Rolling over a workplace retirement account into an IRA can be a savvy financial move. It can open up more investing options and reduce pesky fees that cut into your returns.

If you're leaving your job or have already left, you can perform an IRA rollover. A rollover IRA is a retirement account in which you can consolidate the retirement accounts you have accumulated from prior employers.

Rolling over a retirement account allows you to maintain the tax-deferred status of your savings while taking greater control of your investments.

Definition

What is a rollover IRA?

A rollover IRA is the resulting account when someone moves funds from another retirement account into an IRA.

A rollover isn't just a transfer of assets from one account to another. The difference between an IRA rollover and a transfer of assets is that, when you perform an IRA rollover, you're changing the type of account where you keep your savings. That's important because an IRA has slightly different rules from a 401(k) or another workplace retirement plan.

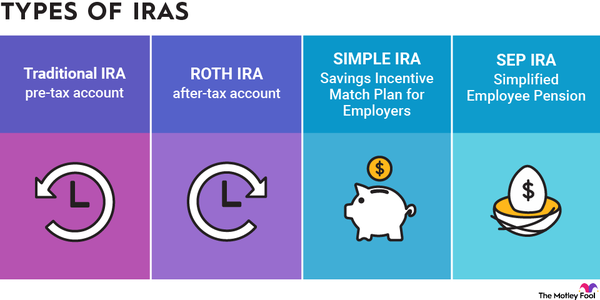

Rolling over a retirement account into an IRA doesn't require any special type of IRA. It's no different from an IRA you open and contribute to directly. In fact, you can roll over your workplace retirement account into a preexisting IRA that you already use for regular annual contributions. Typically you'll roll over pre-tax account funds into a traditional IRA, whereas Roth accounts typically roll over into a Roth IRA.

If you want to directly invest some of your workplace retirement savings in physical gold or other precious metals, you can perform a gold IRA rollover. A gold IRA rollover is just like a regular IRA rollover, but it requires a self-directed IRA with a custodian who can hold precious metals in an IRS-approved depository. You can roll over a portion or all of your holdings in your existing retirement account, and the custodian of your existing account will liquidate your holdings before transferring funds to your gold IRA or sending you a check for deposit with the new rollover gold IRA.

IRA rollover chart

IRA rollover chart

The IRS provides a handy chart detailing which types of accounts are eligible for rollovers (left column) and what types of accounts you can roll them into (top row).

| Can I Roll Over This Type of Account... | ...Into a Roth IRA? | ...Into a Traditional IRA? | ...Into a SIMPLE IRA? | ...Into a SEP IRA? |

|---|---|---|---|---|

| Roth IRA | Yes | No | No | No |

| Traditional IRA | Yes | Yes | Yes, after two years | Yes |

| SIMPLE IRA | Yes, after two years | Yes, after two years | Yes | Yes, after two years |

| SEP IRA | Yes | Yes | Yes, after two years | Yes |

| Governmental 457(b) | Yes | Yes | Yes, after two years | Yes |

| Qualified plan (pre-tax) | Yes | Yes | Yes, after two years | Yes |

| 403(b) (pre-tax) | Yes | Yes | Yes, after two years | Yes |

| Designated Roth account (401(k), 403(b), or 457(b)) | Yes | No | No | No |

You'll notice tax-deferred accounts can roll over into Roth accounts but not vice versa. Note, however, that when you move pre-tax savings into a Roth account, you'll owe income tax on the entire amount. Furthermore, that rollover is now irreversible since the Tax Cuts and Jobs Act went into effect in 2018. It used to be possible to recharacterize Roth IRA contributions as traditional IRA contributions within the same year, but that option was removed by the new tax laws.

Performing a rollover

How do you do an IRA rollover?

Performing an IRA rollover isn't complicated. There are five simple steps you can take to transfer an IRA from one institution to another:

- Determine which type of IRA account(s) you need: If your workplace plan holds pre-tax retirement savings, you'll likely want a traditional IRA. If your workplace plan is a Roth account, then you must use a Roth IRA for the rollover.

- Open an IRA, if you don't already have one: You can use an existing IRA for your rollover, or, if you don't already have one, you can open an IRA at your financial institution of choice.

- Request a "direct rollover" from your plan administrator: Your plan administrator will provide a form for you to fill out to process the rollover. With a direct rollover, your funds will be directly transferred to your IRA for you.

- Gather the appropriate information from your IRA provider: You'll need to provide information about how the plan administrator should transfer your assets to your IRA. You'll get that from the financial institution where you hold your IRA.

- Submit the form to your plan administrator and wait: Once the administrator processes your request, it should take a few days to transfer assets to your IRA.

Indirect IRA rollovers

Indirect IRA rollovers

You can also do an indirect rollover, but it has limited appeal if the direct rollover option is available to you. With an indirect rollover, the plan administrator will liquidate your holdings and send you a check in your name. The administrator will also withhold 20% of your funds for taxes and send it to the IRS as a safeguard. You'll be responsible for depositing those funds, plus the 20% withholding, into your IRA to complete the rollover. Only when the IRA receives the full rollover amount will the agency return the safeguarded 20% to you.

For example, if you take an indirect rollover of $10,000 from a 401(k), you'd receive a check for $8,000, and the government would receive a payment of $2,000. You'd have to take that $8,000 -- plus $2,000 of new money -- and deposit it into your rollover IRA to complete the rollover.

If you deposited only the $8,000 into your brokerage account, you'd owe taxes on the $2,000 sent to the IRS. Sound complicated? That's why it's easiest to stick with a direct rollover whenever possible.

