In January 2024, the U.S. Securities and Exchange Commission (SEC) approved almost a dozen spot Bitcoin exchange-traded funds (ETFs), including the iShares Bitcoin Trust ETF (IBIT +0.31%). The approval allowed investors to gain direct exposure to the world's largest cryptocurrency through a brokerage or retirement account.

NASDAQ: IBIT

Key Data Points

In this article, we'll cover the basics of how to invest in the iShares Bitcoin Trust ETF. You'll learn how this spot Bitcoin ETF works and explore the pros and cons of investing in the fund.

Exchange-Traded Fund (ETF)

What is the iShares Bitcoin Trust ETF?

The iShares Bitcoin ETF Trust is a spot Bitcoin ETF launched by BlackRock (BLK -0.09%) in January 2024. IBIT is the ticker symbol for the iShares Bitcoin ETF, which trades on the Nasdaq Stock Exchange.

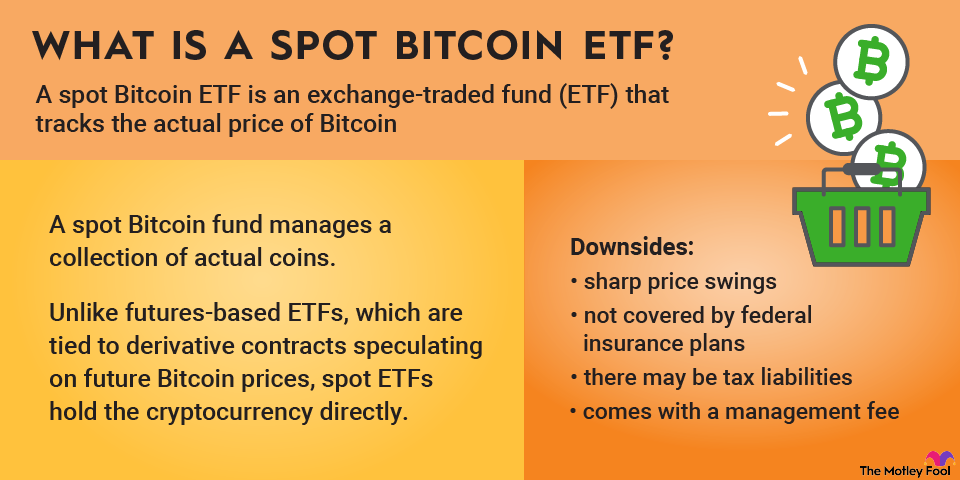

A spot Bitcoin ETF owns Bitcoin and closely tracks its price. It's similar to spot ETFs that own precious metals, such as gold and silver, and track their price movements.

The SEC's January 2024 decision to greenlight spot Bitcoin ETFs was a landmark for investors seeking cryptocurrency exposure. Prior to the approval, ETFs weren't allowed to own cryptocurrency directly. The only Bitcoin ETFs that existed were those that held Bitcoin futures rather than the crypto itself.

The SEC's decision allows investors to gain direct crypto exposure through a brokerage account since the ETFs trade on stock exchanges. That, in turn, makes it easier to invest retirement funds in Bitcoin.

The iShares Bitcoin Trust ETF is the largest spot Bitcoin ETF, with more than $63 billion in assets under management. It's also highly liquid, with a 30-day average daily trading volume of about 44 million shares.

How to buy the iShares Bitcoin Trust ETF

The iShares Bitcoin Trust ETF trades on the Nasdaq. You can invest in ETFs like the iShares Bitcoin Trust ETF using the same steps you'd follow if you were trading individual stocks.

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Holdings of the iShares Bitcoin ETF Trust

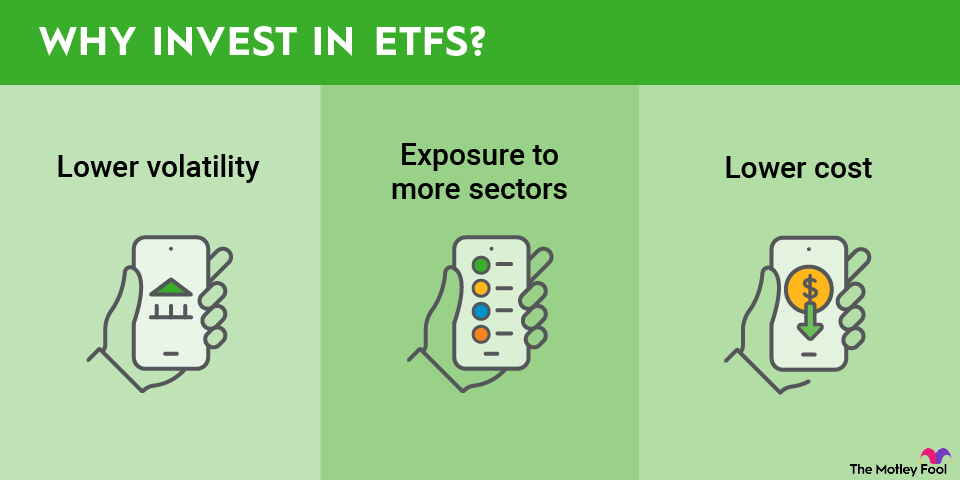

Traditional ETFs offer a large collection of stocks or bonds with a single investment. However, the iShares Bitcoin ETF Trust and other spot Bitcoin ETFs invest solely in Bitcoin. The primary advantage is simplicity, as you don't have to deal with storage, and you can buy and sell shares with a brokerage account. But you're not getting the diversified mix of investments you'd get with most top ETFs for long-term investors.

