The shift to a net-zero economy could cost $75 trillion by 2050, according to research by Wood Mackenzie, and one of the biggest hurdles is securing enough lithium for batteries.

EnergyX, a young company targeting the direct lithium extraction and refinery chain, aims to help close that gap. Below is a quick look at what it does, its mission, and how it may position itself for future growth and potential investment.

What is EnergyX?

EnergyX (Energy Exploration Technologies) is a Puerto Rico–based company focusing on direct lithium extraction and refining, offering a faster, cleaner alternative to traditional evaporation ponds, which take 18 months and create significant environmental damage. Each ton of lithium mined today produces roughly 15 tons of CO₂.

EnergyX says its tech can produce lithium in days, cut the typical 15-square-mile footprint to under 0.2 square miles, and lower costs from about $4,200 to $3,500 per ton. Lithium demand -- 300,000 tons in 2020 -- could reach 5.5 million tons by 2040 as Tesla, Ford, and GM expand EV output.

Founded in 2018 by Teague Egan, EnergyX has raised $199.5 million, holds 100+ patents, and targets 300 tonnes per annum (tpa) of demonstration plants before first commercial production of 20,000 tpa by 2027, with a goal of 500,000 tons by 2030. Revenue would come from lithium production, tech-based fees, and selling replacement materials.

The company recently launched Project Lonestar in the Arkansas-Texas-Louisiana region and opened a new R&D hub in Austin. Lithium prices remain volatile, peaking at $80,000 per ton in 2022 and falling below $10,000 in early 2025—but S&P Global expects stabilization around $20,000–$25,000 through 2027.

