RMD schedules as 401(k)s: You must begin withdrawals at 70 ½; and you can begin at 59 ½ if you choose.

No contributions can be made after you turn 70 ½.

Previous

Next

5. Am I tax-efficient with my Roth IRA?

Unlike traditional IRAs, Roth IRAs are not tax deductible at the time of contribution. They do grow tax-free until withdrawal, like a traditional IRA.

The primary difference between a Roth IRA and a traditional IRA is that Roth IRA withdrawals are not taxed.

The advantage comes in not paying tax on any qualified withdrawals from a Roth IRA, while you do have to pay tax on qualified withdrawals from a traditional IRA.

There are a couple other tax advantages with a Roth IRA.

Roth IRAs have no RMDs, so can be withdrawn more flexibly than traditional IRAs or 401(k)s. You can leave a Roth IRA without taking out any withdrawals as long as you want. In other words, if you want to leave Roth IRA funds in an account for your 90th birthday, you can.

You can also withdraw your contribution amounts from a Roth IRA without penalty. If you withdraw money from a traditional IRA, you will have to pay the Internal Revenue Service (IRS) a 10% penalty, plus the tax. But you’ve already paid the tax on your contributions to a Roth, so you don’t have to pay tax again.

Note that you do have to pay tax if you withdraw investment gains early, because that income hasn’t been taxed in the IRS’s eyes.

You can also make contributions as long as you want with a Roth IRA. Contributions to a traditional IRA are not allowed after you turn 70 ½, but they are with a Roth IRA.

Previous

Next

6. Am I taking advantage of all the tax breaks for retirement savings?

You’ll receive the tax break for a 401(k) plan automatically, because the pretax amount is taken out automatically. Your W-2 tax form will give you wage amounts that reflect your contribution.

When you’ve contributed to a traditional IRA, be sure to include the tax deduction with your taxes.

People with moderate incomes can also take advantage of a tax Savers Credit provided they have contributed to a 401(k) or either type of IRA.

Since nearly two-thirds of tax filers are entirely unaware that this exists, it’s worth checking into to see if you qualify. For 2019, you need to have made an adjusted gross income (AGI) of no more than $64,000 if you’re married and filing jointly, $48,000 if you’re the head of a household, and $32,000 for all other filers.

As its name implies, it is a credit rather than a deduction. If you qualify, you can subtract up to $1,000 from the taxes you owe. If you don’t owe any taxes, you’ll receive a credit that can increase your tax refund.

Taxpayers receive a percentage of the $1,000 maximum, depending on their filing status, their AGI, and the amount of their tax-advantaged retirement contribution. Click here to see a table giving the credit rate you’d be eligible for vis-à-vis these factors.

Previous

Next

7. Do I maximize my employer 401(k) match?

The more money you contribute to a 401(k) that you employer matches, the more money you can save. But it also pays to know your employer’s maximum allowed contribution for you and their matching policy.

If you contribute 3% of your salary and they match 100%, for example, you receive an additional 3% of your salary. Say you earn $45,000 each year and are saving in a 401(k) at that rate. You save $1,350 each year. Your employer also kicks in $1,350, for a total of $2,700. Awesome.

But many employers will match a higher percentage. Some offer matches of up to 6% or more of an employee’s salary. If you save 6% of $45,000, you’d save $2,700 by yourself. Then, your employer would also kick in $2,700, for a total savings of $5,400 per year. Even more awesome. Over time, that becomes a hefty difference in your retirement fund.

Some employers start employees on a 3% contribution automatically, to encourage retirement savings, but will in fact match a higher percentage if you elect a higher contribution.

Others will match only up to a certain percentage, although employees can contribute a higher percentage. So be sure to read the fine print and maximize all you can.

Previous

Next

8. Do I know the income limits if I or my spouse save in both a workplace 401(k) and a traditional IRA?

Yes, both 401(k)s and traditional IRAs are tax-advantaged. But if you participate in a workplace retirement plan such as a 401(k), the IRS imposes an income limit on how much of your traditional IRA contribution can be deducted from your taxes.

This year, for example, you can deduct up to $6,000 ($7,000 if you’re aged 50 or over) from your income for a traditional IRA contribution. If you’re covered by a 401(k) plan at work, however, you can only deduct this maximum if your AGI is $64,000 or less.

