A self-directed IRA (SDIRA) is a type of individual retirement account that holds alternative assets such as real estate, commodities, tax liens, private equity placements, and limited partnerships. You are a candidate for a self-directed IRA if your retirement investment plan goes beyond traditional stocks, bonds, and mutual funds.

Investing within your self-directed IRA

Investing within your self-directed IRA

In a traditional IRA, investing the funds is straightforward: You submit a buy or sell order for securities, and your provider fulfills that order. Self-directed IRA investing gets more complicated for two reasons.

First, these transactions often happen outside your account with a third party. To buy real estate, for example, you need to move money from your self-directed IRA into escrow. Depending on the type of self-directed IRA you have, you'd either ask your provider to disburse the funds or you'd wire the funds yourself from a linked checking account.

Second, self-directed IRA providers, also called custodians, do not provide investment advice. If you request funds to buy equity in a theme park that has no liability insurance, your provider doesn't have to tell you that's a bad idea. It's entirely your responsibility to throughly research your investment opportunities.

What is a checkbook control self-directed IRA?

In a standard self-directed IRA, your custodian disburses funds at your request. Some custodians can take a month or more to send the funds, and many charge a fee for this service.

You can bypass that lengthy process with what's called a checkbook IRA or a checkbook control IRA. This is actually a limited liability company (LLC) checking account that's funded by your self-directed IRA. You can establish an LLC specifically for that purpose, with you as its manager. You can then open a checking account using the LLC's name and tax ID. Your self-directed IRA would fund the checking account.

At that point, you, as LLC manager, can then write checks or wire funds to purchase investments in the LLC's name. Any income and expenses associated with those investments would pass through the LLC to your SDIRA.

Rules for self-directed IRAs

What are the rules for self-directed IRAs?

The IRS regulates the types of investments you can make, as well as who's involved and who benefits from each transaction.

Prohibited assets, disqualified persons, and prohibited transactions

You can invest in a range of assets in your self-directed IRA, but two asset classes are prohibited. You cannot hold life insurance or collectibles in any type of IRA.

The IRS also prohibits transactions with "disqualified persons." These include you, your spouse, ancestors, and lineal descendants, e.g., your children, grandchildren, great-grandchildren, etc., and their spouses.

You should steer clear of any transactions between your self-directed IRA and disqualified persons, but the IRS specifically calls out:

- Lending money

- Selling property

- Using IRA funds as collateral for a loan

- Buying property for personal use

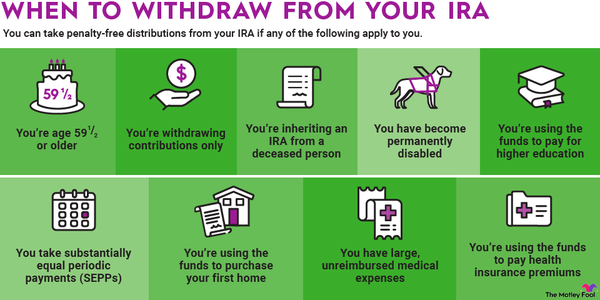

If you violate the prohibited transaction rules, the IRS can strip your account's IRA status. That's treated as a taxable distribution of all assets in the account as of January 1. If you're younger than 59 1/2, you may pay a 10% penalty as well. You also give up future tax deferrals on the earnings from those investments.

Taxes, contributions, and withdrawals

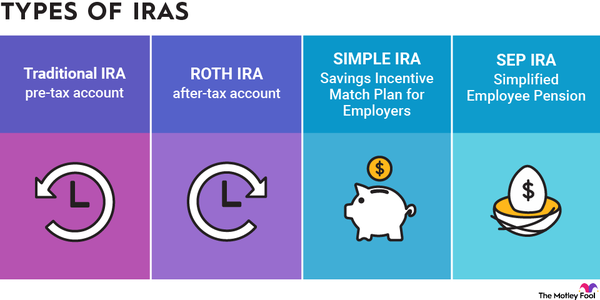

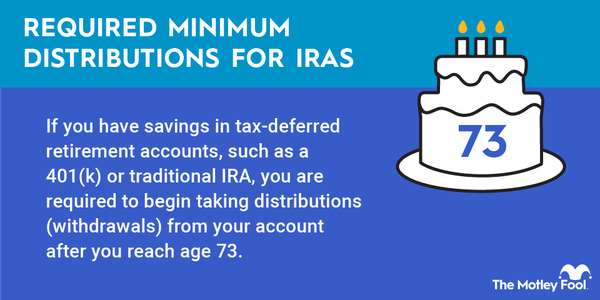

Your self-directed IRA is subject to annual contribution limits, withdrawal limitations, and required minimum distributions, or RMDs. These are the same rules that apply to a traditional IRA. The highlights are:

- Annual contribution limits apply to your total IRA deposits across all accounts.

