Just when it finally started looking like Intel (INTC +3.39%) was back on track, WHAM! Although its recently reported fourth-quarter numbers were better than expected, shares of the iconic chipmaker crashed to the tune of 16% in response to what can only be described as miserable guidance. The company's only looking for a breakeven on roughly $12.2 billion (at the midpoint) worth of revenue for the quarter currently underway -- down from year-ago comparisons, as well as below analysts' expectations for earnings of $0.06 per share on sales of just under $12.6 billion.

It's not an indictment of the entire semiconductor business, though. It's just more evidence that Intel's leadership of the chip market continues to slip, specifically because the industry is becoming more competitive. One of those competitors, in fact, is a fantastic investment opportunity specifically because it's legitimately threatening Intel's dominance.

That company? Qualcomm (QCOM 0.96%).

Image source: Getty Images.

More of a high-performance tech name than you thought

That's not a misprint. The company that rose to fame as a maker of mobile phones is not only deep into the chip business as well, but is outright disrupting the performance-processing sliver of the market.

It started in earnest all the way back in 2007, when Qualcomm first introduced the QSD8250 system-on-chip -- the "Snapdragon" processor -- that was significantly more powerful than most other mobile processors available at the time. The timing of this debut, however, couldn't have been any less lucky.

That was also shortly after Apple unveiled the first iPhone, setting a form-meets-function standard that would be nearly impossible for any competitor meet. Qualcomm would continue working on it, though, developing its power-efficient Arm-based mobile processor that would eventually become AI-capable, ending users' reliance on cloud-based services.

Then, in 2023, the company made a major leap forward. The Snapdragon X Elite unveiled that year wasn't just built from the ground up to be capable of handling generative AI duties directly from the device in question. These processors were specifically meant for laptops, turning them into self-contained artificial intelligence tools themselves. To date, major PC names, including Microsoft, HP, and Dell, not only offer Snapdragon processors but also tout their energy-efficient, onboard-AI computing power.

But the company's not stopping there. As it turns out, this underlying processing technology enjoys potential uses in corners of the tech industry where some investors never thought Qualcomm would operate -- like inside automobiles, and now, inside AI data centers.

It's true. While it's far too soon to suggest the company's going to dethrone Nvidia -- or even Intel -- as the leading name in the data center semiconductor market anytime soon, Qualcomm's giving the industry's owners and operators another computing option worth considering. The AI200 and AI250 chips introduced in October "offer rack-scale performance and superior memory capacity for fast AI inference at high performance per dollar per watt -- marking a major leap forward in enabling scalable, efficient, and flexible generative AI across industries."

Simply put, Qualcomm is now officially in the artificial intelligence data center business too, creating competition for Intel on yet another front.

Forget the past and focus on the future

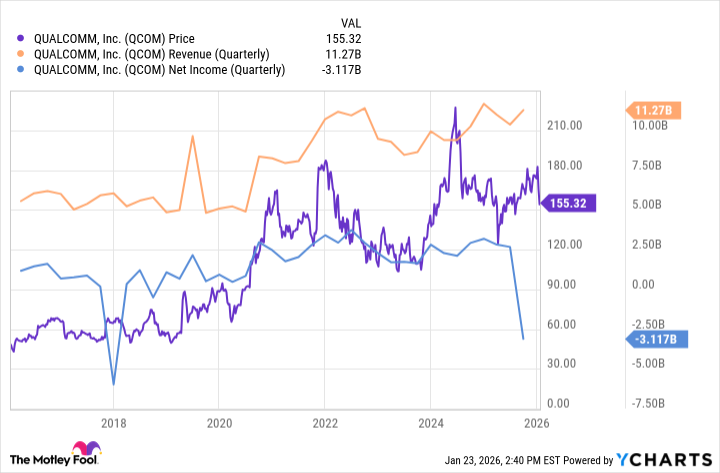

For all the impressive developmental work that Qualcomm has done, it's difficult not to notice that none of it has actually driven significant revenue growth. The stock's not made any net progress since late 2020 either, upended for one reason or another every time it looked like it was finally going to start making progress again.

Data by YCharts.

Blame the post-pandemic lull in smartphone demand, mostly. Roughly three-fourths of the company's business still comes from mobile handsets. If that market is weak, so are Qualcomm's fiscal results. Strained supply chains are a challenge now as well.

The smartest investors aren't fixated on the past, however, or for that matter, even the present. They're looking at the future, trying to figure out where a particular company is going, knowing its stock will follow.

To this end, Qualcomm's longer-term future looks very bright indeed. Although this year isn't likely to look markedly better than last, once the company's AI data center-centric AI200 and AI250 processors are released this year and next (respectively), analysts expect sales growth to accelerate, with earnings growth likely to accelerate at an even faster clip.

Data source: Morningstar. Chart by author.

Bolstering this rekindled growth will be upgrade-driven cyclical demand for next-generation smartphones, as well as expanded interest in AI-capable laptops. Look for growth on other fronts too, like automobiles with onboard AI technology and more AI-powered edge computing solutions. In fact, Precedence Research predicts the global artificial intelligence processor market alone is poised to grow at an average annualized pace of more than 26% through 2034, from less than $60 billion per year now to more than $460 billion per year then, led by edge computing, power-efficient chips, and the convergence of AI training and inference-capable artificial intelligence. All of these trends play right into the development work that Qualcomm's been doing for years, waiting for the AI technology business to finally turn in this more customized direction.

Qualcomm wouldn't necessarily need to capture all of this growth for itself. It wouldn't even need to plug into most of it. The relatively small company could actually experience a big fiscal benefit with only a modest piece of this tech market's expansion. The tough part will just be remaining patient enough to let this long-term growth story fully play out.

Of course, this stock's healthy forward-looking dividend yield of just under 2.3% -- a yield based on a dividend that's been surprisingly reliable -- should help investors maintain this required patience.