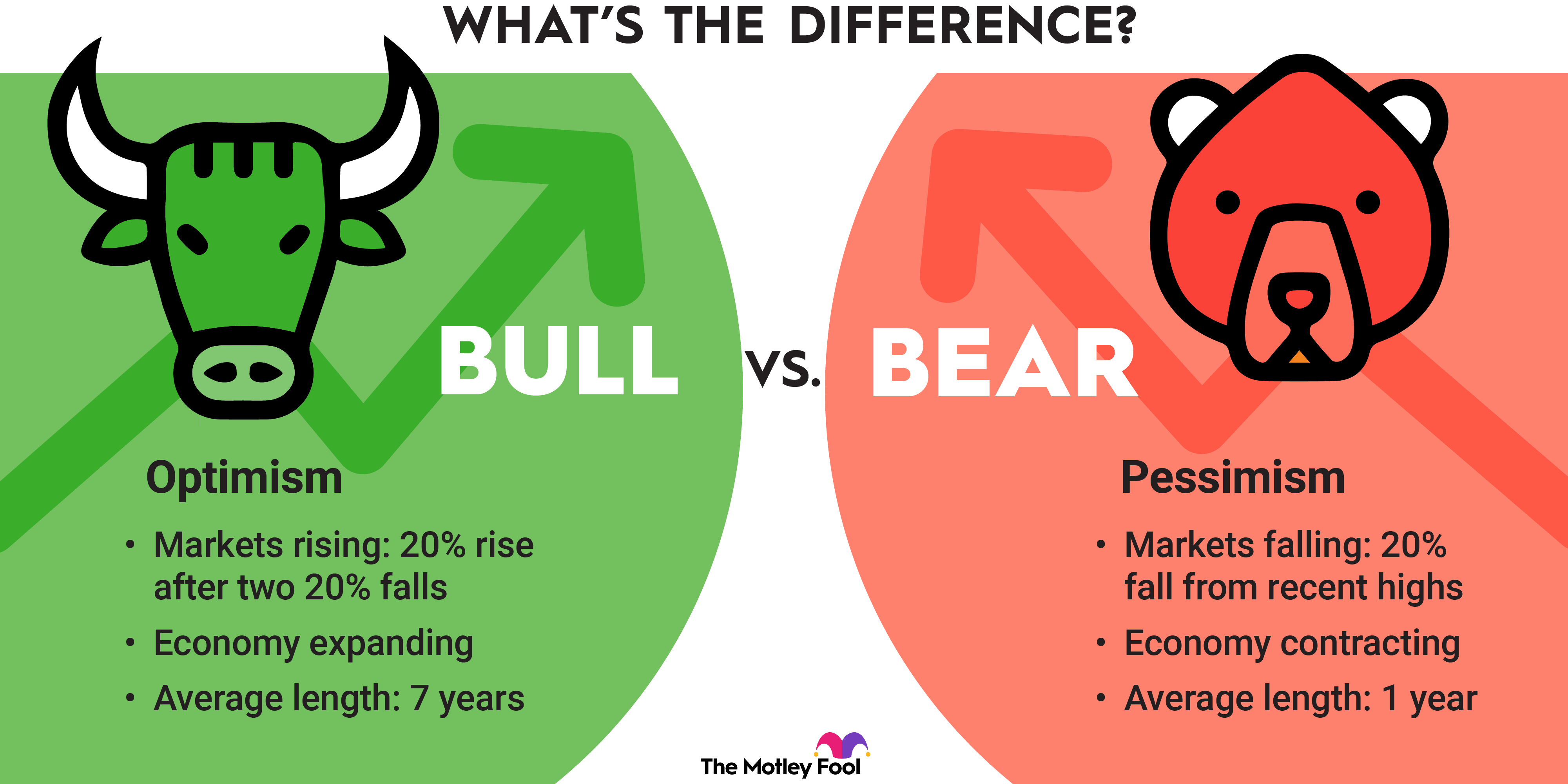

These periods almost always follow a bear market, as stocks have a steady history of rising with the passage of time. Moreover, stock values have increased by more than 100% on average in each of those bull markets.

