A recession refers to a period of declining GDP, and while there isn't a set-in-stone definition, it is generally defined as a sustained GDP decline for two or more consecutive quarters.

Recessions aren't just about poor economic growth. They are often accompanied by several other characteristics -- widespread job losses, fewer available jobs, and more government relief (think stimulus payments and increased unemployment benefits).

With all that in mind, you may wonder if investing is a good idea if we're in a recession or are headed in that direction. Is it wiser to take every dollar you make and keep it in cash?

Is it safe to invest during a recession?

During a recession, stock values often decline. In theory, that's bad news for an existing portfolio. However, leaving investments alone means not locking in recession-related losses by selling.

What's more, lower stock prices offer a solid opportunity to invest cheaply (relatively speaking). As such, investing during a recession can be a good idea, but only under the following circumstances:

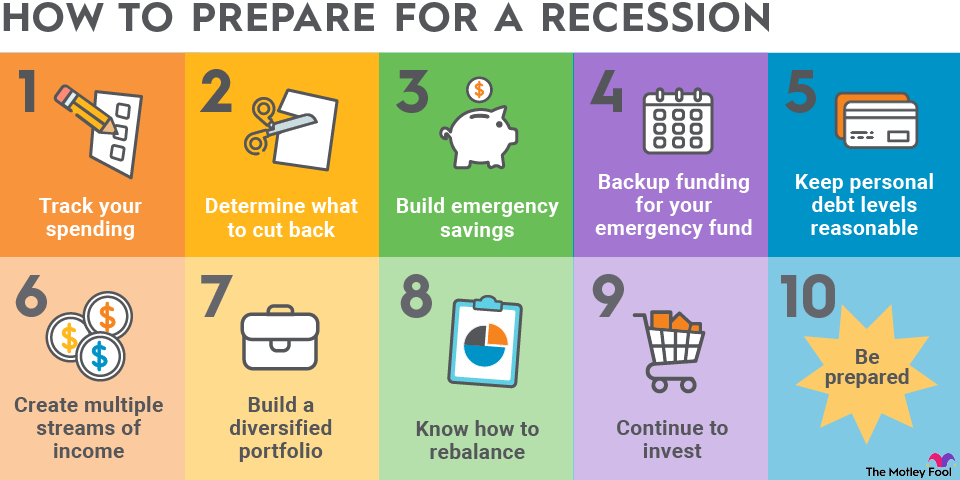

- You have plenty of emergency savings. You should always aim to have enough money in the bank to cover three to six months' worth of living expenses. If you're there and have extra money at your disposal, you can feel free to invest it. If not, be sure to build a solid emergency fund first.

- You're not planning to touch your portfolio for at least five to seven years. Investing during a recession isn't for the faint of heart. The best way to avoid losses in a recession -- and come out ahead -- is to take a long-term approach to investing.

- You're not going to obsessively check your portfolio. When the economy is in bad shape, and there's lots of stock market movement, you may be more inclined to log on to your brokerage account every day and see how your portfolio is doing. But, if you're going to invest effectively during a recession, you simply can't do that.

To sum it up, it can be a great idea to invest during a recession -- but only if you're in a strong enough financial position to do so and only if you have the right attitude and approach. You should never compromise your near-term financial security for long-term gain.

Real-world results of investing in recessions

Long-term investors who put money to work during a recession have done pretty well over time. Looking at data from three modern recessions -- the Great Recession from 2008-09, the recession in 2001 fueled by the dot-com crash and the 9/11 attacks, and the 1990-91 recession that followed a long economic expansion in the 1980s -- you might be surprised at the long-term results, even if investors' timing wasn't perfect.

Obviously, if you invest at the market's lowest point during a recession, you're likely going to do quite well over time. However, one thing investors should realize is that trying to time the market is almost always a losing battle. There's no crystal ball that can tell you when the market will bottom. In other words, you are probably not going to invest at the absolutely perfect time.

But you don't have to. Even if you had invested in an S&P 500 index fund at the worst possible moment in 2007 -- the market's peak before the financial crisis began -- you would have achieved a 467% total return in the roughly 18-year period through July 2025.

What to invest in during a recession

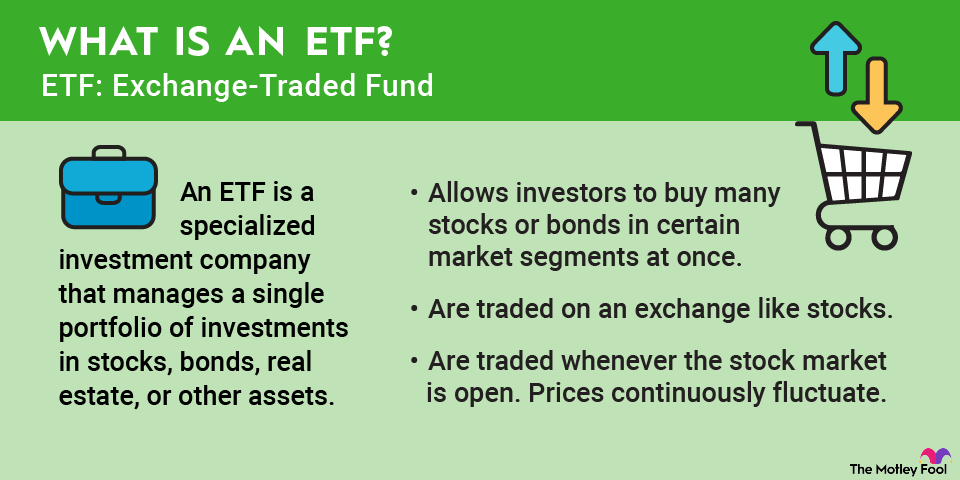

In the last section, we mentioned index funds, and those can be a great way to invest -- recession or not. By purchasing index funds -- especially S&P 500 index funds -- you're betting on the long-term success of U.S. business. Over long periods of time, that's been a pretty solid bet.

