Real estate has historically been an excellent investment. It has traditionally delivered competitive long-term returns compared to stocks, generally produces steady income, and is an excellent hedge against inflation. Most financial advisors recommend that their clients have some exposure to commercial real estate in their portfolios.

There are many ways to invest in real estate. One of the simplest ways to gain broad exposure to the entire sector is through mutual funds that invest in real estate investment trusts (REITs).

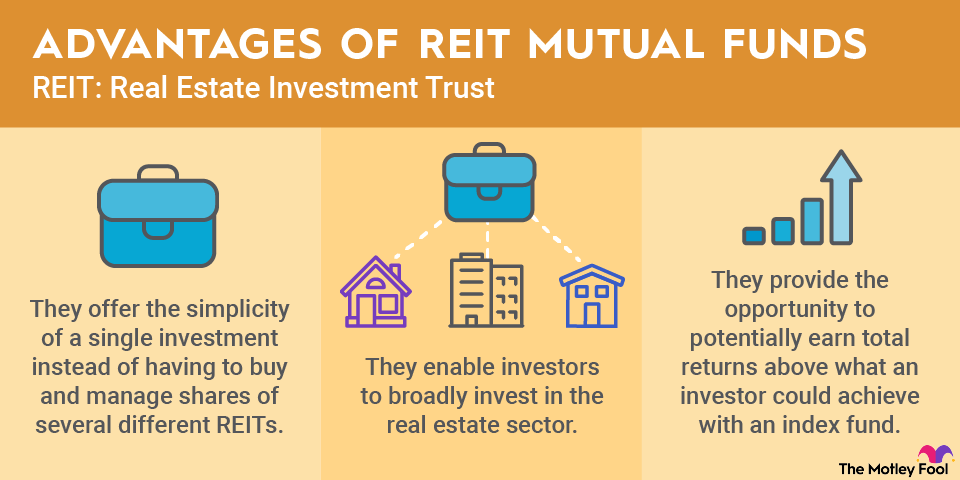

A REIT mutual fund aims to deliver above-average performance compared to an index fund focused on REITs or a REIT exchange-traded fund (ETF). It also offers the simplicity of a single investment instead of buying and managing shares of several different REITs. Here's a look at some of the best REIT mutual funds to buy.

Best REIT mutual funds in 2026

Hundreds of mutual funds own shares of mortgage and equity REITs, providing investors with lots of potential REIT mutual fund investment options. However, some REIT mutual funds have stood out over the years for their ability to produce above-average returns consistently. Here's a look at five of the top REIT mutual funds investors should consider.

REIT Mutual Fund | Assets Under Management | Description |

|---|---|---|

Baron Real Estate Fund (NASDAQMUTFUND:BREFX) | $2.3 billion | The fund invests broadly in real estate, focusing on growth. |

Cohen & Steers Real Estate Securities Fund (NASDAQMUTFUND:CSEI.X) | $8.3 billion | This fund seeks to achieve a total return by investing in real estate securities. |

PIMCO Real Estate Real Return Strategy I (NASDAQMUTFUND:PRRSX) | $465 million | This fund aims to maximize the real return. |

Nuveen Real Estate Securities Select Fund (NASDAQMUTFUND:TIRE.X) | $2.5 billion | The fund invests at least 80% of its assets into companies that own significant real estate. |

Principal Real Estate Securities R5 (NASDAQMUTFUND:PREPX) | $6.1 billion | This fund seeks to generate a total return by investing in real estate. |

1. Baron Real Estate Fund

NASDAQMUTFUND: BREFX

Key Data Points

The Baron Real Estate Fund (BREFX -1.40%) owns a diversified portfolio of real estate businesses. It focuses on companies with growth potential.

As of early 2026, the fund held shares of about 40 real estate companies, led by the following five:

- Jones Lang LaSalle (NYSE: JLL): 7.4% of the fund's assets

- Welltower (NYSE:WELL): 5.8%

- Brookfield Corporation (NYSE: BN): 5.6%

- CBRE Group (NYSE:CBRE): 5.5%

- Toll Brothers (NYSE:TOL): 4.7%

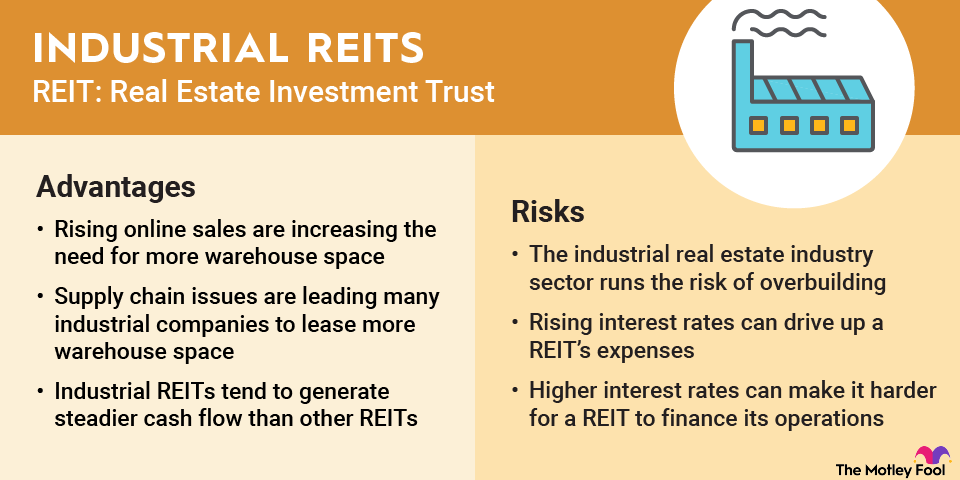

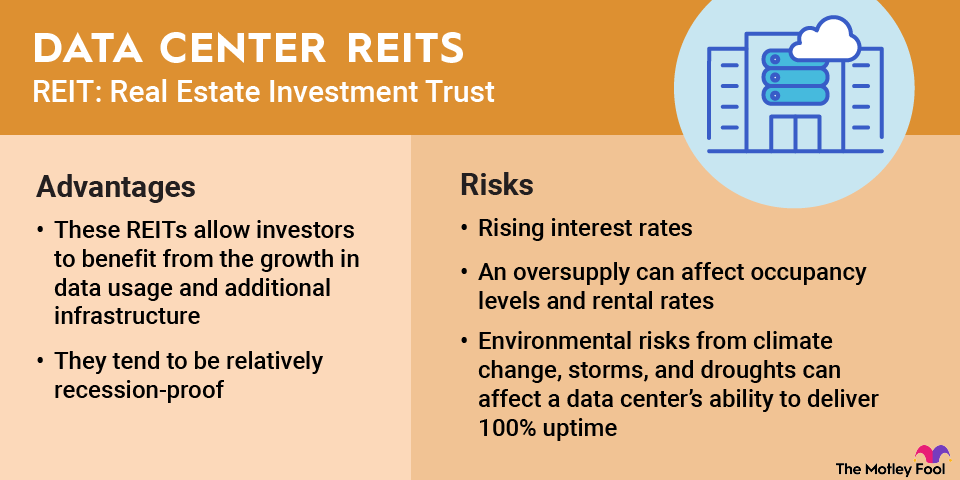

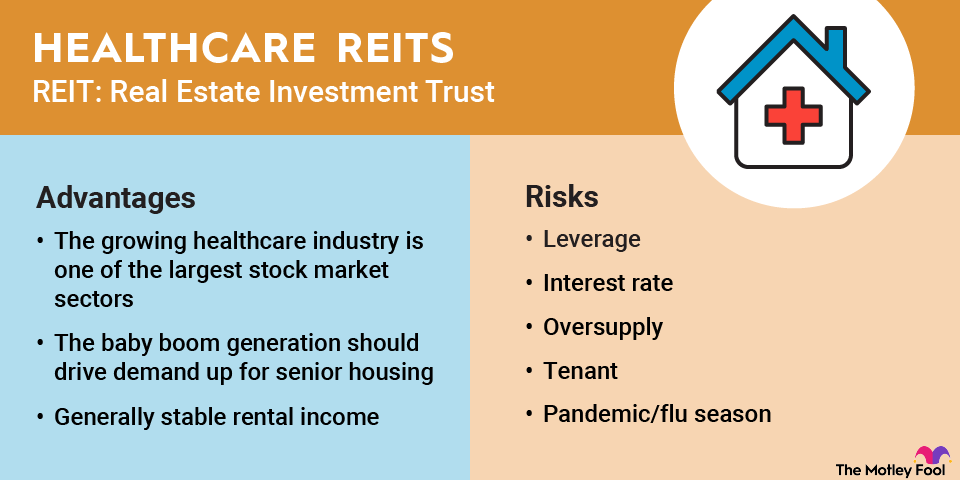

Although only one of the mutual fund's top five holdings is a REIT, it still has significant exposure to the sector. Healthcare REITs make up 8.6% of its assets, industrial REITs are 5.7%, retail REITs are 3.2%, and data center REITs make up 2.9% of its holdings. Most of its other holdings own significant amounts of real estate, with real estate consisting of 40.7% of its assets.

