NYSEMKT: USO

Key Data Points

You can’t exactly go out and buy a barrel of crude oil to stash in your garage and flip for a profit later. The next best thing available in a brokerage account is the United States Oil Fund (USO -5.47%).

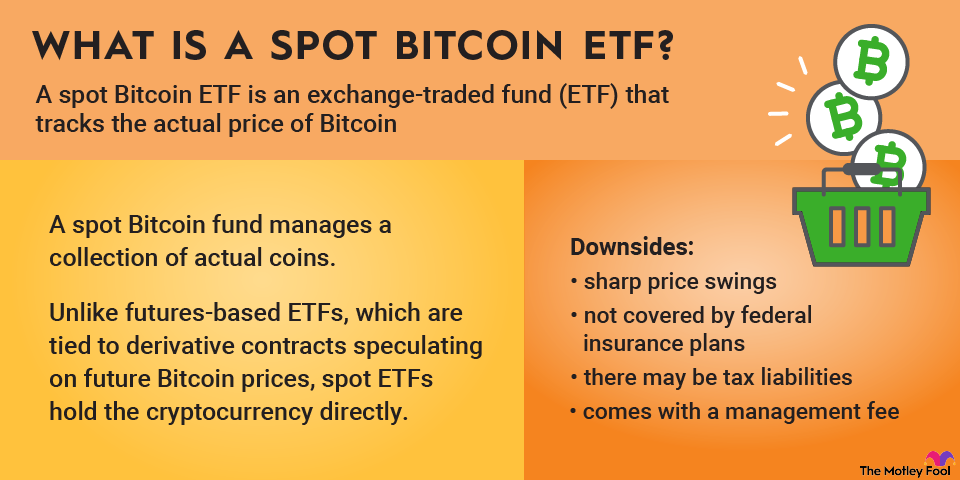

However, as an oil exchange-traded fund (ETF), it comes with unique nuances that many beginners might not be aware of. Here's what you need to know about this popular oil ETF.

Exchange-Traded Fund (ETF)

What is the United States Oil Fund?

The United States Oil Fund tries to track the day-to-day price of crude oil, the same kind used as the U.S. benchmark in Cushing, Oklahoma.

But instead of storing barrels of oil or owning oil stocks, the fund invests in oil futures contracts, which are financial agreements that track oil prices. It regularly adjusts these contracts to stay aligned with the current oil market, after accounting for expenses and interest earned on collateral.

The goal is simple: When oil prices rise, the fund’s value should rise too. But it’s not perfect because if oil prices are higher for future deliveries than for today (a situation called “contango”), the fund’s returns can lag behind the actual price of oil.

How to buy the United States Oil Fund

Step 1: Open your brokerage account: Log in to your brokerage account where you handle your investments.

Step 2: Search for the ETF: Enter the ticker or ETF name into the search bar to bring up the ETF's trading page.

Step 3: Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this ETF.

Step 4: Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

Step 5: Submit your order: Confirm the details and submit your buy order.

Step 6: Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.r order was filled as expected and adjust your investment strategy accordingly.

Holdings of the United States Oil Fund

The fund holds futures contracts that track the price of West Texas Intermediate (WTI) crude, the U.S. benchmark traded on the New York Mercantile Exchange (NYMEX).

Here’s how it works: the ETF holds the nearest-month oil futures contract, meaning the one set to expire soon. Over about 10 days each month, it gradually rolls those contracts into the next month’s contract. This constant rolling is how it maintains ongoing exposure to oil prices without ever taking physical delivery.

As of early October, the ETF’s main holdings included WTI crude oil futures for upcoming delivery months (such as November and December, 2025); total return swaps with major financial institutions like Macquarie and Société Générale, which provide additional oil price exposure; and cash and short-term money market holdings such as U.S. Treasury-backed funds and reserve accounts for collateral and liquidity management.

Should you invest in the United States Oil Fund?

This ETF offers one of the most direct ways to speculate on oil prices without trading futures yourself. However, it’s not a simple one-to-one reflection of oil’s spot price.

What you actually own is a rotating portfolio of oil futures contracts, which behave differently than the current (“spot”) price of oil.

The fund’s own website makes this clear with two prominent disclaimers:

- “An investment in this fund should not be viewed as an investment in the benchmark oil futures contract or light sweet crude oil.”

- “While investing in this fund involves risks similar to those involved with an investment directly in the oil market, it is not a proxy for trading directly in the oil markets.”

The main issue for long-term investors is something called contango, which occurs when future oil prices are higher than today’s. In that case, each month the fund is forced to sell cheaper, expiring contracts and buy more expensive new ones. This creates a persistent “sell low, buy high” cycle that slowly erodes returns over time.

Because of this, the fund is not ideal for long-term investing or buy-and-hold portfolios. It’s best viewed as a short-term trading tool for investors who understand the mechanics of oil futures and want to make targeted bets on short-term moves in crude prices.

Another important consideration is that this ETF issues a Schedule K-1 tax form rather than the standard 1099-DIV used by most stock and bond ETFs. This is because it’s structured as a partnership, not a corporation. The K-1 can complicate your tax filing since it reports your share of the fund’s income, gains, and losses in more detail than a regular dividend form, and often arrives late.

Does the United States Oil Fund pay a dividend?

No, this fund does not pay a traditional dividend, since oil futures contracts don’t generate income or interest. However, the process of rolling and settling futures can sometimes result in capital gains, which must be distributed at year-end if realized.

Currently, the fund does not have a yield, but investors could receive a small capital gains distribution in years where futures contracts are sold at a profit.

What is the United States Oil Fund’s expense ratio?

The expense ratio represents the annual cost of managing the ETF, expressed as a percentage of its assets. It covers expenses such as trading costs, management fees, and administrative services.

This ETF carries an expense ratio of 0.70%, meaning you’ll pay about $70 per year for every $10,000 invested.

While that’s high compared to typical index ETFs, it’s fairly standard for commodity funds that trade complex futures contracts.

Expense Ratio

Historical performance of the United States Oil Fund

1 Year | 5 Years | 10 Years | |

Net Asset Value | -8.01% | 21.19% | -7.48% |

Market Price | -8.14% | 21.10% | -7.47% |

Related investing topics

The bottom line

This is not an ETF for beginners to buy casually or hold long term. The fund’s track record has been poor when compared with the actual price of crude oil, and that’s due to structural factors like contango, which steadily erode returns over time.

It also comes with complex tax reporting, since it issues a Schedule K-1 instead of the simple 1099-DIV most ETFs use.

If you’re not an experienced investor with a clear trading thesis on crude oil and an understanding of how oil futures work, you’re better off avoiding this fund entirely. Even if your call on oil prices turns out right, the ETF’s structure means your returns may not match the move in spot prices.

In short, the United States Oil Fund can be a useful tactical tool for short-term traders, but it’s historically been a terrible long-term investment for most people.