ASML Holdings (ASML 0.44%) is positioned in one of the most lucrative sectors in tech. The Dutch company has spent four decades developing its High-Numerical Aperture (NA) extreme ultraviolet (EUV) machines, which are used to produce the most powerful chips for data centers.

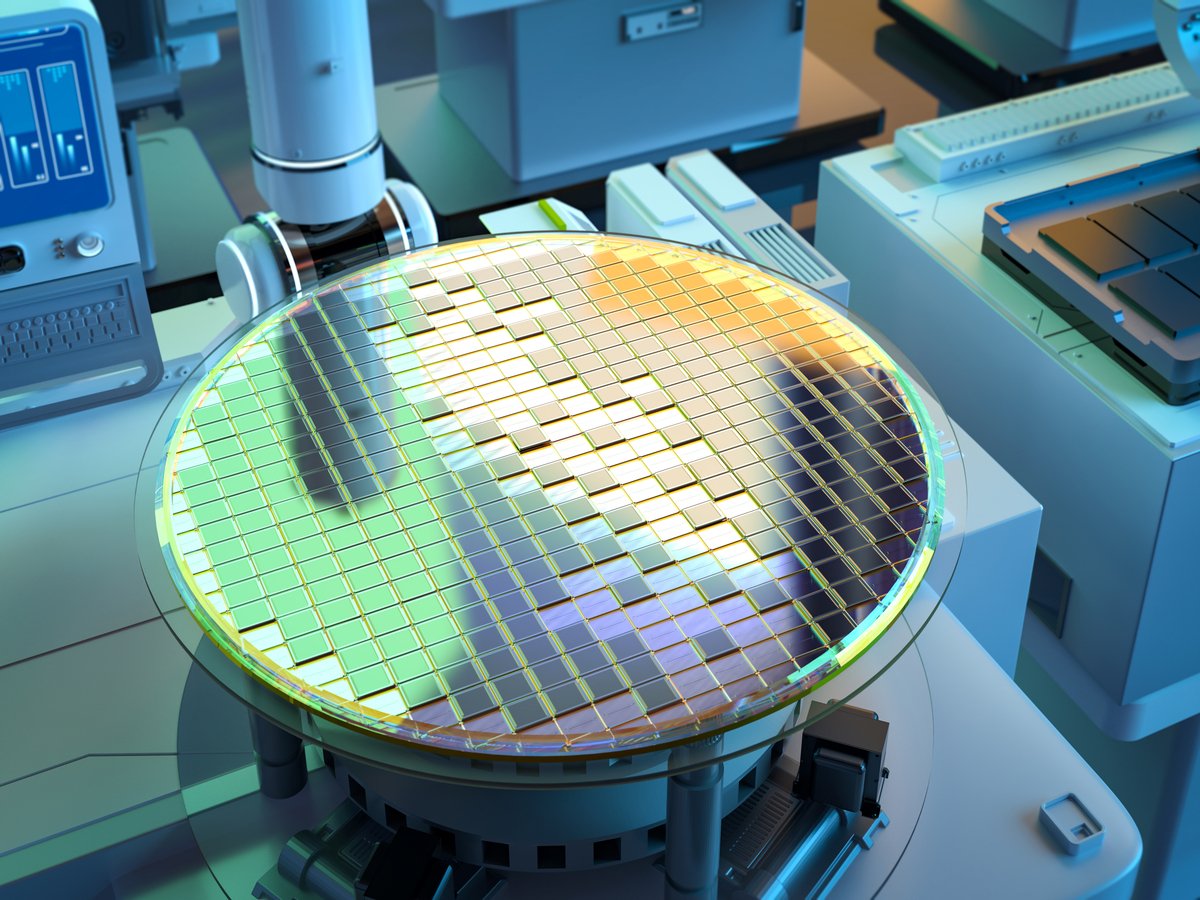

Image source: Getty Images.

TSMC's, Intel's, and Samsung's foundries use ASML's lithography systems to manufacture high-performance semiconductors. The machines work by vaporizing droplets of molten tin in a vacuum chamber by striking them with laser beams 50,000 times per second, turning the tip droplets into a superheated plasma that emits EUV light, which is used to print microscopic patterns onto silicon wafers. That's the kind of tech that investors love.

And with data center demand increasing day by day, ASML is well on its way to joining the trillion-dollar club.

How is ASML's stock performing?

As of Dec. 8, ASML trades around $1,100 per share. It's up 62% year to date, 58% over the last 52 weeks, and around 143% over the previous five years.

NASDAQ: ASML

Key Data Points

The stock trades at a price-to-earnings ratio of 36, slightly below the industry average of 40. Meanwhile, its price-to-sales ratio is around 10, a reasonable multiple for tech manufacturers.

But the best part of this growth story is still ahead.

What could propel ASML even higher?

The company's next-generation technology that uses High-NA EUV has the potential to propel ASML's valuation in excess of $1 trillion. These machines increase the numerical aperture from 0.33 to 0.55, allowing them to print even smaller and more complex patterns than the previous generation of EUV machines. And each system is said to cost a cool $380 million.

These High-NA systems allow chipmakers to produce powerful processors that cannot be manufactured any other way. Period.

In fact, ASML already dominates the EUV market. It supplies machines to major chipmakers such as Intel, Samsung, and TSMC. And the High-NA EUV systems are practically the only path forward for next-generation chips. Even China, with significant state investment, hasn't been able to replicate ASML's technology.

Justifying the entry to the $1 trillion club

There's an undeniable market demand for ASML's tech. However, reaching the $1 trillion mark requires fundamental justification. Otherwise, we're just hoping for runaway valuations.

Today, ASML's market cap is around $432 billion. The company pulled in about $31 billion in top-line revenue in 2024, with about $8.19 billion flowing to the bottom line.

In order for ASML to reach a trillion-dollar valuation, the company will need to grow its bottom line to nearly $19 billion (~131%). This is because, all things being equal, stocks often move in a similar direction to their earnings growth. That way, it reaches the $1 trillion mark with similar P/E and P/S ratios.

If ASML maintains its position in the EUV lithography, hitting $67 billion in revenue isn't unreasonable. If I'm right, the timeline should fall between 2034 and 2036, given that the semiconductor sector is growing at about 8% to 10% annually and ASML's High-NA EUV ramp-up is just beginning. And if the company can accelerate revenue and improve margins, the timeline shortens further.

What do the analysts think about ASML?

Wall Street sees an opportunity here; a consensus among 25 analysts rates ASML stock a strong buy with an average score of 4.56 out of 5, and the rating has been relatively stable over the past three months. I agree.

ASML controls the most critical equipment that enables advanced AI chips, and the industry has no choice but to adopt High-NA technology, as there are literally no alternatives. Combining those factors creates a clear path to much higher valuations.