A single filer who makes less than $74,000 but above $64,000 can partially deduct any traditional IRA contribution. If you’re a single filer and make more than $74,000, you can’t deduct a traditional IRA contribution at all.

Note that you can still contribute to a traditional IRA, and your contributions will grow tax-free, so all tax advantages are not lost if you exceed the income limits. But your ability to take a tax deduction is cut back or nonexistent according to income limits if you’ve got a 401(k).

Income limits also exist if your spouse is covered by a 401(k) in the workplace, although the amounts are different.

Both income limits also vary by tax filing status. See here for an itemization of limits and filing status for both your own and a spousal 401(k) in 2019.

ALSO READ: 401(k) Contribution Limits Increase in 2019, but It Won't Matter to the Average American

Previous

Next

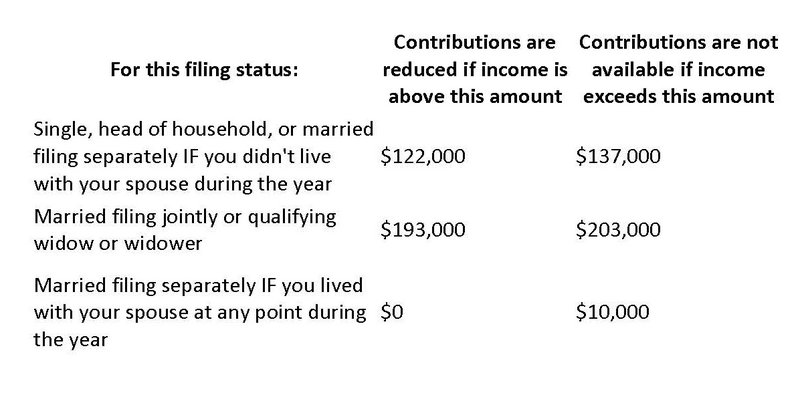

9. Do I know the income limits for a Roth IRA?

While traditional IRAs only have income limits only if you or a spouse are also covered by a 401(k) plan at work, Roth IRAs always have income limits. In other words, whether you can contribute to a Roth IRA, either fully or partly, is contingent every year on how much you make.

The amount varies according to your filing status. For 2019, the income limits are as follows.

Previous

Next

10. What if I can’t seem to save anything for retirement?

Retirement savers need a budget at the same time they draw up their goals. You need a very clear, written-down record of what your expenses are and what your income is, in order to know what you can reasonably save.

So, draw up a budget. This is a process, not a one-time event. You are going to make a record of your expenses first.

Total up all your fixed expenses for the past year (rent/mortgage, utilities, student debt). Then tote up all your variable expenses (food, credit card payments, insurance). These are things you need, but whose expenses vary month to month. Then add up occasional expenses, such as vacations and tax payments. Divide by 12 to see a monthly average.

At the end, you’ll have average expenses. Then compare them with your income.

Determine how much you can reasonably save for retirement. If you need to cut expenses, see here for suggestions.

If it’s tough to save on a monthly basis, make a plan to save any windfalls you get. Any money that is outside the norm can be put in your retirement account. This could be holiday gifts, bonuses, tax refunds -- you name it.

Previous

Next

11. Do I know what investments to choose?

You have literally a wealth of options in choosing specific investments for your retirement savings. Most 401(k) plans offer a number of choices, and in an IRA or other self-directed plan, you can invest in almost anything.

Think in terms of asset classes. Stocks, for example, are an asset class. So are fixed-income investments like bonds, money-market funds, and certificates of deposit (CDs).

Asset classes have a characteristic risk and reward profile.

Stocks, for example, reward historically on the high side. The U.S. stock market indexes return 7% annually on average. But along with that high potential reward goes a fairly high degree of risk. Stocks suffer bear markets occasionally, which are declines of 20% or more.

In those years, can you lose money? You bet you can. You need a strong risk tolerance to invest heavily in stocks. But the 7% average return includes results from bear market years. Over time, your portfolio amounts have the potential to recover and keep rising.

Fixed-income investments have relatively lower reward potential, but they also have far less risk. Right now, fixed-income investments return between 2% and 3% each year. Less than the stock market, see? But also far more stable. While interest rates and bond prices do fluctuate, they fluctuate much less than the stock market.

