By next week, investors will begin receiving updates on fourth-quarter and full-year 2025 financial and operating results for their favorite companies. Netflix (NFLX 0.56%) will kick-start earnings season, as the company is scheduled to release its results next Tuesday, Jan. 20.

Since the company's third-quarter report was published on Oct. 21, shares of the streaming giant have slid 28%. Is now an opportunity to buy the dip in Netflix stock before earnings drop next week? Read on to find out.

Image source: Netflix.

What is Wall Street expecting for Netflix's next earnings report?

During the third quarter, Netflix generated $11.5 billion in revenue -- representing 17% growth year over year. On the bottom line, the company's earnings per share (EPS) came in at $5.87 -- a 9% gain year over year.

While these results were solid, the blemish from Netflix's third-quarter report was operating margin. The company's operating margin of 28.2% was well below Wall Street's expectation of 31.5%.

During the earnings call, Netflix's leadership provided financial guidance for the fourth quarter and full year 2025.

| Category | Q4 2025 | FY 2025 |

|---|---|---|

| Revenue | $11.9 billion | $45.1 billion |

| Earnings per share (EPS) | $5.45 | $25.12 |

| Operating margin | 23.9% | 29.3% |

Data source: Netflix Investor Relations.

Given strong revenue and earnings weren't enough to outweigh Netflix's underperformance in operating margin last quarter, my suspicion is analysts will be dialed in on the company's expense and profitability profiles on the upcoming report.

Why has Netflix stock sold off lately?

Although Netflix missed its operating income expectations last quarter, a near-30% decline seems a bit harsh. The bigger issue surrounding Netflix right now is the company's potential acquisition of the film and TV assets of Warner Bros. Discovery.

NASDAQ: NFLX

Key Data Points

At the moment, the company is in an intense bidding war for the Warner Bros. portfolio with Paramount Skydance. The length of this process, combined with uncertainty around how Netflix will finance such a transaction and integrate any new content into its own intellectual property (IP) library, remains a fluid situation.

Against this backdrop, the unrelenting growth rally that once surrounded Netflix shares has taken a breather.

Should you buy Netflix stock before fourth-quarter earnings?

Generally speaking, I do not encourage investors trying to time their buying and selling activity. Such an approach is almost always an exercise in false precision. Moreover, investors with a long-run time horizon -- think decades -- need not be overly concerned about each individual buy or sell decision.

This is a rare instance in which I think buying Netflix stock before earnings next week could prove wise. Given the relative strength of the company's business performance in combination with its leadership position in the broader streaming realm, I see the current sell-off in Netflix stock as more of an emotional decision driven by fading sentiment rather than an actual issue with the company's business model.

The selling pressure in Netflix stock may be overdone and investors might have priced in a worst-case scenario at this point. I'm confident the company will post strong revenue and earnings figures Jan. 20. To me, the big question mark in the near term is the outcome of the Warner Bros. Discovery deal.

While that will likely consume much of the Q&A session following management's prepared remarks, I don't view the deal as a long-term detriment. In fact, I am bullish that if Netflix can get this acquisition across the finish line, adding a host of new content could be incredibly accretive for the company's streaming and advertising segments in the long run.

When I think about where Netflix could be decades from now, I see the company becoming far more ingrained not only in the streaming environment, but also blossoming into an influential player in merchandising, brand deals, and entertainment.

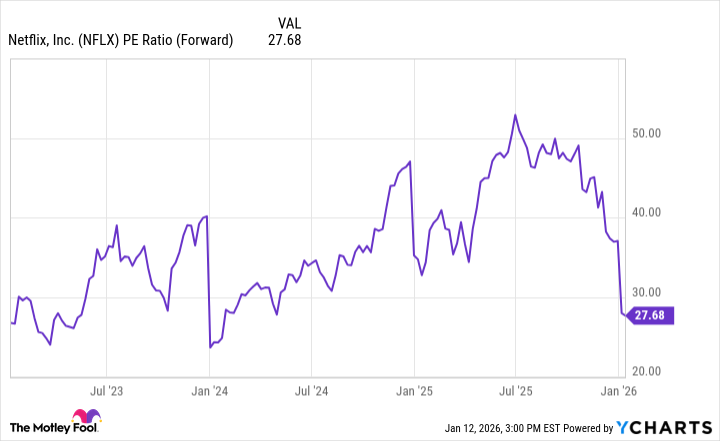

NFLX PE Ratio (Forward) data by YCharts

With this in mind, I think now is a lucrative opportunity to scoop up Netflix stock at a notable discount with the intention to build and hold on to your position over the course of the next several years.