The solar energy industry builds and installs devices to capture energy from the sun and convert it into electric power. Companies in the industry are working to transition the global economy from fossil fuels such as oil and natural gas to renewable energy sources. It will take trillions of dollars and many years to complete the transition, making the solar energy industry a compelling opportunity for long-term investors.

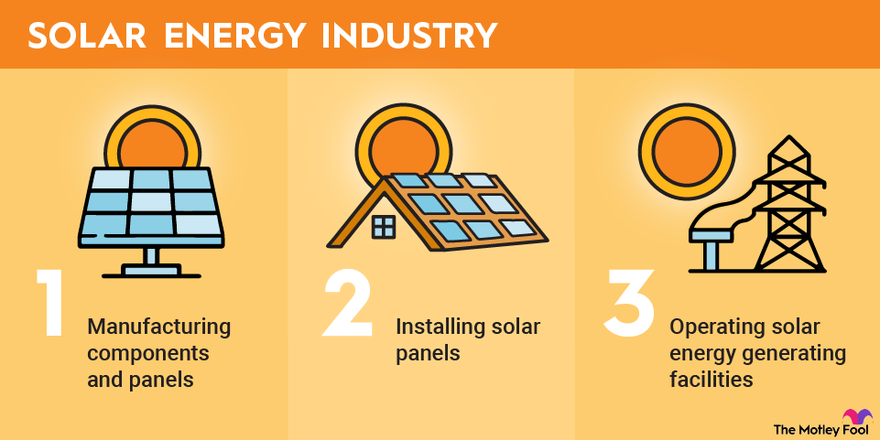

The sector encompasses a wide variety of companies with the following functions:

Best solar stocks to invest in 2025

Solar energy represents an enormous market opportunity. Global spending on solar reached $500 billion in 2024, surpassing all other generation technologies. That annual investment rate will likely rise in the future, powered by growing demand for clean energy, especially from power-hungry data centers used to support artificial intelligence (AI). That technology is driving accelerated electricity demand, making solar's future look even brighter.

Many companies focus on solar energy and should benefit from the sector's growth. However, not all have strategies designed to enhance value for their shareholders. Three solar energy stocks that stand out as the most worthy of investors' consideration are:

| Name and ticker | Market cap | Industry |

|---|---|---|

| Enphase Energy (NASDAQ:ENPH) | $5 billion | Semiconductors and Semiconductor Equipment |

| Brookfield Renewable (NYSE:BEPC) | $6 billion | Independent Power and Renewable Electricity Producers |

| First Solar (NASDAQ:FSLR) | $18 billion | Semiconductors and Semiconductor Equipment |

Here's why these solar stocks shine brightly in this rapidly expanding industry.

First Solar

1. First Solar

First Solar is a global leader in developing solar energy solutions. It develops, manufactures, and sells advanced solar modules.

One thing that sets First Solar apart from other solar panel makers is its focus on manufacturing a proprietary, advanced thin-film module. In less-than-ideal conditions, such as low light and hot weather, its panels perform better than competing silicon modules. They're also larger in size, which helps reduce the cost per watt. Those factors make them ideal for utility-scale solar energy projects.

First Solar also distinguishes itself from its peers in the solar sector by having one of the strongest balance sheets. It routinely has more cash than debt (it ended 2024 with a net cash balance $1.2 billion and anticipates it will close 2025 with between $700 million and $1.2 billion in net cash), giving it the financial flexibility to continue executing its strategy of developing and building thin-film solar modules for utility-scale customers, including expanding its manufacturing capacity. First Solar is in an excellent position to thrive as the solar industry continues expanding.

First Solar also has a lot of growth lined up. In early 2025, the company had 68.5 gigawatts (GW) of total bookings in its backlog, which it expects to deliver over the next several years. Meanwhile, it had another 80.3 GW of booking opportunities in its pipeline. It's investing heavily in expanding its solar panel manufacturing capacity to capitalize on the sector's growth. It's also investing in new solar technologies to stay ahead of the competition. The investments should enable First Solar to expand its revenue and earnings at rapid rates in the coming years.

