Passive Indexing

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

You don't need to be a stock market expert to be a good investor. Index funds are a big reason why. If you want to put money to work in the stock market, you don't necessarily need to buy individual stocks or pay expensive fees to investment managers.

Index funds can put your stock investment strategy on autopilot. And they can do this while still producing excellent appreciation over the long run.

An index fund is an investment that tracks a financial index, such as the S&P 500 or Nasdaq Composite. Index funds can allow you to invest in broad stock market indexes, such as those I just mentioned.

There are also more narrowly focused stock indexes, such as those that invest in specific sectors or types of stocks, as well as others that focus on fixed-income investments, including bonds. There are hundreds of great index funds available.

Index funds are a type of mutual fund or exchange-traded fund (ETF). They are designed to replicate the performance of a certain benchmark index, and they do this by investing proportionally in all the components of their target index.

For example, an S&P 500 ETF would invest in all 500 companies in the S&P 500 index and in the same proportions as each one is represented in the index. The idea is that the S&P 500 index fund would return the same performance (minus any investment fees) as the S&P 500 over time.

Here are the steps to take to start investing in index funds yourself.

There are hundreds of indexes you can track using index funds. The most popular index fund is the S&P 500.

Here's a short list of some additional top indexes, broken down by the part of the market they cover:

In addition to these broad indexes, you can find sector indexes and indexes tied to specific industries. For example, you can buy an index fund that tracks the financial sector. Alternatively, you can find one that tracks an index of artificial intelligence (AI) stocks or cybersecurity stocks, among other possibilities.

There are several other types of index funds. You can find country indexes that target stocks in specific international markets, style indexes emphasizing fast-growing companies or value-priced stocks, and other indexes that limit their investments based on their own filtering systems.

Once you've chosen an index (or just a specific industry), you can generally find at least one index fund that tracks it. For popular indexes, like the S&P 500, you might have a dozen or more choices. If you have more than one option for your chosen index, you'll want to examine the costs.

Of the top index funds that meet your needs, which has the lowest costs? Even a seemingly small difference can have a big impact over the long term. You can determine which index fund is more cost-effective by comparing the expense ratios of two or more index funds.

You can open a brokerage account that allows you to buy and sell shares of the index fund that interests you. Index funds come in both exchange-traded fund (ETF) and mutual fund forms.

Many brokers and investment app providers enable customers to purchase fractional shares of index funds in ETF form. This can enable you to start investing and create a diversified portfolio without needing thousands of dollars upfront.

There are literally thousands of index funds to choose from, and they can be divided into several sub-categories:

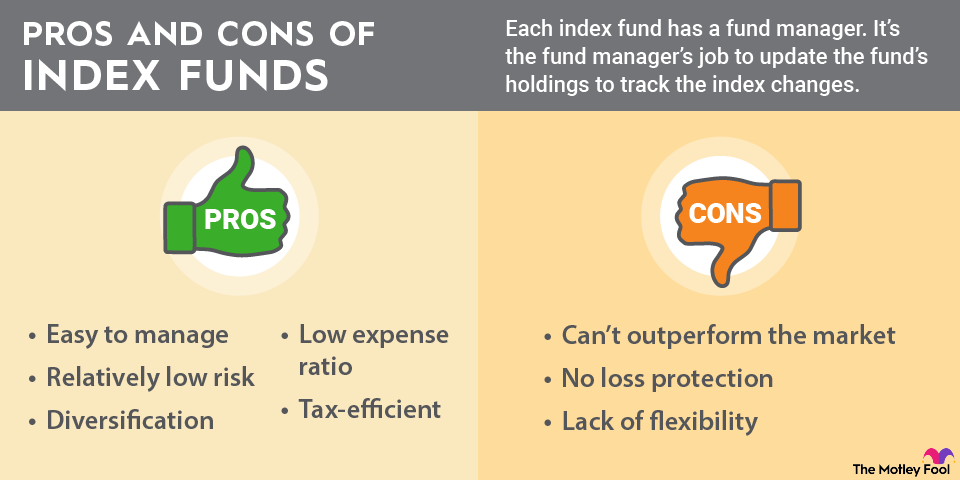

As simple as index funds are, they're not for everyone. The downsides of investing in index funds include the following:

Investing in index funds can be a hands-off approach to investing, but it's essential for investors to understand that this strategy can have significant tax implications.

Whether you need to worry about taxes depends on whether you invest in index funds in a standard (taxable) brokerage account, or if you buy them in a retirement account like an IRA or 401(k). In the latter case, you won't need to worry about taxes -- at least until you withdraw money from the account.

On the other hand, if you own index funds in a standard brokerage account, there are two potential tax situations you need to be aware of:

If you're concerned that owning index funds could have serious tax implications for you, the best course of action could be to seek the advice of a Certified Financial Planner or other professional who can evaluate your specific situation.

It's entirely possible to build a balanced stock portfolio using nothing but index funds. Or, index funds can be a component of a balanced portfolio that also includes individual stock investments. And here are some principles to keep in mind that can help you do it:

If you have the time, knowledge, and desire to create a portfolio of individual stocks, by all means, go for it. However, index funds can be a great wealth-building tool on their own. Index funds offer investors of all skill levels a simple, time-tested way to invest. They can serve as a solid foundation for any stock portfolio, even for the most experienced and knowledgeable investors.

If you're interested in growing your money but would rather put some or all of your investments on autopilot, index funds can be a great solution to achieve your financial goals.