Rules and limits

Rules and limits of IRA rollovers

There are several important rules to know when performing an IRA rollover.

The 60-day rule

If you make an indirect rollover, you'll have 60 days to deposit the funds, plus the amount withheld for taxes, into your rollover IRA. If you don't complete the rollover within 60 days, the distribution will be treated as a regular withdrawal. That means you'll have to pay taxes on the entire amount and could be subject to an early withdrawal penalty of 10%.

You can use an indirect rollover to withdraw funds for 60 days and then replace them in the same account. This allows you to borrow funds for a very short time, but do this with caution. You could face stiff penalties if you don't return the money within 60 days.

One IRA rollover per year

If you're rolling over funds from a traditional IRA, SIMPLE IRA, or SEP IRA to another one of those types of accounts, you're eligible to do that only once per rolling 12 months. Importantly, the one-IRA-rollover-per-year rule doesn't apply to rollovers from a tax-deferred IRA account to a Roth account, which is actually a conversion. It also doesn't apply to rollovers to or from employer-sponsored retirement plans.

If you don't follow this rule, every rollover after your first could be subject to the 10% early withdrawal penalty, and you'll have to pay taxes on the distribution. You could also face a penalty for contributing too much to your IRA if you put funds back into your brokerage account that aren't eligible for a rollover.

The same-property rule

When you execute a rollover, you have to contribute the same property that you withdrew from your original brokerage account. If, for example, you received a check for an indirect rollover, bought some stock with the distribution proceeds, then tried to transfer that stock to another retirement account, you'd violate the same-property rule.

If you violate the same-property rule, the distribution will be treated as a normal withdrawal, which you'll have to pay taxes on and could owe a 10% early withdrawal penalty on as well.

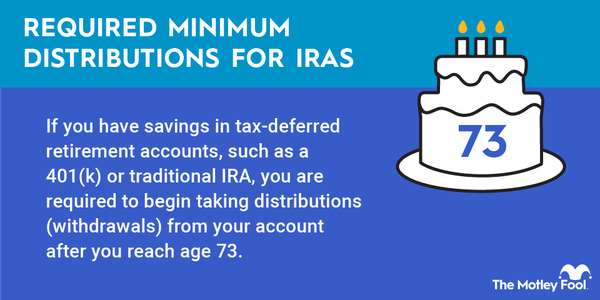

Distributions ineligible for rollover

Some distributions from your workplace retirement plan are ineligible to be rolled over into an IRA. For example, required minimum distributions are ineligible, as are loans and hardship withdrawals.

Limits

There is no limit on the amount you can roll over into an IRA. A rollover will not affect your annual IRA contribution limit either.

There's also no limit to the number of rollover IRAs you can have. However, it's probably easier to manage fewer accounts. You can use the same IRA to roll over funds from multiple accounts. You can also make regular contributions to that IRA, so you don't really need more than one.

Related retirement topics

Know the rules

Know the rules

Rollover IRAs are common, but there are quite a few rules to follow. If you stick to the basics, you shouldn't have any problems getting your money where you need it to go.

FAQs

IRA Rollover FAQs

Can you withdraw money from a rollover IRA account?

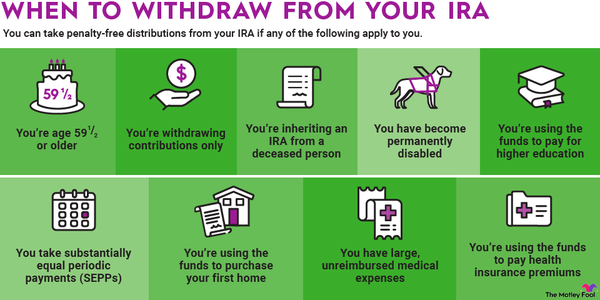

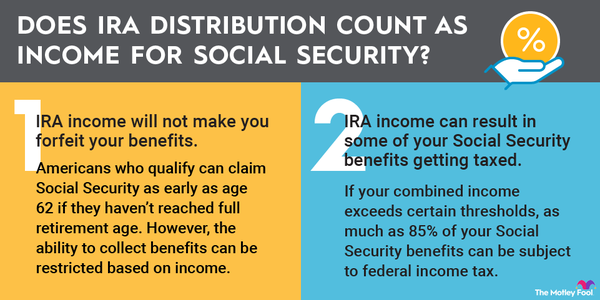

Yes, you can withdraw money from your rollover IRA, but it may incur tax penalties. Withdrawals from a rollover IRA are subject to the same rules as any other IRA. That is, traditional IRA withdrawals are subject to income tax. Additionally, you may face a 10% tax penalty for withdrawing before age 59 1/2, unless your withdrawal meets certain criteria. Early withdrawals from a Roth IRA incur taxes and a penalty on the earnings above your original investment or any amount converted within the past five years.

Is it a good idea to roll over your IRA?

It's usually a good idea to roll over your old company's 401(k) into an IRA. 401(k)s usually have limited investment options and high fees. IRAs usually have no fees and a plethora of investment options. That said, if your 401(k) fees are low and you like your investment options, there can be advantages to keeping your funds in the 401(k). For example, if you take advantage of the backdoor Roth, it's best to keep your pre-tax retirement funds in a 401(k).

What is a rollover IRA?

A rollover IRA is the resulting account when someone moves funds from another retirement account into an IRA. It's functionally the same as any other IRA.

Do you pay taxes on a rollover IRA?

You will only pay taxes on a rollover IRA if you convert funds from a pre-tax retirement account to a Roth IRA.

The Motley Fool has a disclosure policy.