As a result, a prudent portfolio usually utilizes both stocks and fixed-income: stocks provide maximum reward potential, and fixed-income offers some reward while protecting against risk.

Previous

Next

12. What’s a prudent asset allocation for my retirement savings?

There is a standard guideline for asset allocation in retirement accounts. It’s very related to the need to balance reward and risk in portfolios.

Generally speaking, the younger you are, the more you can emphasize reward and de-emphasize risk. Why? Well, say that risk in the stock market manifests itself, and the market drops 20% or more. If you’re 30, you have more than three decades to make up any losses.

But the older you are, the more you want to emphasize safety and minimize your risk. If a bear market occurs and you’re 62, you may not have the years required to make up any losses. If you have $500,000 saved and the market drops 20%, you’ve just lost a whopping $100,000. Not only has your portfolio’s value taken a big hit, but you may have to live with less money in your retirement.

The guideline that helps with this is called the 110 rule. It states: subtract your age from 110. Put the remaining amount into stocks. The amount left over should be placed in fixed-income investments.

In other words, if you’re 30, you could have 80% of your portfolio in stocks. Fixed-income would constitute 20%. But if you’re 62? Only 48% should be in stocks. That means 52% would be safely in fixed-income.

Under the 110 guideline, the younger you are, the more you can invest in stocks, and the older you become, the more your portfolio moves toward safety.

Previous

Next

13. Do I know what I’m being charged in fees?

Financial institutions, advisers, and plan administrators all charge fees. It’s safe to say that, if you have a retirement plan, you’ll be charged fees.

You need to know what you’re being charged. The reason is simple. Fees are taken out of your account. The goal of your account is to maximize the amount in it. Fees can conflict with that goal.

Even a difference that seems minimal, such as 1%, can erode your retirement savings. Let’s say you’ve saved $174,315 over the past 10 years, at a robust stock market return of 9.9%. A 1% annual fee reduces that amount nearly $10,000, to $164,663. Over time, that can add to many thousands of dollars.

Many stock market index funds, which track a major index such as the S&P 500, charge just 0.10% annually. The average 401(k) plan has fees of 1%. In 2017, the median annual fee for stock mutual funds was 1.18%.

If your fees are meaningfully higher than this, it’s reason enough to shop around for other funds or other providers.

Fees should be itemized in the material you receive from your company, plan administrator, or financial institution. They may be called commissions, administrative fees, or investment fees. If you don’t see them, look in the plan prospectuses or directly ask where to find them. Be sure to add multiple fees together.

Previous

Next

14. Do I have a good range of options for 401(k) plan investments?

A 401(k) plan participant has a choice of options in what to invest in. The options will be explained and delineated in the material you receive about the plan.

Your 401(k) plan should offer a reasonable range of options, divided among stock funds (mutual funds, domestic stock funds, international stock funds) and fixed-income choices (bond funds and money market accounts). The average 401(k) fund has 13 options.

Be sure to look at how each option has performed against the averages. Stock funds, for example, should do at least as well as the major market averages like the Dow Jones Industrial Average and the S&P 500.

Some companies offer their own stock as an option. In general, it’s not advisable to invest a great deal -- or anything -- in your own company’s stock. The reason? If the company encounters business difficulty, or even goes bust, it will affect your job and promotional prospects. Weighting the company’s performance in your retirement funds too is overly risky. You don’t want all your economic fortunes tied to any one company.

If you don’t think the options you are offered are particularly good, you can always open an IRA and invest in anything you’d like. Be aware, though, that if your company offers a match, you’d be forfeiting it.

Previous

Next

15. When do I vest in my 401(k)?

When you contribute to a 401(k), you always fully own your own contribution. If you’ve contributed $1,000 and want to leave after the first six months of employment, you can take that $1,000 with you.

But to fully own an employer’s matching contribution, you need to vest in it. The vesting is determined by a vesting schedule, which is up to the employer. There are three types of vesting schedules.

In an immediate vesting schedule, as the name implies, you are immediately vested. If they have contributed $1,000 in a match, that’s also yours when you leave.

In a graded vesting schedule, you own a certain percentage every year. Employers are required to vest you a minimum of 20% at the end of two years, and an additional 20% every year subsequently. In other words, graded schedules can last a maximum of six years, at which point you’re fully vested.

