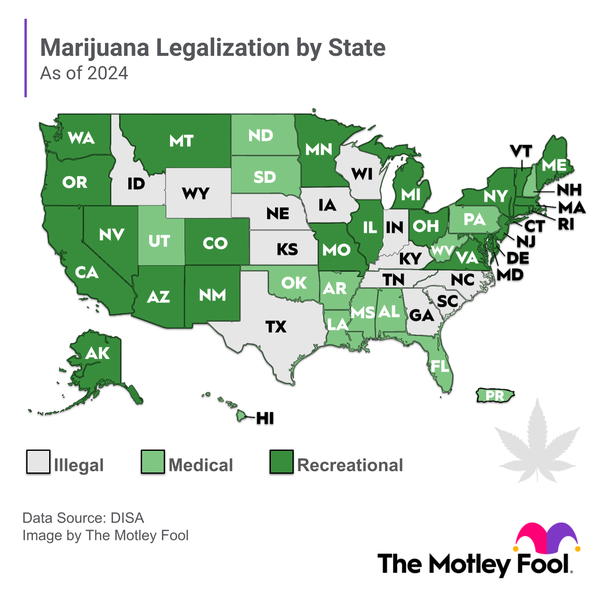

The global medical marijuana market is projected to grow at an annualized rate of 21.8% through 2030, according to Grand View Research. Much of this growth will likely be in the U.S., where 39 states have already legalized medical cannabis. Medical cannabis products sold in the U.S. include dried flower, vaping concentrates, cannabis-infused edibles, and topical products such as lotion.

Investors who opt to buy individual medical marijuana stocks can choose from Canadian or U.S. companies. Canadian medical cannabis companies can legally list on U.S. stock exchanges, while U.S. medical cannabis companies operating legally at the state level can legally list on Canadian stock exchanges and over-the-counter (OTC) markets.

Before you invest in medical cannabis companies, find out what you need to know about this growing sector.

Top 4 stocks

Top medical marijuana stocks to buy right now

These four medical marijuana stocks are top buys for 2025:

| Company name | Company ticker | Market cap | Sector |

|---|---|---|---|

| Village Farms International | NASDAQ:VFF | $192 million | Consumer Staples |

| Jazz Pharmaceuticals Plc | NASDAQ:JAZZ | $6 billion | Health Care |

| Trulieve Cannabis | OTC:TCNNF | $1 billion | Health Care |

| Innovative Industrial Properties | NYSE:IIPR | $1 billion | Real Estate |

1. Village Farms

1. Village Farms International

Village Farms International's roots lie in the fresh produce business. The company still generates almost half of its total revenue from selling cucumbers, peppers, and tomatoes. However, Village Farms' primary growth driver these days is cannabis.

The company has the fourth-largest share in the Canadian cannabis market. It operates in eight other international markets. The list includes the Netherlands, where Village Farms' Leli Holland subsidiary owns one of 10 licenses to grow and sell recreational marijuana.

Meanwhile, Village Farms already sells hemp-derived cannabidiol (CBD) health and wellness products in the U.S. market. The company hopes to enter the U.S. cannabis market if and when marijuana is legalized at the federal level.

2. Jazz

2. Jazz Pharmaceuticals

Jazz Pharmaceuticals became the largest cannabis-focused drug developer following its acquisition of GW Pharmaceuticals in May 2021. Sativex, developed by GW, is a medical cannabis drug that contains both the high-inducing tetrahydrocannabinol (THC) and the non-psychoactive CBD. It treats spasticity associated with multiple sclerosis.

Epidiolex, also developed by GW, is a CBD drug. Sativex is approved in multiple countries, excluding the U.S., while Epidiolex is approved in the U.S., Europe, and several other countries. Epidiolex generated sales of $972 million in 2024 and is significantly boosting Jazz's revenue. The company expects Epidiolex to become a blockbuster drug in 2025.

Jazz is not a pure-play medical cannabis company. It makes the sleep disorder drugs Xyrem and Xywav, which account for more than 40% of its sales. Jazz also sells the cancer drugs Rylaze, Vyxeos, and Zepzelca.

3. Trulieve

3. Trulieve Cannabis

Trulieve Cannabis is a vertically integrated U.S.-based cannabis company that grows medical cannabis and distributes medical cannabis products to its own retail dispensaries. The company's primary operations are in Florida, where it commands a dominating market share. Trulieve also has operations in Arizona, Colorado, Connecticut, Georgia, Maryland, Ohio, Pennsylvania, and West Virginia.

Although Trulieve's initial success was in the medical cannabis market, the company has also expanded into recreational marijuana. Five states in which it operates -- Arizona, Colorado, Connecticut, Maryland, and Ohio -- have legalized adult-use cannabis.

Trulieve had high hopes that its home state of Florida would legalize recreational marijuana in November 2024. However, while 56% of citizens voted in favor of legalization, that wasn't enough to meet the 60% threshold required for the constitutional amendment to pass. Efforts are underway to put the issue before voters again in 2026.

4. Innovative

4. Innovative Industrial Properties

As a real estate investment trust (REIT), Innovative Industrial Properties is the leading real estate provider for the U.S. medical cannabis industry. The company buys properties from medical cannabis operators and then leases them back to the operators, providing needed cash to growing cannabis businesses and stable income for Innovative.

Innovative Industrial Properties currently owns properties leased to tenants in 19 states. The company is increasing its customer base not only in the states where it already operates but also in additional states that legalize medical or recreational cannabis.

Few medical cannabis stocks have delivered the level of growth Innovative Industrial Properties has achieved. During the past five years, the company's trailing-12-month revenue has more than quadrupled, while its earnings have vaulted almost 270%.

As a REIT, Innovative Industrial Properties distributes at least 90% of its taxable income to investors in the form of dividends. The company's consistent profitability is due in part to its diversification across many tenants.

How to choose

How to choose the best medical marijuana stocks

Investors should consider the same key attributes for medical marijuana stocks that they would for any stock:

- Financial performance: Many medical marijuana companies aren't yet profitable, but the best companies have clear and defined plans for achieving profitability in the future. The safest companies also have plenty of cash, which creates financial flexibility and preserves the stock's value.

- Growth opportunities: The patchy regulatory framework of the marijuana sector means that medical cannabis companies' growth prospects vary widely. The best companies are minimally limited by geographic constraints.

- Competitive position: Leading medical marijuana companies have high production capacity, plenty of distribution channels, and beneficial partnerships with established companies.

If you don't want to choose specific stocks, another way to gain exposure to medical marijuana stocks is to buy shares in a cannabis-focused exchange-traded fund (ETF). Such funds confer instant diversification across the cannabis sector (although, currently, no pure-play medical cannabis ETFs are available).

Related investing topics

Should I invest?

Should you buy medical marijuana stocks?

Investing in the medical marijuana sector is relatively risky as long as cannabis remains federally illegal in the U.S. The plant's federal status also constrains the growth of the sector, and investors have no guarantee that the federal government will continue to allow states to treat cannabis as legal.

But the long-term prospects of the medical marijuana industry are excellent. More countries and U.S. states are recognizing the potential benefits of medical cannabis and legalizing the use and sale of medical cannabis products. More individuals and the broader medical community are also recognizing the plant's medicinal benefits, driving demand higher for medical marijuana.

Risk-tolerant investors with long investing horizons are likely to profit by investing in medical marijuana.