While the Dow Jones Industrial Average (DJINDICES:^DJI) and S&P 500 (SNPINDEX:^GSPC) get most of the headline attention, it's important for investors to understand there are many different stock indexes. Of the most popular indexes, one that doesn't track large companies, is the Russell 2000 index, widely considered the benchmark for smaller U.S. stocks.

With that in mind, here's a rundown of what investors should know about the Russell 2000 index, how it works, and whether it could be a smart investment choice.

What is it?

What is the Russell 2000 index?

The Russell 2000 index, sometimes abbreviated Russell 2K, is the most widely used index of small-cap stocks, or those with a relatively small market capitalization. There are no hard-and-fast rules for when a stock is a small cap.

The key point here is that there's a broad market index known as the Russell 3000. It is divided into two smaller ones: the Russell 1000, which accounts for the 1,000 largest companies, and the Russell 2000, which accounts for the remaining two-thirds.

The largest company in the Russell 2000 has a market cap of roughly $107 billion; the average market cap of companies in the index is roughly $4.5 billion.

The Russell 2000 is a market cap-weighted index, as are the majority of popular stock indexes -- the Dow Jones Industrial Average being the main exception. This means that the 2,000 companies that comprise the index don't contribute equally to its performance. Larger companies have a proportionally greater impact than smaller ones.

How it works

How does the Russell 2000 index work?

The Russell 2000 is designed to provide the best indicator of the performance of small-cap U.S. stocks. To keep up to date on these stocks, the Russell 2000 is reconstituted annually to ensure that the companies in it represent the small-cap universe.

In simple terms, if a company grows too large, it will be removed from the Russell 2000. In turn, it will likely be placed in the Russell 1000, which is designed to be a barometer of large-cap stocks' performances.

As an example, GameStop (GME -1.42%) was added to the Russell 1000 in the 2021 reconstitution and removed from the Russell 2000 after its price soared in the meme stock craze. In all, 38 companies were added to the Russell 1000 in June 2024, with 27 moving from the Russell 2000.

Notably, one of the companies that departed the Russell 2000 during the 2024 reconstitution is Super Micro Computer (SMCI -0.41%). The stock left behind some big shoes to fill as it made its way into the Russell 1000 as the largest company by weight.

How it differs

How is the Russell 2000 different from other major stock indexes?

There are many important stock indexes, and all focus on a different basket of stocks. Here are some of the most common:

- Dow Jones Industrial Average: The Dow, the best-known stock index in the U.S., includes 30 of the largest publicly traded companies. Unlike most indexes, the Dow is price-weighted, meaning stocks with higher share prices contribute more to the index's performance.

- S&P 500: This one includes 500 large public U.S. companies. Note that they aren't necessarily the largest 500.

- S&P MidCap 400: This index comprises 400 public U.S. companies with market capitalizations between $201 million and $27.7 billion.

- S&P SmallCap 600: This index includes 600 public U.S. companies with market capitalizations of between $17 million and $12 billion. The S&P 500, S&P MidCap 400, and S&P SmallCap 600 are collectively known as the S&P Composite 1500 index.

- Nasdaq Composite: This index includes all the companies traded on the Nasdaq exchange.

- Nasdaq-100: The Nasdaq-100 index includes 100 of the largest Nasdaq-listed companies and is widely considered a barometer for tech stocks' performances.

- Russell 1000: This comprises the 1,000 largest public U.S. companies. The Russell 1000 and Russell 2000 are collectively known as the Russell 3000, regarded as one of the best barometers for the overall U.S. stock market's performance.

So, what makes the Russell 2000 different from the rest?

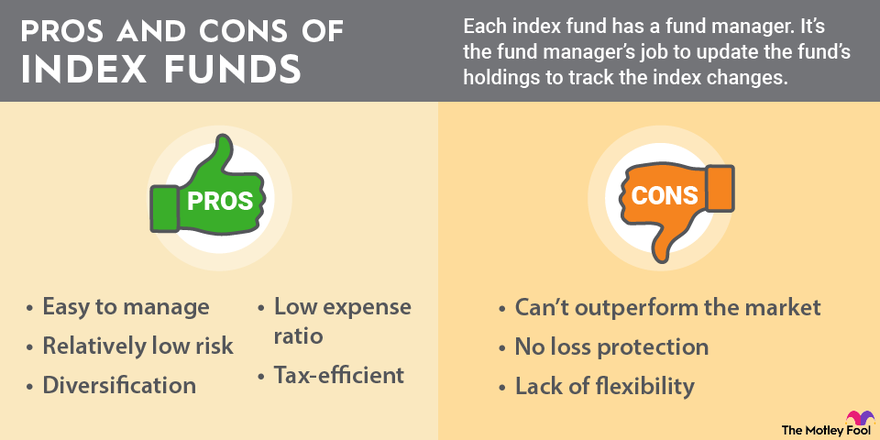

- Smaller and more volatile companies: The stocks in the Russell 2000 are smaller than those in "headline" indexes such as the S&P 500. Many are newer growth companies that tend to be more volatile than their larger counterparts. In other words, don't be surprised if the Russell 2000 experiences more dramatic swings than large-cap indexes.

- Higher growth potential: While they tend to be more volatile, smaller-cap stocks typically have much more growth potential than larger companies. Think of it this way: It would be far more difficult for Apple (AAPL 0.53%) to double in size than for a newer tech company with a $1 billion market cap. So, while their price swings tend to be more dramatic, over long periods, small-cap stocks typically outperform large-cap stocks.