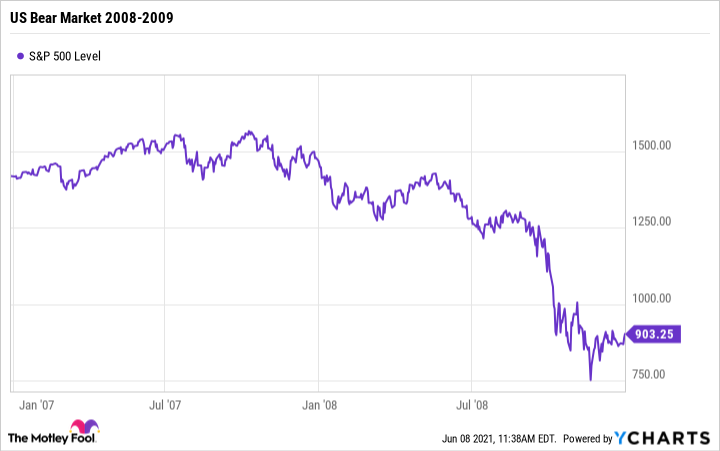

Bear markets appear on average every 3.5 or so years. The good news is that bull markets tend to last considerably longer than bear markets. Case in point: The historical average length of a bear market is 289 days, compared to the average length of a bull market, which is 965 days.

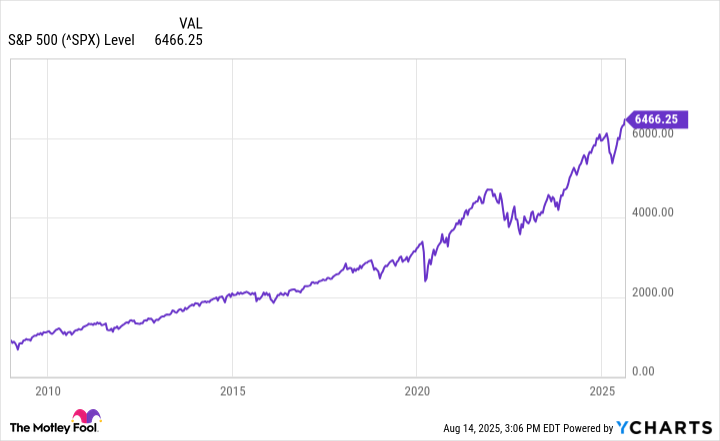

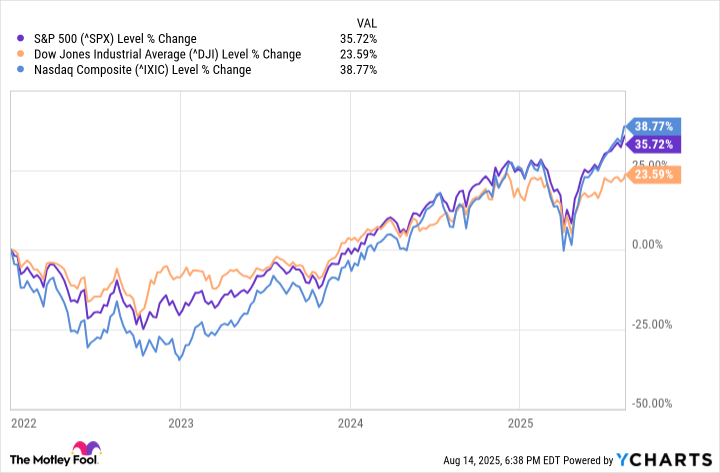

What does this tell investors? If you're investing in stocks for the long term, you will encounter both bull and bear markets on a fairly regular basis. However, if you stay invested through those peaks and valleys, history has shown that you can benefit from significant upside over the long run.