Valuation methods

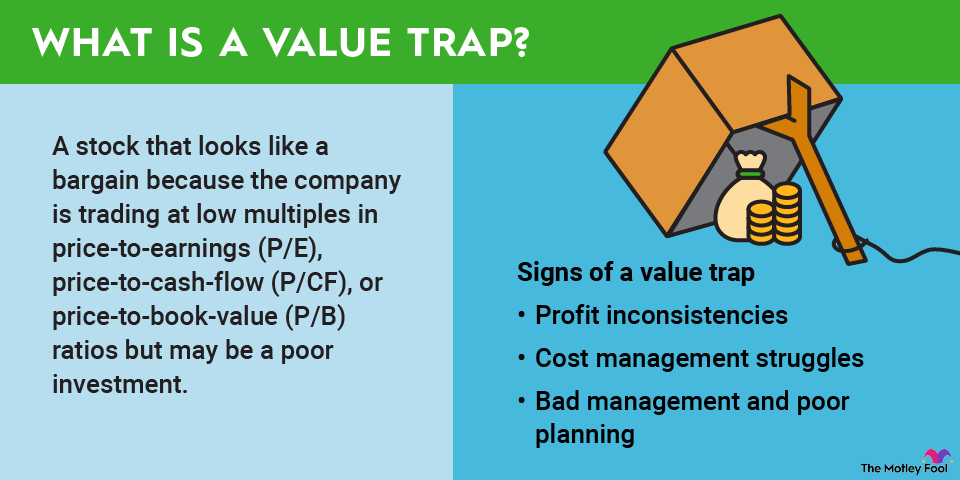

In the above example, investors would use the price-to-earnings (P/E) ratio to value my imaginary shoe business. But there are situations when things aren't so simple, and different valuation tools are helpful. For example, companies without earnings can't be valued with a P/E ratio because earnings are literally part of the equation. But this doesn't necessarily mean that those businesses are worthless, so they instead might be valued with a price-to-sales (P/S) ratio. Additionally, accounting practices can distort profits, which is why many investors like to value a company with the price-to-free cash flow ratio. In short, there are many popular valuation metrics, and each has merits.

However, investors should remember that many metrics share a key shortcoming. Renowned value investor Bill Miller puts it this way, "One hundred percent of the information you have about a company represents the past, and 100% of the value depends on the future." In other words, investors can't solely rely on the known numbers, but rather, they also need to have an opinion about what will happen with the business, the industry, and the economy.