However, we completely understand that many people reading this prefer to invest in individual stocks. The best investment strategy in any environment is to find good businesses and hold on to them for as long as they remain good businesses, but this focus on quality is especially important in a recession.

Companies with the financial flexibility to survive a long disruption tend to be excellent long-term investment opportunities during recessions.

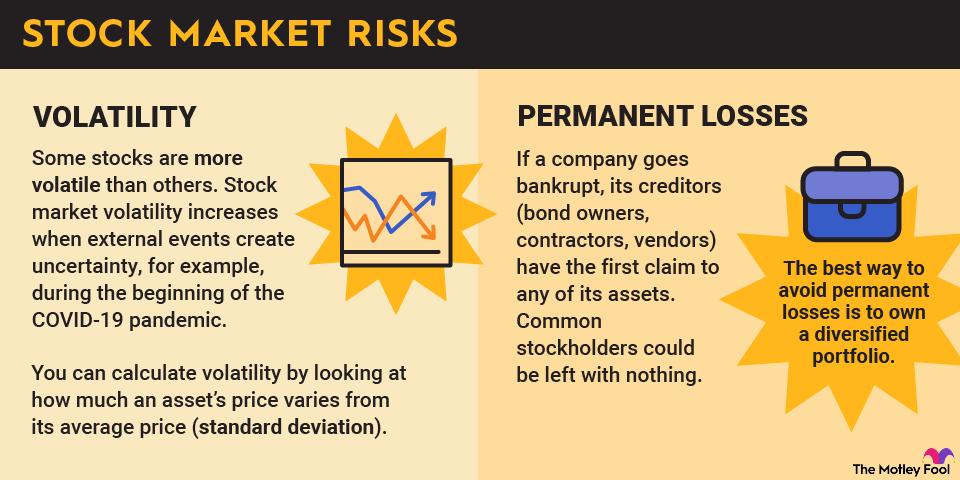

In a recession, how you invest can be just as important as what you invest in. In recessions, stocks tend to be rather volatile, as anyone who was involved in the market during the 2008-09 financial crisis can tell you.

Rather than trying to time the market, invest incrementally. Known as dollar-cost averaging, this strategy refers to investing equal dollar amounts at certain time intervals as opposed to buying all at once. This way, if prices continue to fall, you can take advantage and buy more. And, if prices start to rise, you'll end up buying more shares at the lower prices and fewer shares when your favorite stocks start to get more expensive.

In a nutshell, a recession can be a great time to buy the stocks of top-notch businesses at favorable prices, but there's no need to put all of your money to work at the same time, regardless of how cheap stocks look.

What not to invest in during a recession

A recession is a good time to avoid speculating, especially on stocks that have taken the worst beating. Weaker companies often go bankrupt during recessions, and while stocks that have fallen by 80%, 90%, or even more might seem like bargains, they are usually cheap for a reason. Just remember -- a broken business at an excellent price is still a broken business.

That said, the most important thing isn't necessarily what not to invest in but what behaviors to avoid. Specifically:

- Don't try to time the bottom. As previously mentioned, trying to time the market is a losing battle. Wouldn't it have been great if you had invested as much as you possibly could on March 9, 2009, when the S&P 500 was at the lowest levels of the financial crisis? Sure, but it would also be great if you knew tomorrow's lottery numbers ahead of time. Nobody knows when the market is going to hit bottom.

- Don't try to day trade. Long-term investing is a far more certain path to wealth in the stock market. Day trading as an investment strategy is generally best left to professionals at major investment firms.

- Don't sell just because your stocks went down. Last but certainly not least, one thing that's extremely important to avoid during recessions is panic selling when stocks fall. The goal of investing is to buy low and sell high, but panic selling is the exact opposite.

Strategies for investing during recessions

Just to quickly recap some of what we've discussed so far, here are some of the most effective strategies to implement during a recession:

- Keep investing regularly, using the principle of dollar-cost averaging to buy more shares when prices are lower.

- Avoid trying to time the market. You aren't going to buy right at the bottom, and it's unlikely you will consistently make money from short-term trading.

- Don't panic and sell because your stocks went down. If the underlying business is doing well, that's the important thing.

Related investing topics

Industries that can thrive during recessions

As we've discussed a bit already, recessions don't affect all businesses equally.

Some of the most recession-proof industries include companies that sell things people need, such as:

There are some industries that tend to do even better during tough times, specifically those that sell products at a discount. Big-box retailers like Walmart (NYSE:WMT), warehouse clubs, and dollar stores are good examples.

Investing in a recession

The bottom line is that, during recessions, it's important to stay the course. It becomes a bit more important to focus on top-quality companies in turbulent times, but for the most part, you should approach investing in a recession in the same manner you would approach investing any other time. Buy high-quality companies or funds and hold on to them for as long as they stay that way.