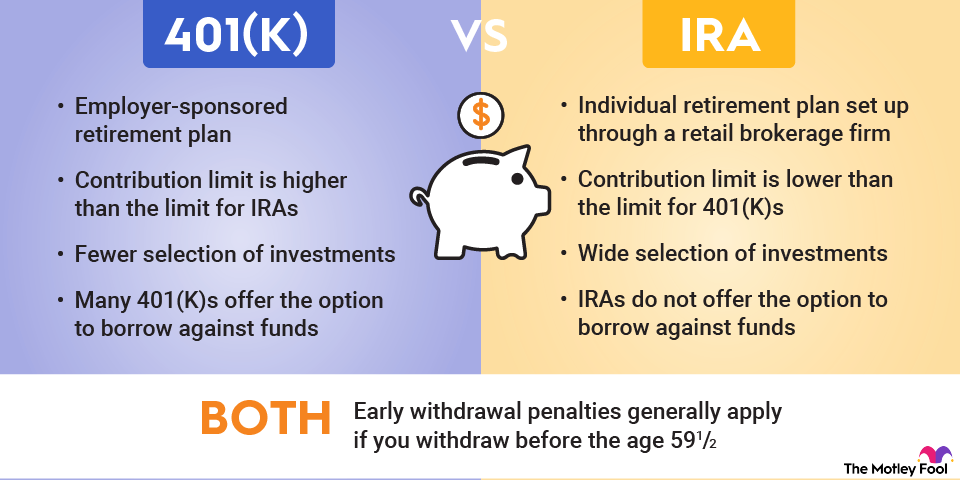

A 401(k) and an individual retirement account (IRA) are both tax-advantaged retirement accounts. While 401(k)s are typically only offered through employers (who often match employee contributions), individuals can open IRAs through any retail brokerage firm.

401(k)s generally allow higher contributions but offer fewer investment options, whereas IRAs have lower contribution limits -- and income caps for high earners -- but offer the opportunity to invest in almost any stock, bond, or mutual fund.

401(k) vs. IRA

If you're debating between investing in a 401(k) or an IRA, the first thing to know is that you don't have to choose. You can invest in both.

Some of the key differences between IRAs and 401(k)s include:

- Account sponsorship: Employers typically offer 401(k) plans, whereas you can open an IRA through any retail brokerage. You don't have to depend on your employer to establish an IRA.

- Contribution limits: While limits change annually, the contribution limit for 401(k)s is around three times higher than the contribution limit for IRAs.

- Eligibility rules: There are no upper income limits for 401(k) contributions, but 401(k) plans must pass nondiscrimination tests to ensure that the plan doesn't disproportionately benefit highly compensated employees. Taxpayers who earn above certain income thresholds are ineligible to make tax-deductible contributions to traditional IRAs or to invest in Roth IRAs.

- Investment options: IRAs opened with major brokers offer a wide selection of investment vehicles, while most 401(k)s offer just 20 or fewer investment choices (usually in the form of mutual funds).

- Withdrawal rules: Early withdrawal penalties generally apply to both 401(k)s and IRAs if you withdraw money before age 59 1/2. However, with each type of account, there are different ways to receive exemptions from these penalties. Additionally, many workplace plans offer the option to borrow against 401(k) funds, whereas IRAs do not include this provision.

Let's take a closer look at some of the rules governing IRAs and 401(k)s.

Contribution limits

A 401(k) has a significantly higher annual contribution limit than an IRA. For 2025 and 2026, the maximum contribution limits for each type of plan are:

Type of Contribution Limit | IRA | 401(k) |

|---|---|---|

Standard annual contribution limit | $7,000 (2025), $7,500 (2026) | $23,500 (2025), $24,500 (2026) |

Catch-up contribution limit for those aged 50 to 59 or 64 or older | $1,000 (2025), $1,100 (2026) | $7,500 (2025), $8,000 (2026) |

Super catch-up contribution for those aged 60 to 63 | N/A | $11,250 (2025 and 2026) |

Total limit for those 50 and older | $8,000 (2025), $8,600 (2026) | Aged 50 to 59, 64 or older: $31,000 (2025), $32,500 (2026); Aged 60 to 63: $34,750 (2025), $35,750 (2026) |

Eligibility to make tax-deductible contributions to a traditional IRA phases out for high earners if either the high earner or their spouse has access to a workplace retirement plan. High earners also cannot make Roth IRA contributions unless they use a backdoor Roth IRA strategy.

It's important to note that the 401(k) annual contribution limits apply only to individual contributions, not those from your employer. For example, if you contribute $14,000 and your employer matches up to $6,000, then that's a total contribution for the year of $20,000 -- but only your $14,000 contribution counts toward the annual contribution limit. In 2026, you could still contribute another $10,500 if you're younger than 50.

