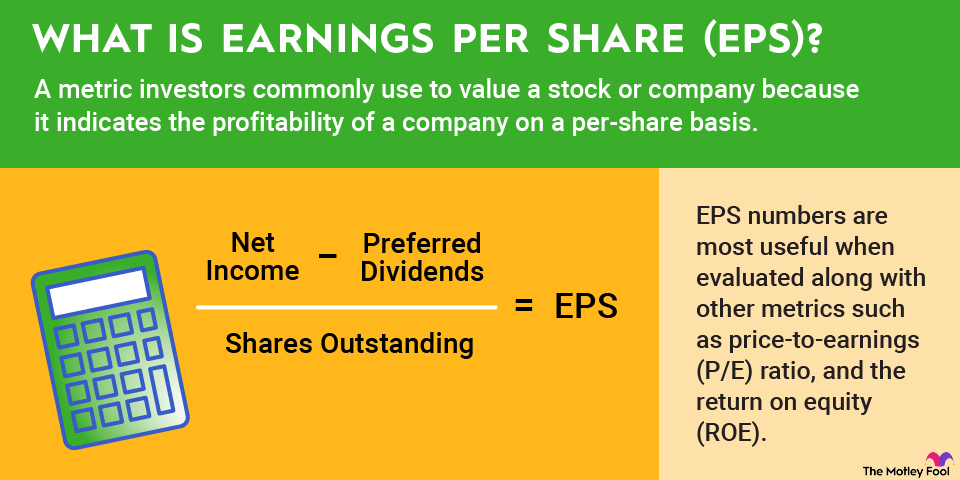

What is Earnings Per Share (EPS)?

Earnings per share (EPS) is a metric investors commonly use to value a stock or company because it indicates the profitability of a company on a per-share basis. EPS is calculated by subtracting any preferred dividends from a company's net income and dividing that amount by the number of shares outstanding. Net income is the amount of money that remains in a reporting period after all cash and non-cash expenses are deducted, and net income minus preferred dividends is synonymous with a company's profit for the period. Preferred dividends must be subtracted because holders of preferred stock have contractual rights to dividend payouts. Read on to find out more about earnings per share -- calculating them, understanding how to use them, and the difference between different ways to look at this important metric.

A company reports its EPS in consolidated statements of operations (income statements) in both annual (10-K) and quarterly (10-Q) SEC filings. Considering a company's earnings as its profit, the company can either distribute that money to shareholders or reinvest it in the company.

It's useful to know how to calculate EPS yourself for a few different reasons.

How to calculate earnings per share (EPS)

Let's walk through an example EPS calculation using Netflix (NFLX -0.02%). For its most recent fiscal year, the company reported a net income of $4,491,924,000 and total shares outstanding of 444,698,000. The company's balance sheet indicates Netflix has not issued any preferred stock, so we don't need to subtract preferred dividends. Dividing $4,491,924,000 into 444,698,000 produces an EPS value of $10.10.

Net Income

Limitations of EPS

The main limitation of using EPS to value a stock or company is that EPS is calculated using net income. Non-cash expenses such as depreciation and amortization are subtracted from net income, and the lumpy nature of capital expenditures can cause a company's net income to vary greatly across reporting periods. Businesses can have many different non-operating expenses, such as tax and interest payments, which affect net income. A company's net income doesn't accurately reflect its cash flow or the health of its business.

Additionally, companies can and do manipulate their EPS numbers by changing the number of shares outstanding. Share issuances, splits, and stock buybacks all change the denominator by which net income less preferred dividends is divided.

EPS numbers are most useful when evaluated along with other metrics. The two most common are the price-to-earnings (P/E) ratio, which compares a company's stock price to its EPS, and the return on equity (ROE), which indicates the amount of profit a company generates from its net assets.

Dividends Per Share

Basic EPS vs. diluted EPS

Diluted EPS numbers, unlike the "basic" EPS metric described above, account for all potential shares outstanding. Financial instruments like convertible debt and employee stock options, which are often used to raise capital and motivate employees, must be added to the outstanding share count to calculate a company's diluted EPS.

Let's calculate the diluted EPS for Netflix. The company has granted 6,592,000 stock options to employees, which raises the total outstanding share count to 451,290,000. Dividing the same $4,491,924,000 of net income into 451,290,000 equals an EPS value of $9.95.

Valuation models use fully diluted EPS because it is more conservative. Share counts tend to increase, especially for fast-growing companies that leverage their abilities to issue more shares in order to expand.

What is the difference between EPS and adjusted EPS?

Companies often report EPS values using net income numbers that are adjusted for one-time profits and expenses, like sales of business units or losses from natural disasters. Although a company's adjusted EPS can be a more accurate indicator of the company's performance, some companies aggressively "adjust" their net incomes in misleading or even fraudulent ways to boost their adjusted EPS numbers.

Related investing topics

What is a good EPS?

A good EPS is determined less by the absolute value of the EPS and more by its year-over-year change. The absolute value of a company's EPS should increase annually, but the rate of increase of EPS should also accelerate.

A company's EPS can vary based on fluctuations in earnings, total number of shares outstanding, or both. A company can boost its EPS by increasing its earnings or reducing its share count through share buybacks, but a company that increases its outstanding share count faster than its earnings will cause its EPS to drop.

Stock investors can further evaluate a company's EPS by considering it in conjunction with its P/E ratio and determining how the company's share price is fluctuating relative to its earnings.