In a cliff vesting schedule, you don’t own any of the matching contribution until a certain point in time -- and then you own it all. The maximum time in a cliff vesting schedule is three years.

If you leave without being vested under the latter two schedules, you will forfeit any company contribution you’re not vested in.

Previous

Next

16. What happens with my 401(k) if I leave the company?

What if you leave a company in which you’ve got a 401(k) plan? You are entitled to all your contributions and to any amount in which you’re vested. You need to make a decision about what to do with your 401(k) funds if you leave your employer for any reason.

Many employers allow employees to simply leave a 401(k) in the account they have. Some have limits that must be met to do this. It can be a good idea if you’re new employer doesn’t offer a similar plan and you’re comfortable with the options in the existing plan.

You can also roll over the 401(k). A roll over means that you transfer the money to another tax-advantaged retirement account, like an IRA.

You can do this within 60 days of leaving a company without fees or penalty. If you wait more than 60 days and have taken the money out of the 401(k) account, you will be charged penalties and fees.

If your new employer does offer a 401(k), it might be wise to roll it over into the new one, as long as you like the investment choices. Many employers allow new employees to roll past 401(k)s over into their 401(k) plans. It can be a good idea if the plan offers good options, as it’s convenient to keep track of as few accounts as possible.

Don’t, by the way, just take the money from a 401(k) and spend it. You’ll pay taxes and penalties, as we note above. In addition, you’ve just knocked the ability of your retirement funds to increase over time off-course. Don’t do it!

ALSO READ: 4 Reasons to Roll Over Your 401(k) to an IRA

Previous

Next

17. Do you know where all your funds are?

You might start out with one 401(k) fund or one IRA fund. Keeping track of where your retirement money is? It’s no big deal.

Ah, but then you move through life. You change jobs. You open another IRA. Two more companies in 10 years, maybe, each with 401(k) plans.

Twenty-five years after you started saving for retirement, you’re no longer positive you know where all your retirement accounts are. Didn’t you have one in that first company? But you’re no longer receiving statements. How come?

The solution to this particular dilemma is twofold. First, rollovers can be your friend, because they aggregate your retirement accounts in as few accounts as possible.

Second, keep track of your accounts and where they are. In the last year on record (2016), $35 million in retirement funds was estimated to be “lost.” That means funds and financial services firms had turned the money over to state unclaimed property divisions because no one had claimed it or statements were being returned.

Approximately $25 million was reclaimed, with average 401(k) amounts of $601 and average IRA amounts of $5,817. If that’s your retirement fund, that could have grown a lot over time.

Keep track of your account numbers, any financial services firms where you opened IRAs, and the company information and plan administrator information for 401(k)s.

It may seem like retirement is a long way to Tipperary when you start out, especially if you’re in your 20s. But it gets there. When it does, you want every penny you’ve ever saved.

Previous

Next

18. Do I know how my retirement funds performed this year?

You should have a good idea of how your retirement funds are performing. That doesn’t mean you need to follow them obsessively every day. (If you want to follow them every day, that’s fine. But a daily tracking of performance can actually cause you to focus too much on short-term moves that may not represent the long-term trajectory.)

Look at your performance every year at a minimum. If you are in funds that underperform the averages, it’s a good idea to find funds that are at least performing in line with them -- and outperformance is even better. Maximization is the goal here.

Previous

Next

19. Do I rebalance my retirement accounts every year?

Every year, you should sit down and rebalance your retirement accounts to make sure your asset allocation is still optimal.

“Rebalancing” means that you look at your percentages in each type of asset. Market moves in both stock and fixed-income will change the amount of money in your retirement portfolios. In many years, it’s enough to change the asset allocation percentages.

If you had a portfolio of $50,000, for example, and 85% is invested in stocks, $42,500 of that money at the beginning of the year was in stocks. Say the following year brings a very nice stock investment return of 25%. By the end of the year, you have $53,125 in that portion.

If you have 15% of your portfolio in fixed income at the beginning of the year, and it has gone up 2%, you’ll now have $7,650 versus $7,500.