How to buy stocks similar to EnergyX

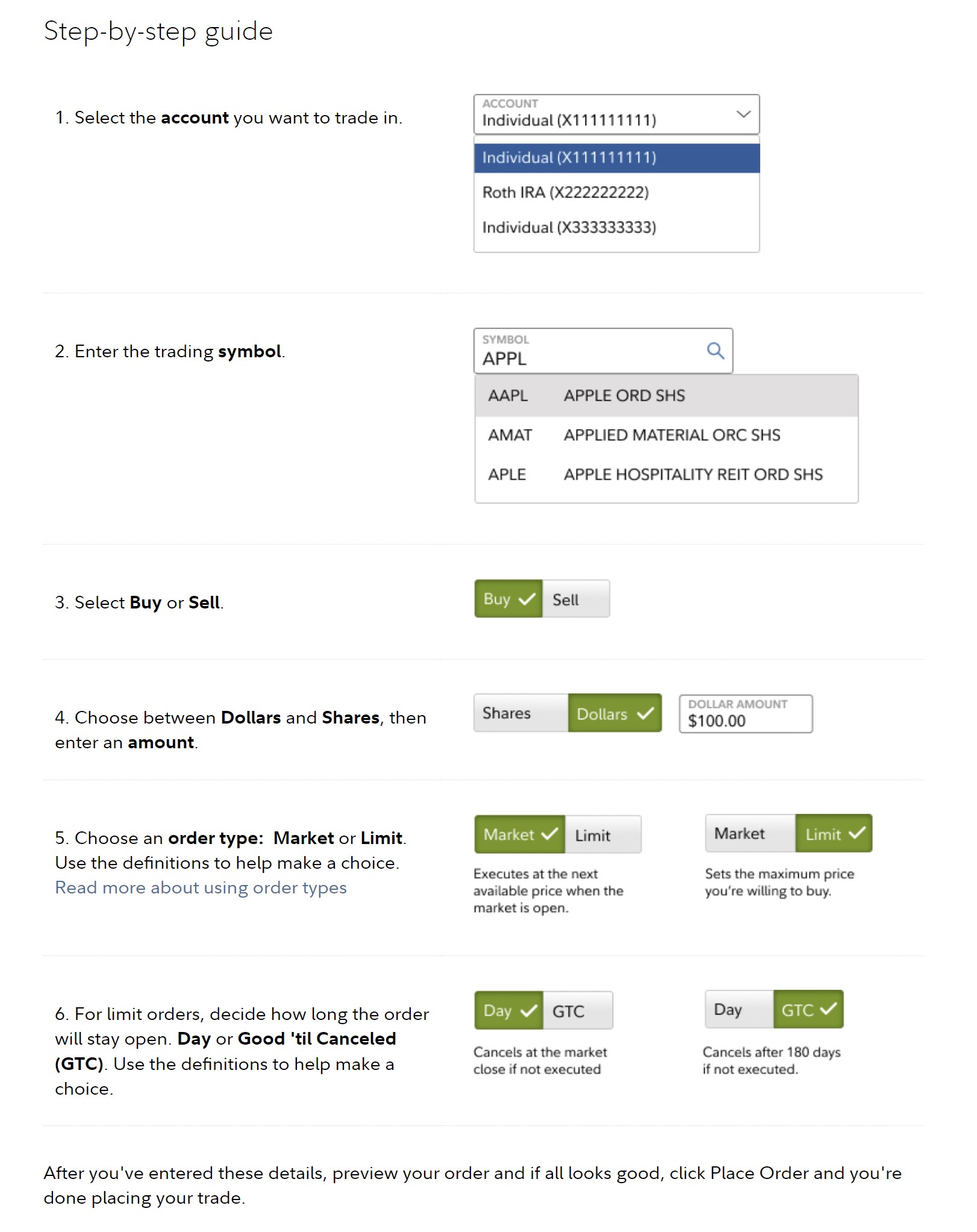

Here are the steps you'll need to follow to buy one of these stocks:

1. Open your brokerage app: Log in to your brokerage account where you handle your investments.

2. Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

3. Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

4. Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

5. Submit your order: Confirm the details and submit your buy order.

6. Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

ETFs with EnergyX exposure

Exchange-traded funds (ETFs) offer a hedge against volatility by providing investors with a basket of similar stocks. Instead of betting everything on one company, an ETF investor can spread the risk across multiple stocks. If one company suffers a major setback, other stocks in the ETF might prevent the setback from becoming a complete rout. Of course, the opposite is also true; only one stock in an otherwise pedestrian ETF might be a runaway success, limiting investor profits. Here are three ETFs that are focused directly or indirectly on lithium:

Global X Lithium & Battery Tech ETF (NYSEMKT:LIT)

The fund, one of two that focuses directly on the lithium battery market, manages about $$846.9 million in investments. It charges a 0.75% expense fee, which means you'd pay $7.50 for every $1,000 invested. The fund's biggest holding is Albemarle, which makes up 7.6% of its assets. The fund, which has a total of 39 holdings, also owns shares of a number of Asian battery manufacturers.

Amplify Lithium & Battery Technology ETF (NYSEMKT:BATT)

The Amplify fund, launched in 2018, manages about $57.1 million in assets. Its expense ratio is 0.59%, so you'd only pay $5.90 for every $1,000 invested. The fund holds 56 stocks, with its largest holding at 7% being Chinese battery manufacturer Contemporary Amperex Technology (CATL), which isn't traded on U.S. exchanges. It's followed by Australian miner BHP Group, which makes up about 6.8% of total assets. Other significant holdings include Tesla (TSLA +0.04%) at about 5.9%, Chinese car manufacturer BYD (BYDD.F -2.17%) at 5.3%, and Freeport-McMoRan (FCX +6.43%) at about 5% of holdings in mid-2025.

Ark Autonomous Technology & Robotics ETF (NYSEMKT:ARKQ)

The fund is managed by well-known investor Cathie Wood. Unlike the other two funds, the ETF invests in far more than energy storage. Despite being actively managed, the ETF's expense ratio is only 0.75%. As of mid-2025, it managed about $853.5 million in assets, with top holdings including Tesla at 12.9% of total assets, Kratos Defense & Security (KTOS +7.50%) at 8.5%, and Archer Aviation (ACHR +2.06%) at 8.2%.

Should you invest in lithium stocks?

You may want to skip buying a lithium-related stock if:

- You believe the demand for lithium is exaggerated.

- You think interest rates will remain high, discouraging potential EV buyers.

- Promised production numbers or new lithium mining methods look too good to be true

- You're skeptical about the sustainability of lithium mining.

- You're concerned about the political stability of lithium-rich countries.

- You don't understand the market for lithium.

On the other hand, you may want to go ahead and buy a lithium-related stock if:

- You believe demand will continue to rise for lithium, even absent growth in electric vehicles.

- You think that the energy transition will accelerate, increasing the need for lithium.

- You believe the lithium industry can become more environmentally friendly.

- You think lithium prices will eventually rebound from their recent lows.

- You think the economy will rebound when interest rates are lowered, increasing interest in EVs.

As with any other investment, there's a short answer to why you might consider investing in this stock: It depends. Factors that might affect your decision include the level of your portfolio diversification, personal risk tolerance, company and industry knowledge, and assessment of a stock's competitive position.

If you've decided the pros of investing in the company outweigh the cons, then complete the order page, click the "Place Order" button at the bottom, and become a shareholder.

The bottom line

There's no doubt that a massive change in energy markets is underway. Electric vehicles accounted for 4% of total car sales in 2020 but were expected by the International Energy Agency to grow to 20% in 2024. That's going to require a lot of lithium, and companies like EnergyX could be poised to take advantage of the trend.

Despite its promise, though, EnergyX is far from profitable, and there's no guarantee that it will turn the corner. Its solicitation for investments on social media platforms is unusual; it's hardly the sign of a company that's confident in its ability to attract significant investment. If and when EnergyX goes public, investors who believe in the company's future should consider it as part of a long-term buy-and-hold strategy.