Brookfield Renewable

2. Brookfield Renewable

Brookfield Renewable is an energy company that generates renewable energy that it sells under long-term power purchase agreements. Brookfield's business model provides it with steady cash flow to pay an attractive dividend yield (more than 5.5% in early 2025).

Brookfield Renewable has a globally diversified renewable energy portfolio. It's a global leader in hydroelectric power plants (8.1 GW of capacity and 47% of its funds from operations or FFO). It complements those facilities with rapidly expanding onshore wind energy (17.5 GW and 21%), utility-scale solar (12.3 GW and 16%), distributed energy (e.g., rooftop solar), and energy storage platforms (8.3 GW and 8%). The company also has a growing sustainable solutions business (8%), which includes carbon capture and storage, biofuel production, nuclear services, and solar panel manufacturing.

The clean energy company believes solar could make up the majority of its production capacity within the next decade -- not because it doesn't see a bright future for wind or hydro, but because it sees greater opportunity in solar. Declining costs are making solar development projects increasingly lucrative. Utility-scale solar energy makes up 50% of its 200 GW global development pipeline, while distributed energy comprises another 25%.

Brookfield has made several acquisitions in recent years to increase its solar energy development capabilities. In 2024, it agreed to buy a majority stake in Neoen. The leading European renewable energy developer had 8 GW of wind, solar, and storage assets in operation or under construction. It had another 20 GW of projects in its advanced-stage development pipeline.

Brookfield's solar-powered development pipeline has it on track to expand its FFO per share at a 3% to 5% annual rate through 2030. Add that to its other organic growth drivers and acquisitions, and Brookfield believes it can grow its FFO per share by more than 10% annually through the next decade. That should support the company's plan to increase its high-yielding dividend by 5% to 9%. Its dividend growth makes it one of the top renewable energy dividend stocks. Meanwhile, its overall combination of growth and income should enable Brookfield Renewable to generate attractive total returns in the coming years.

Enphase Energy

3. Enphase Energy

Enphase Energy (ENPH -3.06%) is a pioneer in the solar industry. The company launched its revolutionary microinverter technology in 2006. It helps convert the direct current (DC) produced from sunlight into alternating current (AC) used in homes and businesses. The company has since expanded its capabilities to provide battery storage, EV chargers, energy management systems, and an installer platform.

As of early 2025, Enphase has shipped 80 million microinverters. It has also supplied more than 4.7 million systems to over 160 countries and shipped 1.7 GWh of energy storage systems.

That's only the beginning. The company's innovation has opened up new market opportunities, giving it an expanding share of potential revenue generated by each residential solar installation. Enphase estimates that its serviceable addressable market will reach $25.4 billion by 2025. That's a massive market opportunity for a company that only did $1.3 billion in revenue in 2024.

Related investing topics

Future of solar energy

Solar energy's future has never looked brighter

Solar energy was already on track for significant growth before AI burst onto the scene. The technology requires a tremendous amount of power, which should drive accelerated growth from solar in the coming years.

As a result, the solar industry could grow even faster in the future than current projections suggest. This potential growth is another reason why investors should consider investing in solar energy stocks. First Solar, Brookfield Renewable, and Enphase Energy stand out as among the best options, thanks to their strong financial profiles and visible growth outlooks.

FAQ

Solar Energy FAQ

Is solar energy a good investment?

Solar energy has the potential to be a good investment over the long term. With development expected to accelerate in the coming years due to AI and other catalysts, solar energy companies should grow rapidly, boosting stock prices.

What is the best solar energy stock to buy?

There are many well-run solar energy companies. That gives investors lots of good options. Investors might want to consider taking a basket approach. For example, they could buy several solar stocks that should all benefit from the renewable energy megatrend, such as First Solar, Brookfield Renewable, and Enphase Energy. By diversifying their holdings, investors are less likely to miss out on an overall trend by selecting a solar energy stock that underperforms the sector.