Like most other spot Bitcoin ETFs, the iShares Bitcoin Trust ETF uses the Coinbase (COIN -1.75%) crypto exchange to store its assets. Although there's no way to completely eliminate crypto custodial risks, the platform uses cold storage, or offline storage, which is far less vulnerable to hacking than online storage methods.

Should I invest in the iShares Bitcoin Trust ETF?

Investing in a spot Bitcoin ETF has the potential for big rewards -- but also substantial losses. Although the 2024 SEC decision made Bitcoin more of a mainstream investment, it's still a speculative asset.

In other words, it produces nothing of value. Instead, its value is based on investor speculation about what it might be worth in the future. A common recommendation in financial planning is to limit speculative assets to 5% of your total investments.

Consider investing in the iShares Bitcoin Trust ETF if:

- You're bullish on Bitcoin and wouldn't sell even if the price were to tank. For example, Bitcoin's price peaked at over $64,000 in November 2021 but then plummeted to under $17,000 in late 2022 during the crypto winter. Only invest in the iShares Bitcoin Trust ETF -- or any Bitcoin product -- if you wouldn't lose sleep over a large price drop.

- You want to own Bitcoin but don't want to deal with custody. If you're bullish on Bitcoin but don't want the headaches associated with storing it, investing in the iShares Bitcoin Trust ETF or a similar ETF can simplify things.

- You're seeking additional diversification for an already diversified portfolio. Bitcoin has long appealed to investors seeking additional diversification from traditional securities, such as stocks and bonds. You can get the same exposure to Bitcoin through the iShares Bitcoin Trust ETF that you'd get from directly buying the crypto.

Avoid investing in the iShares Bitcoin Trust ETF if:

- You don't already own a diversified mix of investments. When you invest in an S&P 500 index fund, you're getting exposure to 500 historically profitable companies. If you invest in a total stock market ETF or mutual fund, you're spreading your risk across thousands of stocks. The iShares Bitcoin Trust ETF invests solely in Bitcoin.

While the stock market has a long history of generating profits, Bitcoin's limited history has been marked by volatility. If you're new to investing, consider starting with an ETF that tracks a broad segment of the U.S. stock market, then gradually add small positions in the iShares Bitcoin ETF trust. - You're investing money that you can't afford to lose. If you're investing money that you're counting on in the next few years, the iShares Bitcoin Trust ETF probably isn't a great choice, given Bitcoin's history of wild price swings. If you may need to withdraw your money soon -- for instance, if you're near retirement -- your money may not have time to recover if the price of Bitcoin plummets.

- You don't understand how Bitcoin works. If you're investing solely based on the fat returns you've heard about, resist the urge to join the bandwagon. Take time to research Bitcoin. Make sure you understand how Bitcoin works before investing directly in the cryptocurrency or a spot ETF. Don't invest with the expectation that the price will keep rising forever.

Does the iShares Bitcoin Trust ETF pay a dividend?

The iShares Bitcoin Trust ETF doesn't pay dividends because Bitcoin doesn't produce dividends. Any profits you earn from investing in a spot Bitcoin ETF are due to increases in the price of Bitcoin. That's important to keep in mind because when you invest in a stock ETF, you'll typically earn dividends that get reinvested unless you opt to receive them in cash, which can, in turn, boost your returns.

Dividends can soften the impact of lousy stock market returns, but you won't get this cushion if you invest in the iShares Bitcoin Trust ETF. If dividends are important to your investment strategy, consider a top dividend ETF instead.

What is the iShares Bitcoin Trust ETF's expense ratio?

An ETF expense ratio is the percentage of an investment that is allocated to fees. The best ETFs to invest in typically have low expense ratios. After all, a higher fee means less of your money gets invested.

ETF Expense Ratio

The iShares Bitcoin Trust ETF charges a gross expense ratio of 0.25%. That amounts to a $25 fee on a $10,000 investment. Other spot Bitcoin ETFs generally have gross expense ratios ranging from 0.15% to 0.25%. One notable exception is the Grayscale Bitcoin ETF Trust (GBTC +0.42%), which converted from a Bitcoin futures ETF to a spot Bitcoin ETF following the SEC's decision.

The fund still charges a 1.5% expense ratio, which isn't particularly surprising, given that it already had billions of dollars in assets under management when the SEC announced its decision in January 2024. However, as investors have moved money from the Grayscale ETF to cheaper Bitcoin funds, like the iShares Bitcoin Trust ETF, Grayscale's CEO has said that the company plans to gradually lower its fee.

Historical performance of iShares Bitcoin Trust ETF

Since the SEC just approved spot Bitcoin ETFs in January 2024, there isn't much historical data we can look at to gauge the iShares Bitcoin ETF Trust's performance. As of May 2025, the fund is up about 62% in the past year and 134% since its inception. Because they all track the same underlying asset, other spot Bitcoin ETFs have delivered very similar returns.

A 134% gain in just 16 months certainly sounds impressive. Bear in mind, though, that the SEC's decision is one of the key reasons Bitcoin's price has climbed in recent months. So, the rising price of Bitcoin doesn't necessarily make the case for investing in a spot Bitcoin ETF.

Related investing topics

The bottom line on the iShares Bitcoin Trust ETF

The iShares Bitcoin Trust ETF and other spot Bitcoin ETFs make it easier to get direct Bitcoin exposure through a brokerage account. However, like Bitcoin, the iShares Bitcoin Trust ETF isn't appropriate for everyone. Only invest if you're comfortable with dramatic price swings and you're willing to hold the fund for the long term. Limit your stake to a small percentage of your overall investments, ideally 5% or less.