Combining a SEP IRA with other retirement accounts

If you have a SEP IRA, you can still establish other types of retirement accounts. But because a SEP IRA is an employer-sponsored retirement plan, the IRS imposes some additional restrictions on your ability to contribute to other retirement funds.

SEP IRAs combined with traditional IRAs

If you participate in a SEP IRA, you can still open a traditional IRA. But if your employer contributes to your SEP IRA and you earn more than a certain amount of income, your contributions to your traditional IRA are not fully tax-deductible.

For 2025, the tax deduction starts phasing out when your modified adjusted gross income reaches $79,000 for individuals and $126,000 for people married filing jointly. In 2026, these thresholds increase to $81,000 for single filers and $129,000 for married couples filing a joint tax return.

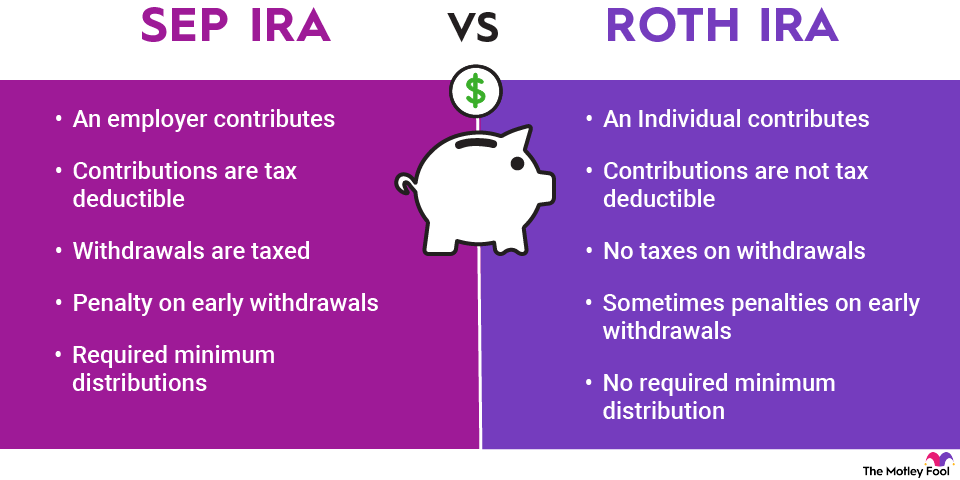

SEP IRAs combined with Roth IRAs

You can establish a Roth IRA even if you participate in a SEP IRA. The maximum amount that you are annually allowed to contribute to a Roth IRA is unaffected by holding any employer-sponsored plan such as a SEP IRA. However, the ability to contribute to a Roth is restricted for all high earners.

SEP IRAs combined with 401(k)s

You are unlikely to have a SEP IRA and a 401(k) from the same employer since the annual contribution limits for employers apply to both types of accounts combined. If you have two separate jobs offering two retirement plans, you can fully participate in both employer-sponsored retirement plans. You can have a SEP IRA at one job and a 401(k) at the other.

SEP IRAs combined with HSAs

You can contribute to both a SEP IRA and a health savings account (HSA). SEP IRA contributions don't affect HSA contribution limits or the tax treatment of HSA contributions. If your employer offers both a SEP IRA and an HSA and contributes matching funds to the HSA, those HSA funds are not counted as income to you as an employee.

How to open a SEP IRA

Opening a SEP IRA is very simple. Most banks and brokerages offer a pre-approved SEP IRA plan prototype that meets IRS standards. The IRS also offers business owners the option of using its own model SEP or a custom plan.

Employers must provide all pertinent information about the SEP IRA to employees. Then the business owner can open individual accounts for each eligible person.

The annual deadline to open and fund a SEP IRA is the due date of the company's income tax return. The deadline to open and fund an account for 2025 is when the business files taxes in 2026.

Is a SEP IRA right for you?

SEP IRA contributions are deductible as a business expense on corporate tax returns, and, for self-employed individuals, SEP IRA contributions are tax-deductible on individual tax returns. These tax benefits, combined with the low cost and administrative simplicity of establishing a SEP IRA, make them appealing to many entrepreneurs.

But since business owners are responsible for 100% of contributions to SEP IRAs and must contribute equally on a percentage basis to the SEP IRA of every owner and employee, SEP IRAs are not well suited for every business. SEP IRAs are best designed for small businesses with few employees and with few or none of those employees meeting the eligibility requirement. Highly compensated owners of single-person businesses can also benefit from SEP IRAs because of the high contribution limits.

If you earn enough money to contribute the maximum permissible amount to a SEP IRA, a SEP IRA may be a smart choice. But if you are self-employed with no employees, then a solo 401(k) may be a better option.