DigitalOcean (DOCN +0.34%) is a small company with a market capitalization of just $5 billion. It built a cloud computing platform exclusively for small and midsized businesses (SMBs), which provides access to everything from basic data storage to complex software development tools. Think Amazon Web Services, just on a much smaller scale.

Over the last couple of years, DigitalOcean has used its experience in the cloud space to build an expanding portfolio of artificial intelligence (AI) tools and services, which provide SMBs with an affordable way to develop and deploy this revolutionary technology. Demand is through the roof, with DigitalOcean's AI revenue doubling in the last five consecutive quarters.

The stock soared by 41% in 2025, and it's already up by another 13% in 2026. However, it remains 56% below its record high from 2021, when a frenzy in the tech sector propelled its valuation to an unsustainable level. Fortunately, Wall Street thinks the recovery will continue, with the majority of the analysts tracked by The Wall Street Journal assigning the stock a buy rating.

Here's why their bullish consensus might be justified.

Image source: Getty Images.

A growing portfolio of AI tools and services

DigitalOcean differentiates itself from the larger cloud providers by offering clear and transparent pricing, personalized service, and a simple dashboard, which makes it easy to deploy its services. These attributes appeal to SMBs, especially those with limited technical and financial resources.

When it comes to developing AI software, computing capacity and foundation models are two of the main ingredients. DigitalOcean operates data centers fitted with advanced AI chips from leading suppliers like Nvidia and Advanced Micro Devices, and it rents the computing capacity to SMBs for a fee. It allows them to start with just one chip and scale up as needed, whereas larger cloud providers focus on leasing out thousands of chips at a time.

DigitalOcean also built an AI platform called Gradient, where SMBs can tap into ready-made large language models (LLMs) from leading third parties like OpenAI and Anthropic, which they can use to bring their AI software applications (like chatbots and AI agents) to market much faster than if they had to create a foundation model from scratch.

Accelerating revenue growth, fueled by AI

The company generated $659 million in total revenue during the first three quarters of 2025 (ended Sept. 30). It was a 14.5% increase year over year, which marked an acceleration from the 12.4% growth that the company delivered in the first three quarters of 2024.

The momentum was driven by DigitalOcean's AI business, where revenue has doubled for five consecutive quarters. The company will report its operating results for the 2025 fourth quarter (ended Dec. 31) in February, and according to management's guidance, AI revenue likely doubled year over year yet again.

NYSE: DOCN

Key Data Points

One of the most impressive things about DigitalOcean's recent results is management's cost discipline. The company's total operating expenses actually decreased in the first three quarters of 2025 compared to the year-ago period, and with revenue growth accelerating, that led to a whopping 252% increase in its net income (profit), which came in at $233.6 million.

Even after stripping out some favorable one-off tax benefits, DigitalOcean still delivered $275.5 million in adjusted non-GAAP (generally accepted accounting principles) earnings before interest, tax, depreciation, and amortization (EBITDA) during the period, which was up 13.5% year over year.

Wall Street is bullish on DigitalOcean stock

The Wall Street Journal tracks 15 analysts who cover DigitalOcean stock, and eight have given it a buy rating. Two others are in the overweight (bullish) camp, while the remaining five recommend holding. None recommend selling.

DigitalOcean stock has risen so quickly over the last 12 months that it's actually trading above the analysts' average price target of $54.33 right now. Given the company's momentum, I would expect analysts to gradually lift their targets as this year progresses, especially if the momentum in its AI business persists.

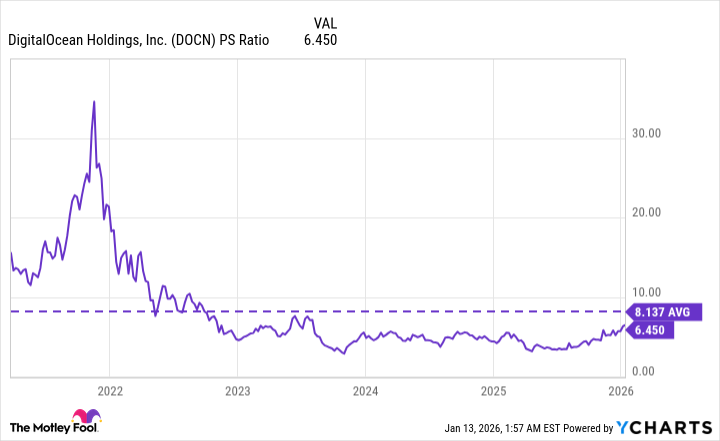

The stock still looks cheap as I write this, which only reinforces my point. Its price-to-sales (P/S) ratio of 6.4 is still below its average of 8.1 since going public in 2021.

DOCN PS Ratio data by YCharts

Plus, based on DigitalOcean's non-GAAP earnings of $2.18 per share over the last four reported quarters, its price-to-earnings (P/E) ratio is also just 25.4, which makes the stock cheaper than both the S&P 500 (P/E of 25.7) and the Nasdaq-100 (P/E of 32.6) indexes. As a result, I think Wall Street's bullish consensus on DigitalOcean stock is justified, and it could be a great buy as 2026 gets underway.