Do a happy dance on the stock return front. But then look to see that your asset allocation is still intact. You now have a portfolio totaling $60,775. An 85% stock allocation would be just under $51,659. A 15% fixed income allocation would equal $9,116 -- which, nicely enough, equals the amount that the stock portion of the portfolio exceeds its percentage allocation. If you want to keep your stock allocation what it is, then you need to move the $9,116 from stocks to your fixed-income component. Voila! You have rebalanced.

Previous

Next

20. Do I have an emergency fund along with my retirement funds?

Everybody should have an emergency fund. While emergency funds and retirement savings may seem unrelated, they are alike in that both lead to financial health throughout your life.

An emergency fund is three to six months of your income, banked away and earning interest. Say you get hit with a $600 car repair bill, and your monthly income won’t cover it. You hit the emergency fund. (And then replenish it as necessary.) Your daughter sprains an ankle and needs to go to the emergency room. The cost is going to be borne by your emergency fund.

Life throws the unexpected at everybody. If you don’t have a financial cushion to tide you over, you run the risk of incurring credit card debt to pay for unexpected events. Then you start a cycle: part of your income has to go to pay off the debt. It becomes harder to save. You reduce or eliminate emergency savings or retirement savings. You don’t have a cushion.

You also need an emergency fund in retirement, not just when you’re working. Older people can be subject to severe financial shocks, such as unexpectedly high medical expenses or a drop in income due to loss of a spouse. An emergency fund should be with you for life.

Previous

Next

21. Do I know how much inflation will affect my retirement savings?

Inflation moves inexorably over the long term to erode the value of any savings. Retirement savings are no exception.

Over the past decades, inflation has run at slightly higher than 3%, on average. What does that mean for your retirement funds?

Say you have been saving with a $1 million goal in mind for 30 years. Kudos to you when you achieve it. But inflation will eat its purchasing power. Assuming the historical average, roughly 90% of the purchasing power of $1 million will be eroded by inflation over 30 years.

Nicely enough, some investments keep pace with and exceed inflation. Stocks, for example, have returned 7% on average. So stock investments keep you roughly 4% ahead of inflation. That $1 million, invested in stocks, won’t be eroded but will gain.

The ultimate lesson from a sober reflection upon inflation? Choose your retirement fund plans and investments with inflation in mind.

Previous

Next

22. What’s the deal with RMDs?

RMDs are withdrawals from your 401(k)s and traditional IRA accounts. Investors in these must take RMDs when they reach 70 ½. You can take RMDs earlier, starting at the age of 59 ½, but at 70 ½ you must take them. RMDs are taxable income.

To arrive at the RMD amount for each year, you divide the totals in your 401(k) and traditional IRA accounts by your life expectancy, as itemized in the IRS’s Uniform Lifetime Table. Most financial institutions will do this for you if you prefer. Then, you continue to take RMDs every year. The amounts can be taken in a lump sum or every month.

There is a very high tax penalty if you fail to take RMDs at 70 ½. The IRS will levy 50% of the amount you should have taken.

Some investors may feel that their retirement income is fine without RMDs, and prefer to keep their funds in the assets they were in. If that’s you, you can reinvest your RMD in the same assets after withdrawal, but hold them in regular accounts, not tax-advantaged retirement accounts. In other words, if you had $10,000 in a stock you want to stay invested in, you would have to buy $10,000 of that stock once you receive your RMD, and then place it in a taxed brokerage account.

Previous

Next

23. How do I make sure my savings won’t run out as I get older?

One of investors’ chief retirement fears is that their savings are not going to last until the end of their lives.

In the 1990s, however, a financial planner came up with a method of ensuring the safe withdrawal of retirement funds. If people withdrew 4% from their retirement funds every year, adjusted for inflation, they could do that until their end of their lives with no fear of running out.

The 4% rule, as it came to be called, assumed a 60%/40% stock/bond asset allocation. It was devised in a period when bond funds returned roughly double what they do now.

If your portfolio allocation and bond returns vary, you may need to adjust the 4% rule a bit.

It also assumed that funds would need to last 30 years. If you expect to be retired longer than this, you may have to revise the 4% rule accordingly.

ALSO READ: Even Americans With Decent Savings Worry About Running Out of Money in Retirement

Previous

Next

Put this info to work for you

That’s your checklist for retirement savings sanity! If you can answer all the questions successfully, you’re a retirement savings master -- and on the path to comfortable and economically secure golden years.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.