Tesla (TSLA 0.46%) stock is on track to end 2025 with a gain of over 25%, and it's currently trading near a record high. Investors have piled into the stock in anticipation of the company's future product platforms, like the Cybercab robotaxi and Optimus humanoid robot, which are both set to launch over the next couple of years.

However, over 70% of Tesla's revenue still comes from selling electric vehicles (EVs), and this critical part of its business is suffering from weak demand right now, driven by a sharp increase in global competition. On or around Jan. 2, the company will release its EV delivery numbers for the fourth quarter of 2025, which could help determine the direction of its stock in the near term.

Should you invest in Tesla ahead of the report?

Image source: Tesla.

Two straight years of declining EV sales

Tesla delivered 1.79 million EVs in 2024, which was down 1% compared to the previous year. It was the company's first annual sales decline since it launched its flagship Model S in 2011. But the weakness accelerated in 2025, with Tesla's deliveries sinking by 6% year over year through the first three quarters (ended Sept. 30).

According to FactSet, Wall Street expects Tesla to have delivered around 450,000 EVs during the fourth quarter (ending Dec. 31). This would take its annual total for 2025 to 1.67 million, representing a 7% decline compared to 2024.

Competition is one of Tesla's biggest challenges right now, especially in key markets like China and Europe. Consumers are opting for low-cost options from manufacturers like BYD, which sell EVs at a price point Tesla simply can't match. For example, BYD's entry-level Dolphin Surf EV sells for just $26,900 in Europe, whereas Tesla's Model 3 starts at $44,300.

As a result, Tesla's EV sales declined by 12% year over year across Europe during November alone. If we exclude Norway, where sales benefited from the upcoming expiry of an EV tax credit, Tesla's European sales in November were actually down by over 36%. The company's market share across Europe is now just 1.6%, down from 2.4% last year.

Tesla stock trades at a ludicrous valuation

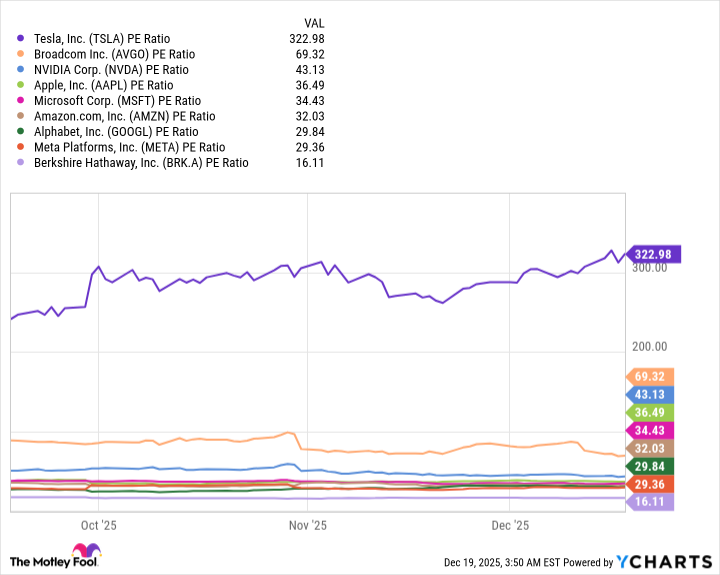

Tesla's weak EV sales have fueled a steep decline in its profits this year, yet its stock continues to climb, resulting in a sky-high valuation. Based on the company's trailing-12-month earnings of $1.44 per share, its stock is trading at a price-to-earnings (P/E) ratio of 322 as I write this.

That makes Tesla almost 10 times more expensive than the Nasdaq-100 technology index, which trades at a P/E ratio of 33. It also makes Tesla the most expensive American stock in the exclusive $1 trillion club -- and it's not even close.

TSLA PE Ratio data by YCharts. PE Ratio = price-to-earnings ratio.

Based on its valuation alone, it's very hard to make an argument for buying Tesla stock ahead of Jan. 2. Even if the company delivers far more cars than expected, it still won't be enough to justify its sky-high P/E ratio. In fact, its stock would have to decline by 78% just to trade in line with the P/E ratio of the next-most-expensive stock in the trillion-dollar club, Broadcom.

Why are investors paying a hefty premium for Tesla stock?

Tesla's Cybercab autonomous robotaxi is expected to enter mass production in 2026. It will run on the company's full self-driving (FSD) software, so it will be able to haul passengers around the clock, creating a potentially lucrative revenue stream. Wall Street firms, like Cathie Wood's Ark Investment Management, think this could become Tesla's biggest source of revenue in the future.

However, Tesla's FSD software isn't approved for unsupervised use anywhere in the U.S. yet (although approval in California is reportedly close), so the company's robotaxi program is already falling behind the competition. Alphabet's Waymo, for example, developed a robotaxi that is already completing over 450,000 paid autonomous trips every single week across five U.S. cities.

NASDAQ: TSLA

Key Data Points

Then there is the Optimus humanoid robot, which Tesla CEO Elon Musk believes could generate $10 trillion in revenue for the company over the long term. He thinks humanoid robots will outnumber humans by 2040 because they will have applications in businesses and households alike.

However, Optimus is even further away than the Cybercab in terms of commercialization. Musk thinks the latest version, Optimus 3, probably won't enter mass production until the end of 2026, but he expects to scale to 1 million annual units relatively quickly.

Even though these new products present Tesla with extremely valuable opportunities, neither of them will be a factor before the company's upcoming EV deliveries announcement on Jan. 2. Since they are still a couple of years away from contributing meaningful revenues, I think there is a risk that Tesla stock will suffer a sharp correction in the meantime.