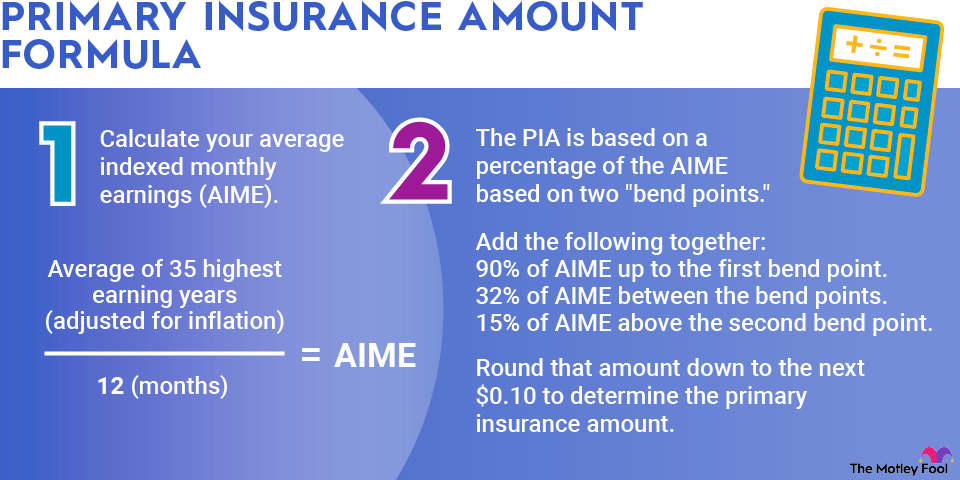

Take your annual wages and multiply them by the percentage increase in the average wage index since the year they were earned. The SSA provides that data on its website.

Then, select the 35 highest-earning years, add them together, and divide by 420 (the number of months in 35 years). If you don't have 35 years of earnings, add all your earnings and divide by 420.

That's your AIME. Let's say your AIME came out to be $7,000.

The next step is to calculate the primary insurance amount.

Use the bend points to make the calculation. So, in this example, you'll take 90% of $1,115 (the first bend point in 2023) plus 32% of $5,606 (the difference between the bend points) and 15% of $279, the amount above the second bend point. The sum total is $2,839.27. You round that down to $2,839.20 to get your primary insurance amount.

You can also use the tools on the Social Security Administration's website to determine your PIA, but understanding the factors that go into it and how it's calculated can help you make better decisions on how long to work and when to claim Social Security.