One thing that stands out about the Baron Real Estate Fund is its performance. Over the past decade, the fund has delivered an average annualized return of 10.4%, significantly outperforming the MSCI U.S. REIT Index and its 4.4% annualized return. The fund also has a four-star rating from Morningstar (NYSE:MORN).

The only potential negative is its expense ratio, which is 1.31%, a bit high for a mutual fund. However, given its long track record of outperformance, it could be worth the price.

2. Cohen & Steers Real Estate Securities Fund

NASDAQMUTFUND: CSEIX

Key Data Points

The Cohen & Steers Real Estate Securities Fund (CSEIX +0.25%) seeks to achieve a total return (income plus capital appreciation) by investing in real estate securities such as common stock, preferred stock, and other equity and debt securities issued by real estate companies. The fund invests in REITs and REIT-like entities.

The REIT mutual fund had more than 40 holdings as of early 2026, led by the following five:

- Welltower: 12.9% of the fund's holdings

- Digital Realty (NYSE: DLR): 7.8%

- Crown Castle (NYSE:CCI): 7.1%.

- American Tower (NYSE: AMT): 5.7%

- Prologis (NYSE: PLD): 4.5%

The REIT offers investors diversified exposure to the entire REIT sector. Its top five subgroups are healthcare (17.4% of the fund's holdings), telecommunications (14.9%), data centers (11.9%), and industrial (8.2%).

The fund has a solid performance track record. Over the past decade, it has delivered a 6.7% average annual total return, including its sales charge. That has outpaced the 4.9% annualized total return of the FTSE Nareit Equity REIT Index.

It also boasts a five-star overall rating from Morningstar. The fund has an expense ratio of 0.84%, which could be worth it for investors seeking a highly rated REIT mutual fund with an excellent performance track record.

3. PIMCO Real Estate Real Return Strategy Fund

NASDAQMUTFUND: PRRSX

Key Data Points

The PIMCO Real Estate Real Return Strategy Fund (PRRSX +0.47%) takes a unique approach. It provides exposure to a broad REIT index backed by a collateral portfolio of Treasury Inflation-Protected Securities (TIPS). That strategy enables it to provide a double real inflation hedge.

The mutual fund provides broad exposure to the real estate sector, led by the following REIT types:

- Healthcare: 21% of its holdings

- Diversified: 17.2%

- Warehouse/Industry: 14.7%

- Apartments: 13.4%

- Storage: 7.5%

In addition to holding REITs, the fund has long and short positions in several fixed-income securities. It has a reasonable expense ratio of 0.74%.

The REIT mutual fund's unique approach has paid off for its investors over the years. It has grown the value of a $10,000 investment made at its inception in 2003 into almost $81,700. That's significantly more than the over $52,285 you would have made by investing the same amount in a fund tracking the Dow Jones U.S. Select REIT Total Return Index.

4. Nuveen Real Estate Securities Select Fund

NASDAQMUTFUND: TIREX

Key Data Points

The Nuveen Real Estate Securities Select Fund (TIREX +0.17%) seeks to deliver a favorable total long-term return by investing in the real estate industry. It typically invests as much as 80% of its assets in real estate securities, including companies that own significant real estate assets, such as REITs.

It will also invest as much as 15% of its assets into foreign companies. The fund has the flexibility to invest as much as 20% in the debt or equity of companies unrelated to the real estate sector. The fund doesn't invest directly in real estate or private REITs.

As of early 2026, the fund held more than 40 positions, led by the following five:

- Prologis: 10.3% of its net assets.

- Welltower: 10.1%

- Simon Property Group (NYSE:SPG): 6.9%

- Equinix (NASDAQ:EQIX): 5.4%

- American Tower: 5.2%

The fund has a solid performance track record. Over the past decade, it has delivered a 5.9% average annual total return, outpacing the 5.8% average annual total return of the FTSE Nareit All Equity REITs Index. The fund boasts a four-star rating from Morningstar and has a reasonable expense ratio of 0.62%.

5. Principal Real Estate Securities R5

REIT mutual funds are an easy way to invest in real estate

REIT mutual funds enable investors to invest broadly in the real estate sector. They provide the opportunity to potentially earn total returns above what an investor could achieve with an index fund. The opportunity makes REIT mutual funds a potentially attractive alternative for investors looking for above-average return potential without investing directly in individual REITs.

FAQ

REIT mutual fund FAQ

About the Author

Matt DiLallo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.