- More diversified: Because it focuses on smaller companies and contains 2,000 of them, the Russell 2000 is more diversified than other popular indexes such as the S&P 500. For one thing, it is less top-heavy and doesn't depend as much on the performance of just a few large companies. The median market cap of a Russell 2000 stock was $840 million as of May 31, 2025.

In a nutshell, the Russell 2000 comprises smaller and more volatile stocks than those in large-cap indexes. However, the large number of companies in the index helps mitigate risk since it's less reliant on any particular stock's performance.

Company list

Russell 2000 companies list

It wouldn't be practical to list all 2,000 companies here. Instead, here are 10 of the largest Russell 2000 companies, just to give you an idea of the types of companies that make up the index.

- Sprouts Farmers Market (SFM 1.38%)

- Insmed (INSM -0.53%)

- FTAI Aviation (FTAI 1.61%)

- Carpenter Technology (CRS 1.77%)

- Hims & Hers Health (HIMS 1.22%)

- Applied Industrial Technologies (AIT 0.04%)

- Mueller Industries (MLI -0.59%)

- Credo Technology Group (CRDO 4.6%)

- HealthEquity (HQY 0.82%)

- SouthState (SSB 0.2%)

Data source: Vanguard. Data current as of May 31, 2025.

The takeaway is that while these aren't exactly tiny enterprises, they aren't giant companies either. That's the key difference between the Russell 2000 and the "headline" indexes.

Russell 2000 by industry

Russell 2000 by industry

| Industry | Percentage of Index |

|---|---|

| Industrials | 19.6% |

| Financials | 18.7% |

| Healthcare | 15.9% |

| Consumer Discretionary | 11.5% |

| Technology | 10.9% |

| Real Estate | 6.4% |

| Energy | 4.9% |

| Basic Materials | 3.9% |

| Utilities | 3.5% |

| Consumer Staples | 3% |

| Telecommunications | 1.8% |

Subindexes

Small-cap subindexes in the Russell 2000

Although designed as a barometer of small-cap stocks, some subindexes comprise stocks in the Russell 2000. For example, the Russell 2000 growth index is designed to gauge how small-cap growth stocks are performing. About 1,100 stocks out of the broader Russell 2000 qualify for the growth subindex, with the technology and healthcare sectors making up the largest contributions.

Conversely, the Russell 2000 value index comprises hundreds of value stocks from the index. It's also worth noting that many Russell 2000 stocks are included in both subindexes. As of May 2025, 1,423 stocks were in the Vanguard Russell 2000 Value ETF (VTWV 0.71%) and 1,125 in the Vanguard Russell 2000 Growth ETF (VTWG 1.19%).

Exchange-Traded Fund (ETF)

How to invest

How to invest in the Russell 2000 index fund

If you want to invest in the Russell 2000 index, you don't need to buy all 2,000 stocks. You can invest in the index rather easily through a mutual fund or exchange-traded fund (ETF) designed to track it passively.

One good example is the Vanguard Russell 2000 ETF (VTWO 0.93%), which invests in all the stocks in the index according to their relative weights. With a small (0.10%) expense ratio, the ETF's fees are low, and its long-term performance should be virtually identical to the index.

Related investing topics

Is investing in the Russell 2000 index right for you?

Investing in the Russell 2000 is a great way to get exposure to the exciting world of small-cap investing without relying too heavily on the performance of any single company. The vast diversification of the index should help to smooth out the volatile nature of investing in smaller stocks while maintaining the potential for market-beating performance.

FAQ

Russell 2000 stock market index FAQ

What is the Russell 2000?

The Russell 2000 index, sometimes abbreviated as Russell 2K, is the most widely used index of small-cap stocks -- those with a relatively small market capitalization.

What are stock market indexes?

A stock market index shows how investors feel an economy is faring. An index collects data from a variety of companies across industries. Together, that data forms a picture that helps investors compare current price levels with past prices to calculate market performance.

What is the Dow Jones?

The Dow Jones Industrial Average is a stock index that tracks 30 of the largest U.S. companies. Created in 1896, it is one of the oldest stock indexes, and its performance is widely considered a useful indicator of the health of the entire U.S. stock market.

The Dow Jones Industrial Average index is managed by S&P Dow Jones Indices, a joint venture majority controlled by the financial information and analytics company S&P Global (NYSE: SPGI).

What is the 10-year average return on the Russell 2000?

The Russell 2000 index had recorded an annual average total return of 6.7% over the 10-year period through June 15, 2025. The index recorded a dividend-adjusted total return of 90.5% across the decade-long period.

What Is the Russell 2000 methodology?

The key methodology for determining the components of the Russell 2000 involves selecting the 2,000 smallest companies by market capitalization from the Russell 3000 index. To be included in the Russell 3000 index, companies must meet certain minimum share price and free float requirements -- and these criteria for inclusion extend to the Russell 2000 index. The Russell 2000's components are updated at the end of June each year, and companies that are either too big or too small are removed from the index.

What's the highest the Russell 2000 has ever been?

The Russell 2000 index hit an all-time high of 2,466.49 on Nov. 25, 2024, but closed out the daily trading session below that level. Meanwhile, the index's highest ever daily closing price stands at 2,442.74 and was achieved on Nov. 8, 2021.

What is the smallest company in the Russell 2000?

Mondee Holdings was the smallest company included in the Russell 2000 index as of June 15, 2025. The stock had lost virtually all of its value over the last year, but it was still included because the annual reconstitution of the index had not taken place yet.