The total annual contribution limits for a 401(k) with the inclusion of employer contributions in 2025 are:

- $70,000 for individuals under 50.

- $77,500 for those who are 50 to 59 or 64 or older

- $81,250 for ages 60 to 63

The total annual contribution limits for a 401(k) with the inclusion of employer contributions in 2026 are:

- $72,000 for individuals under 50

- $80,000 for people 50 to 59 or 64 or older

- $83,250 for ages 60 to 63

The table below presents the maximum combined total contributions allowed for 2025 and 2026:

Age of Employee | IRA | 401(k) Combined Limit for 2025 | 401(k) Combined Limit for 2026 |

|---|---|---|---|

Younger than 50 | N/A | $70,000 | $72,000 |

50 to 59 or 64 or older | N/A | $77,500 | $80,000 |

60 to 63 | N/A | $81,250 | $83,250 |

Unfortunately, when you leave your job, you are no longer allowed to contribute to your former employer's 401(k). Instead, you must make a choice between keeping your 401(k) account as is with that company, rolling it over to an IRA, or rolling it over to your new employer's 401(k) plan.

Withdrawal rules

Since both 401(k) and IRA plans are supposed to help you save for your later years, the IRS assesses penalties for withdrawing money early. In general, if you withdraw funds from either a 401(k) or an IRA before the age of 59 1/2, a 10% early withdrawal penalty applies. However, there are some important differences in the rules governing IRA and 401(k) withdrawals.

First and foremost, it's possible to withdraw money in the form of a 401(k) loan, but not from an IRA. Borrowing against your retirement account has significant downsides, but it does enable you to tap these funds without incurring the early withdrawal penalty.

On the other hand, with an IRA, there are more scenarios in which you may withdraw money early without incurring the 10% penalty. The table below shows when you can withdraw money penalty-free from each type of account:

Reason for Withdrawal | 401(k) | IRA |

|---|---|---|

Birth or adoption expenses (up to $5,000 per child) | Yes | Yes |

Becoming totally and permanently disabled | Yes | Yes |

Experiencing economic loss as a result of a federally declared disaster (up to $22,000) | Yes | Yes |

Being a victim of domestic abuse (up to the lesser of $10,000 or 50% of account balance) | Yes | Yes |

Incurring qualified higher-education expenses | No | Yes |

Taking a distribution for emergency personal expenses (up to the lesser of $1,000 or your vested account balance over $1,000, max once per calendar year) | Yes | Yes |

Taking a distribution from a pension-linked emergency savings account | Yes | No |

Taking a series of Substantially Equal Periodic Payments (SEPPs) | Yes | Yes |

Purchasing a home for the first time (up to $10,000) | No | Yes |

Incurring unreimbursed medical expenses exceeding 7.5% of income | Yes | Yes |

Paying health insurance premiums while unemployed | No | Yes |

Called to active duty as military reservist | Yes | Yes |

Leaving your job during or after the calendar year you turn 55 | Yes | No |

Being certified as having a terminal illness | Yes | No |

If you think you may leave your job in your mid-50s, then a 401(k) offers more flexibility due to the Rule of 55. However, if you want your retirement account to cover education expenses, insurance premiums in the event of job loss, or a portion of a home purchase, only an IRA provides these options penalty-free.

Cost

As many as 95% of workers pay 401(k) fees, according to a Morningstar analysis. The average fee is approximately 0.5%; however, fees can vary substantially depending on the type of investment account.

Because 401(k) plans offer limited investment options, you may be restricted to only buying shares in mutual funds, which often charge higher fees than other types of securities accessible with IRAs.

By contrast, investments in IRAs typically come with few or no fees. Most brokers don't charge a fee to open an IRA account and have eliminated commissions on trades. You can compare IRA providers to identify those that don't impose fees. Plus, with a broader choice of investment types, you may also save money in fees by choosing low-fee exchange-traded funds (ETFs) for your IRA's portfolio.

Flexibility

Most 401(k) plans offer the choice of investing in just 20 or fewer mutual funds, according to BrightScope. A minority of 401(k) plans now allow you to establish self-directed accounts -- meaning you can invest in many different types of securities, the same as you could with a typical brokerage account -- but self-directed 401(k)s are not the norm.

An IRA is more like a typical retail brokerage account in that your investment options are not restricted. If unrestricted investment choice is important to you, then an IRA is your best alternative. However, some investors appreciate the simplicity of having only a few investment funds from which to choose; in such cases, a 401(k) may be preferable.

Ultimately, as you compare all of the differences between IRAs and 401(k)s, you may decide that you prefer one over the other, or you may opt for both. Either way, the important thing is that you're saving now for your later years and building a diversified portfolio of sound investments that will provide for you in retirement.