What is a good price-to-sales ratio?

It depends on the company and the industry.

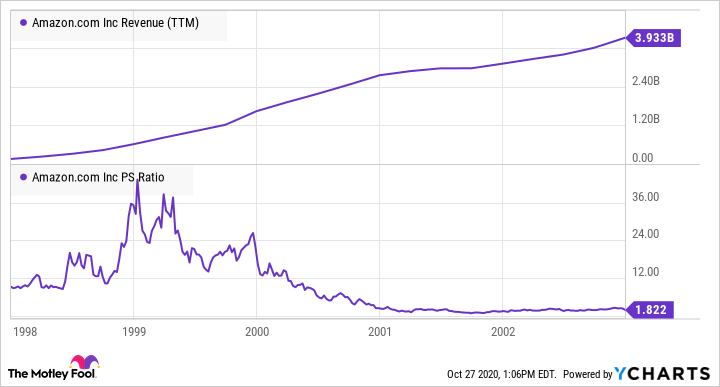

Grocery stores, for example, have massive amounts of sales but relatively low profit margins, so it's not unusual for grocery store stocks to see P/S ratios of 0.2 or even 0.1. A higher-margin company could have a much higher P/S ratio and still be considered a bargain. Amazon's P/S ratio, for example, has ranged between 2 and 6 for the past five years.

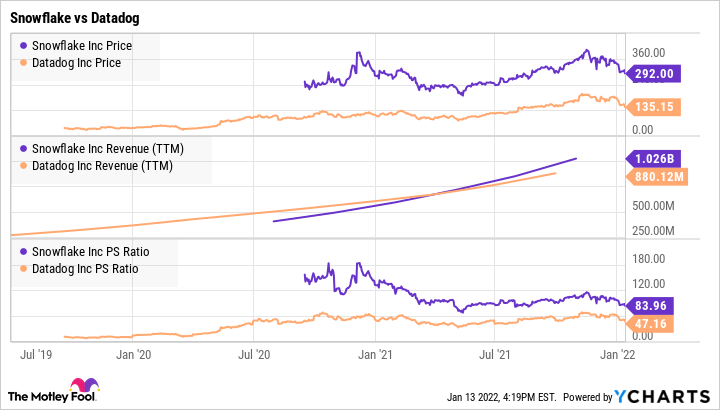

Because P/S ratio is a rear-facing metric that looks only at past performance, fast-growing companies such as Snowflake or Datadog can easily see massive P/S ratios as investors bid up the price in expectation of future sales growth.

Your best bet when looking at a company's P/S ratio is to compare it with the P/S ratios of similar companies in the same industry.