Broadly speaking, a bull market is a sustained period -- usually months or years -- when prices rise. The term is most commonly used in reference to the stock market, but other asset classes can have bull markets as well, such as real estate, commodities, or foreign currencies.

What exactly is a bull market?

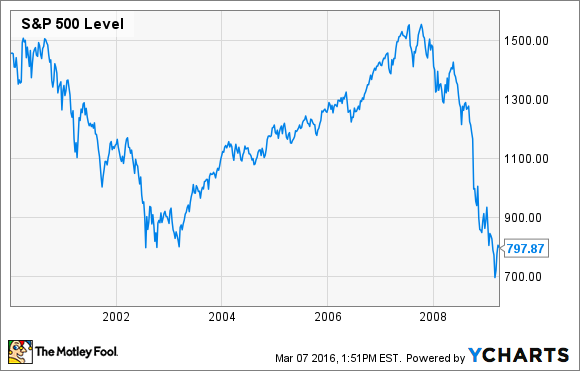

Usually, a bull market marks a 20% rise in stock prices, which follows a previous 20% decline and is followed by another 20% decline. As you can see from the chart below, there was a bull market that began in 2003 and ended when the S&P 500 hit its peak in 2007.

But there's one important caveat: The dates of a bull market can only be known in retrospect.

Characteristics of a bull market

There are several things that tend to accompany a bull market. For starters, they generally happen during periods when the economy is strong or strengthening. Bull markets are often accompanied by gross domestic product (GDP) growth and falling unemployment, and companies' profits will be on the rise.

Additionally, one of the best non-numerical indicators for a bull market is rising investor confidence. During these times, there is a strong overall demand for stocks, and the general "tone" of market commentary tends to be positive. And, because companies can get higher valuations for their equity, we tend to see high levels of initial public offering, or IPO, activity in bull markets.

The opposite of a bull market is a bear market, which is typically defined as stocks falling by 20% or more from a recent peak. Bear markets are often accompanied by recessions, falling investor confidence, and declines in corporate profits.

Learn more: Bull vs. Bear Market

How to invest in a bull market

Regardless of what the market is doing, you should maintain a long-term focus to cultivate long-term wealth. While it can be a smart idea to invest when stocks are cheap, it's unwise to try to time the market. Great long-term businesses can be found in any market.

One smart thing to do is learn the principle of dollar-cost averaging. This involves investing equal dollar amounts at specific time intervals, which can help you invest during a bull market while allowing your portfolio to benefit from corrections and crashes as well.

Historic bull markets

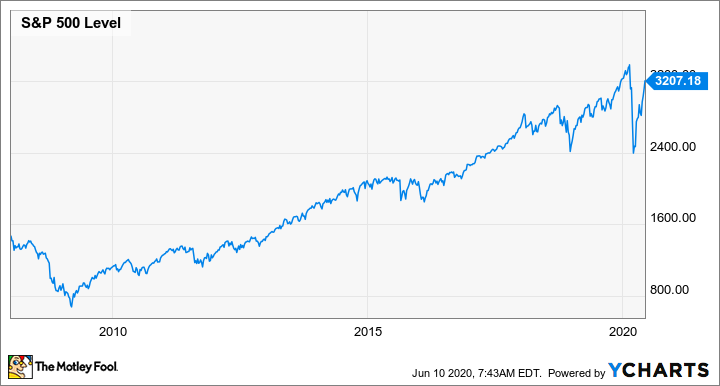

As an example, consider the 2009-2020 bull market, which was the longest in stock market history. After plunging as a result of the 2008 financial crisis, the S&P 500 bottomed out in March 2009 and then proceeded to climb until early 2020 when the COVID-19 pandemic sent stocks crashing.

Related investing topics

Prior to the latest one, there was a lengthy bull market that lasted from 2002 until the late-2007 bear market that coincided with the financial crisis. The bottom line is that bull markets tend to be several years in length and are always preceded by and ended by bear markets.