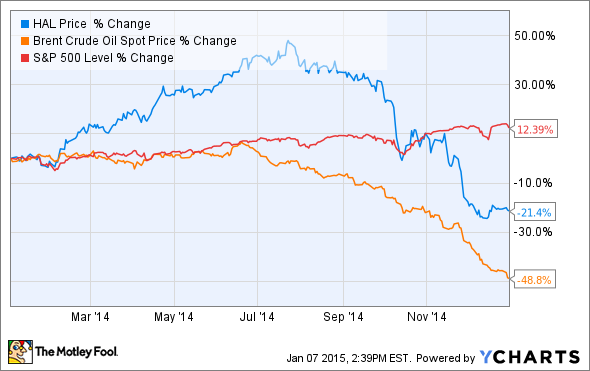

Most investors will look back fondly at 2014 thanks to the stock market's 12% rise on the year. Energy investors, on the other hand, will remember 2014 as the year the price of oil plunged by nearly 50%, taking most oil stocks down with it. That rapid, unexpected fall ruined what had looked to be an exceptional year for oil-field services company Halliburton (NYSE: HAL), as this chart shows.

Halliburton's stock handily outperformed the S&P 500 through midsummer. At one point it was up nearly 50% on the year. However, as oil prices began to roll over, so did Halliburton's stock price. While the announcement of a merger agreement with Baker Hughes (BHI +0.00%) halted the stock's slide for a little while, the enthusiasm quickly evaporated as oil prices continued an unrelenting sell-off.

Why oil prices squeezed Halliburton's stock

Halliburton makes its money by helping oil and gas companies drill new oil wells. With the price of oil now in the $50 per barrel range, oil companies are slashing capital expenses, which will impact Halliburton's growth and margins in 2015, and likely beyond.

Halliburton's business also faces being squeezed by cost reductions demanded by oil companies. Several oil producers have said they expect service costs to come down as a result of falling oil prices. The CFO of Breitburn Energy Partners (NASDAQ: BBEP), for example, said this:

Obviously, moves in commodity prices extended over time are reflected in our cost structure, ultimately. On that note, if you go back to 2008 and 2009... we saw our operating costs dropped by almost 20%. So for those of you that are thinking about lower oil prices for a longer period of time, go back and take a look at what LOE per BOE did at BreitBurn during that period. And think about that in terms of what happens to our costs and, ultimately, what happens to our capital costs, too, as they get essentially rebased in an environment where things start to improve.

These sentiments were echoed by Kinder Morgan (KMI 0.07%) COO Steven Kean at a recent conference. He pointed out that there is a correlation between oil prices and service costs:

Now, there's another side of that too. It's smaller, but oil -- previously when oil prices have gone down, the cost of getting the oil out has gone down too. It's not enough to offset it, but it's a partial mitigant. So, we'll see some of that too.

Ready for another rough rodeo

Halliburton knows lower oil prices mean it must reel in its costs so it can pass those savings to its customers. Chief Financial Officer Mark McCollum pointed this out at a conference:

From a cost standpoint we are already pulling in. We are right now anticipating a restructuring charge in the quarter, probably to the tune of about $75 million as we trim out some headcount and activities around the world -- as a just. Just basically remind you, we have been here before. It's not our first rodeo.

The company is being proactive as oil prices fall. It has experienced the cyclicality of the oil market before and it knows how to survive the rough ride ahead of it.

Investor takeaway

Last year started off great for Halliburton investors as the stock surged through the first six months. However, as oil prices turned so did the company's stock price. That being said, the fall in oil prices likely is what made Baker Hughes available, and that deal could pay big dividends down the road for Halliburton. So, while the company is bracing itself for slower growth and lower margins over the near term, it knows how to maneuver through a tough oil market to thrive once normalcy returns.