- Qualified withdrawals in retirement are taxed as ordinary income.

- If you withdraw funds before age 59 1/2 and you don't qualify for an exception, you will owe a 10% penalty, plus the normal income taxes.

- Starting at age 72, you have to take RMDs. The amounts you must withdraw annually are based on your year-end account balance and your life expectancy.

- If you want to contribute post-tax, a self-directed Roth IRA is also an option.

Holding real estate in a self-directed IRA

The prohibited transaction rules dictate most of the dos and don'ts of holding real estate in your self-directed IRA. At the highest level, you have to keep your self-directed IRA real estate transactions totally separate from your personal finances and your family's.

That means you can't buy property from a disqualified person. You also can't rent IRA-owned property to disqualified persons or even stay on the property yourself. Don't try to pay yourself or a disqualified person for maintenance work at the properties owned by the self-directed IRA, either.

It's also a no-no to partner with a disqualified person to buy real estate through your self-directed IRA. If you don't have the funds in the account to buy the property outright, you have two other options. You can partner with someone else, such as a family member who's not disqualified, or take out a mortgage in your IRA's name.

Mortgages in that scenario can get tricky, however. You cannot personally guarantee the loan, and the debt must be secured by the property only, with no recourse for the lender to tap into the IRA for unpaid amounts. You may also owe taxes on part of the income, even though the property is owned by your self-directed IRA. Consult with an experienced tax advisor for guidance.

Reporting fair market value of your real estate

You need to report the fair market value of your real estate and other alternative assets to the IRS annually. Your custodian should remind you of this requirement and also specify what documentation is acceptable.

If you are not yet taking RMDs, your custodian might accept a Zillow report or a professionally compiled comparative market analysis as proof of a property's value. Once you start taking RMDs, many custodians will ask for a formal real estate appraisal instead.

Choosing a provider

Choosing a self-directed IRA provider

Not all IRA providers offer self-directed accounts. Among those that do, fee structures and feature sets can vary dramatically. The best self-directed IRA custodian for you will be the one that is easy to understand and serves your specific needs at an affordable price.

Start by listing out your must-haves. Do you want checkbook control? Are you interested in investing in specific asset classes such as cryptocurrencies? Also consider whether you want to hold traditional and alternative assets in the same account, how much hand-holding you need in the setup process, and how long you're willing to wait for your custodian to fulfill your disbursement instructions (if you don't want checkbook control).

Next, think about fees. Providers can charge any combination of setup fees, transaction fees, event-based administrative fees, and annual maintenance fees based on your account value. If you don't plan to transact frequently, for example, you may accept modest transaction fees in exchange for a lower annual fee.

From there, prepare a list of questions to ask self-directed IRA custodians, and start interviewing. Some self-directed IRA providers to research are uDirect, Rocket Dollar, Equity Trust, IRA Financial, Alto IRA, STRATA Trust Company, and the Entrust Group.

How do I set up an self-directed IRA?

Account setup should be fairly straightforward since many providers will direct this process. That includes taking the lead on creating the LLC for your checkbook IRA. All you have to do is answer questions, review documentation, and sign.

You will need to fund the account once it's open. You can roll over funds from another qualified account or make a contribution that doesn't exceed the annual limit. Depending on your provider, you may have the option to set up a periodic, automatic investment.

Once your IRA is funded, you are ready to start investing through your custodian. A checkbook IRA requires the extra step of transferring money from the IRA to your LLC checking account.

Related retirement topics

Discipline required

If you have an investment plan that a traditional IRA account doesn't support, the self-directed IRA may be your solution. Just recognize the responsibility that comes with it. It's your job to vet your opportunities, make informed investing decisions, and avoid prohibited transactions. If you're up for that challenge, you may be ready to start building assets within a self-directed IRA.

The Motley Fool has a disclosure policy.