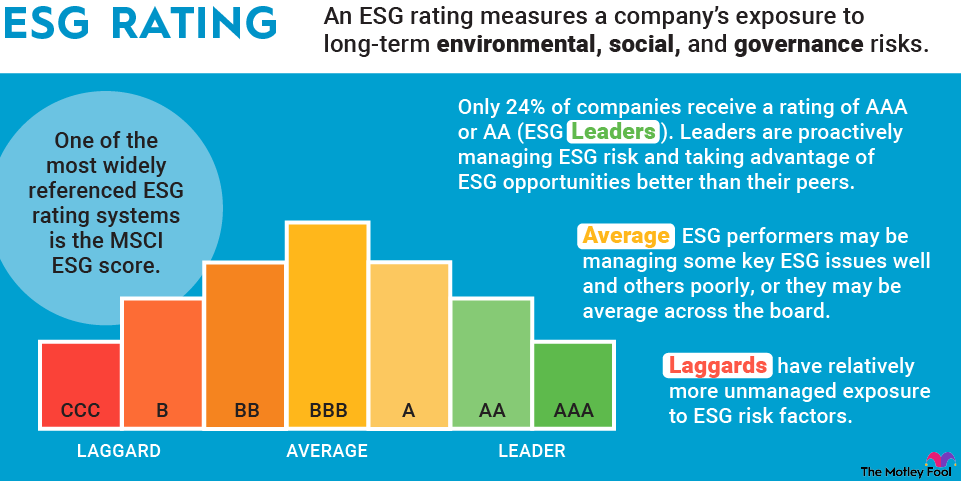

Comparative Performance | ESG Rating | Numerical Score |

|---|---|---|

Leader | AAA | 8.571-10.000 |

Leader | AA | 7.143-8.571 |

Average | A | 5.714-7.143 |

Average | BBB | 4.286-5.714 |

Average | BB | 2.857-4.286 |

Laggard | B | 1.429-2.857 |

Laggard | CCC | 0.000-1.429 |

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

An ESG rating measures a company's exposure to long-term environmental, social, and governance risks. These risks -- involving issues such as energy efficiency, worker safety, and board independence -- have financial implications. But they are often not highlighted during traditional financial reviews. Investors who use ESG ratings to supplement financial analysis can gain a broader view of a company's long-term potential.

Here's a closer look at ESG ratings, including how companies are scored and how these ratings affect you and your portfolio.

A good ESG rating means a company is managing its environment, social, and governance risks well relative to its peers. A poor ESG rating is the opposite -- the company has relatively higher unmanaged exposure to ESG risks.

Along with ESG reporting, ESG ratings help investors understand a company's priorities and the long-term risks it could face in the future.

One of the most widely referenced ESG rating systems is the MSCI ESG score. MSCI scores roughly 8,500 companies and more than 680,000 fixed-income and equity securities globally, including ESG funds.

The foundation of the MSCI ESG score is a key issues framework that measures risk across 10 categories of environment, social, and governance areas.

MSCI's key environmental issues fall under the categories of climate change, natural capital, pollution and waste, and environmental opportunities.

Climate change issues include:

Natural capital issues are:

The pollution and waste category encompasses:

Environmental opportunities are:

Social score issues fall into four categories: human capital, product liability, stakeholder opposition, and social opportunities.

Human capital issues are:

Product liability areas of focus include:

Stakeholder opposition includes:

Social opportunities are:

MSCI breaks governance into two categories: corporate governance and corporate behavior.

Corporate governance includes:

Corporate behavior encompasses:

The best ESG stocks in 2022 and the six best ESG ETFs put together companies that have sustainable business practices and deliver outstanding financial returns. You don't have to be committed to sustainable investing to value the role ESG review plays in the investment process.

ESG scores help you find lower-risk, higher-return stocks, and that's an outcome most investors, from institutional investors to retirement savers, can appreciate.

ESG investing does not involve picking stocks based on ESG factors alone. Instead, the investor adds an ESG review to the traditional investment process. How you incorporate ESG scores into your decision-making is up to you. For example:

Amazon (AMZN +1.00%) had an average MSCI ESG rating of BBB as of August 2024. Amazon leads in product carbon footprint. However, the e-commerce retailer has average corporate governance, privacy and data security, raw materials sourcing, and poor scores for supply chain labor standards, labor management, and corporate behavior.

Overall, Amazon is average for its industry -- but if labor relations are major sticking points for you, it may be a company for you to avoid. Poor treatment of workers and unsavory trade practices are more than problematic on principle. They pose financially relevant risks such as workforce churn, higher recruitment costs, lawsuits, and loss of reputation.

If you are (or want to be) an Amazon shareholder, the more you know about factors that can affect the retailer's returns, the better decisions you will make.

MSCI translates the numerical score into an ESG rating. ESG ratings range from CCC to AAA. The leaders have AA and AAA scores. As shown in the table below, the ratings are also grouped into three segments: laggard, average, and leader.

Laggards have relatively more unmanaged exposure to ESG risk factors than their peers. Average ESG performers have mixed performance. They may be managing some key ESG issues well, or they may be average across the board. Leaders are proactively managing ESG risk and optimizing ESG opportunities better than their peers.

MSCI uses public data sources to measure ESG exposure. These sources include company 10-Ks, sustainability reports, and proxy reports, plus thousands of monitored media outlets and data from governments, regulatory organizations, and NGOs. MSCI also works directly with corporations to validate the information collected.

ESG ratings have been making the news recently for a lack of transparency in data sourcing. ESG ratings are a useful tool only if they are data-backed, reliable, and objective. While that remains largely the case, recent events have called that into question.

One major event is the war in Ukraine, where environmental and social values are colliding. Europe is loosening climate objectives and reverting to fossil fuel use to ban Russian oil, leading to increased fossil fuel use across business sectors.

Simultaneously, Russian-backed Sberbank (ETR:SBNC)(AKSJ.F) has sparked outrage since it was highly rated by both MSCI ESG research and Sustainalytics as of December 2021. The bank scored especially well on data security and governance compared to Western lenders.

MSCI and Sustainalytics have now downgraded or suspended Sberbank and other Russian government-backed companies. Investors are calling for an overhaul in how geopolitics and human rights factor into ESG ratings.

Meanwhile, a working paper from the European Corporate Governance Institute found that a significant number of ESG rating agencies were downgrading ESG scores retroactively. The findings call into question the reliability of ESG ratings and may reduce investor confidence.

In better news for ESG integration in mainstream finance, the UK’s Financial Conduct Authority (FAC) stated in June 2022 that it has a clear rationale for regulating ESG ratings. ESG rating standardization means greater transparency and standardization for investment decisions.